By Jeff Domansky, Oct 29, 2020 New developments and improvements in voice technology are already driving customer service, bot automation, and even investments in the banking and payments world. Juniper Research estimates that over 4.2 billion digital voice assistants are in use on devices worldwide ...

Read more

Blog

By Jeff Domansky, October 27, 2020 Editor’s update: CNBC reported today (Nov 3) that “Ant Group’s controller Jack Ma, executive chairman Eric Jing and CEO Simon Hu were summoned and interviewed by regulators in China, according to a statement Monday from the China Securities Regulatory ...

Read more

As the biggest shopping season of the year approaches in the US and around the world, it’s also a hectic time for payments industry news. We’ve got another payments news roundup with all that you need to stay ahead of the latest payments and fintech ...

Read more

In the first seven months of the pandemic, more than half of American consumers (57%) have unfortunately seen a reduction in their income, and 42% have missed at least one bill payment as a result. These and other results from a new survey of US ...

Read more

After a year of development and testing, Visa rolled out its new Tap to Pay mobile payment app that will let micro-merchants and sellers worldwide quickly and securely accept contactless payments on any NFC-enabled Android device without the need for any additional hardware. The new ...

Read more

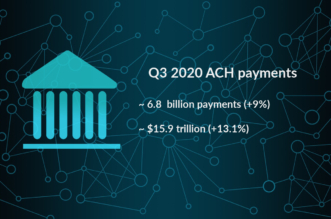

Nacha’s US Automated Clearing House Network (ACH) report for electronic funds transfers in the third quarter of 2020 showed exceptionally strong growth in volume and value despite the end of some government pandemic payments. ACH handled more than 6.8 billion payments in the third quarter, ...

Read more

By James Brear, CEO, Zycada This has been a rough year for retailers, with the pandemic taking a steep toll across most of the industry. An eMarketer study found that COVID-19 will hurt retailers worse than the Great Recession, estimating that worldwide retail revenue will ...

Read more

It’s all over except for deliveries and returns for Amazon Prime Day 2020 as sales by the estimated 2.3 million third-party small and midsized sized sellers exceeded a record $3.5 billion (up nearly 60%) across 19 countries participating in the annual sales love-in. Amazon is ...

Read more

By Rafael Lourenco, EVP, ClearSale Can online merchants earn more customer trust by talking about fraud? Yes, according to a recent survey of more than a thousand US online shoppers. It sounds counterintuitive, but raising the topic of fraud can reassure customers that your online ...

Read more

New research suggests 58% of US consumers will stop using cash after the coronavirus pandemic ends. According to the September 2020 study by Travis Credit Union (TCU), consumers are now twice as likely to use a debit or credit card instead of cash to purchase ...

Read more