There’s one ballooning payments problem that simply isn’t going away soon. It’s the $1.6 trillion debt carried by an estimated 44.7 million American students.

For years, policymakers and economists alike have recognized that growing student debt places a huge drag on the economy both for spending as well as borrowing, investment, and simple economic well-being.

This debt load is particularly heavy during the pandemic as students and new entrants to the workforce are usually the first laid off or impacted by a serious downturn in the economy like we’ve witnessed.

Some students have been unable to complete their degrees because of the coronavirus crisis which leaves many with what Mark Kantrowitz, publisher of SavingForCollege.com, has called a “completion crisis” in the past.

In 2008, many went back to school

In a recent report on student debt, CNBC noted in the 2008 recession when job opportunities were limited, many chose to return to school. “Since then, the cost of a four-year college degree increased by 25% and student debt increased by 107% and many are less sure if college will be the solution to riding out a recession this time around.”

Since the great recession in 2008, state and federal funding for higher education has declined and in 2018 was $7 billion less than a decade earlier.

In the 2019-2020 school year, the cost of getting a college degree is going up according to the College Board with students leaving after graduation was an average debt of more than $29,000.

“During the 2019-2020 school year, the average cost of tuition, fees, and room and board was $21,950 for in-state students at public universities, $38,330 for out-of-state students at public universities and $49,870 at private non-profit universities.”

In 2018, it was estimated 30% of student loan borrowers were in default, late in payment, or have stopped making payments six years after graduation.

Women and black students owe more

The American Association of University Women (AAUW), says 56% of college students are women, but they have two-thirds of US student debt, nearly $929 billion in outstanding student debt in 2019.

Because of economic and racial differences, black students owe an average of $34,000 after graduation compared to $30,000 for white students. White students paid their debt an average of 10% per year, while black students averaged 4% in annual payments, likely due to racial inequality in salaries.

These disparities mean women and students of color carry more debt on average, will take longer to repay it, and may find it more difficult to pay off debt and begin building personal equity through things like homeownership.

“To build intergenerational wealth, a lot of that is bundled up in homeownership and having the ability to buy and own a home. If you’re saddled with too much student loan debt, your ability to actually save up enough for your down payment is influenced by that,” Nicole Smith, chief economist Georgetown University Center on Education and the Workforce told CNBC.

“The average black household has about 1/13th the wealth of the average white household. And if you view student loan debt as negative wealth, as money that could have been used to save for wealth or to purchase a home or to invest in the stock market to accumulate wealth, that potential wealth is now used to repay loans,” Smith added.

Past reports by Bankrate have shown that student debt caused 21% of borrowers to delay getting married, 26% to wait to have children, and 36% put off buying a home.

College closures and education costs accelerate problems

With the pandemic causing many colleges to close or adopt online learning, the benefit of a college degree is much more up in the air.

Even with temporary loan payment forgiveness for up to six months, the problem simply remains on the horizon as another post-pandemic payment problem for students, consumers, and governments to deal with in the near future.

In Congress in May, Democrats proposed a second economic relief package that would eliminate up to $10,000 in some federal loans but the bill remains on hold in the Senate, likely until after the November US election.

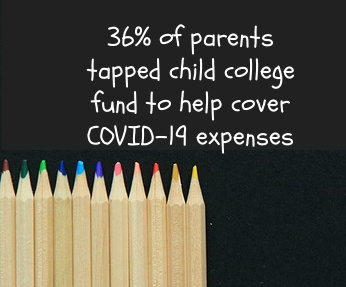

Meanwhile, a May LendingTree survey shows the added impact of the pandemic on students and their parents:

- 56% of parents have gone into debt due to coronavirus-related circumstances; four in 10 added credit card debt, and 15% had to turn to a personal loan

- 36% of parents tapped their child’s college fund to help cover expenses caused by the COVID-19 outbreak

- 6 in 10 parents had to spend money on their child’s distance learning. On average, they spent a little over $1,000 on supplies ranging from iPads and laptops (48%) to office furniture (15%).

Sadly, when it comes to parents and students, the pandemic is the gift that keeps on giving and the problem is growing larger every month as the US government fails to coordinate an effective national response to the coronavirus crisis.

Coming up tomorrow, we’ll have 10 things you should know about the impact of the pandemic on the world of payments.