When it comes to online fraud globally, there’s good news and there’s bad news.

According to a new report from TransUnion, the good news is online business fraud dropped 9% from the first phase of the pandemic (Mar 11 – May 18) and the second phase (May 19 – July 25) as businesses began to reopen. Unfortunately, cybercriminals turned their attention to consumers, resulting in a 10% increase in online fraud in the same timeframe.

The company’s findings follow a review of billions of transactions on more than 40,000 websites and apps monitored globally by its fraud prevention service IDVision® with iovation®. Phishing was the top pandemic fraud scam reported by 27% of consumers.

“With the rush for businesses to go digital as many were forced to go completely online almost overnight, fraudsters tried to take advantage,” said Shai Cohen, senior vice president of Global Fraud Solutions at TransUnion. “They were most likely unsuccessful in their attempts and took their scams elsewhere as those businesses ramped up their digital fraud prevention solutions while providing a friction-right consumer experience. Conversely, with consumers, fraudsters are increasingly using COVID-19 to prey on those persons who are facing mounting financial pressures.”

Consumers pay the price for fraud

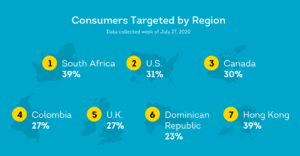

TransUnion surveyed 8,265 adults in Canada, Colombia, Hong Kong, South Africa, UK, and the US during the week of July 2, 2020, to better understand the impact of fraud.

More than three out of 10 respondents (32%) said they were targeted by digital fraud related to COVID-19, with Gen Z (age 18-25) the most targeted at 36%. Among consumers reporting being targeted with digital COVID-19 schemes globally, 27% said they were hit with phishing pandemic-themed scams.

Despite the survey showing Baby Boomers were the generation least targeted with Digital COVID-19 scams, among consumers reporting being targeted they were the age group saying they faced the highest percentage of COVID-19 themed phishing scams.

“Phishing shows fraudsters aren’t after a quick hit, but rather looking for the long haul,” said Melissa Gaddis, senior director of customer success, Global Fraud Solutions at TransUnion. “Once a fraudster steals consumer credentials, the wave of disruption they can cause with a stolen or synthetic identity is endless from compromising multiple online accounts to significantly impacting credit scores.”

Global fraud snapshot

As we reported earlier this week, consumers are feeling the brunt of fraud attempts, especially in the US where 3.2 million identity theft attempts were made in 2019 according to the FTC.

A LEXIS-NEXIS Risk Solutions 2020 Cyberthreat Defense Report identifies several key trends in cybercrime in 2019 including:

- 56% rise in mobile attacks vs a 26% decrease in desktop attacks

- mobile browser transactions were attacked more frequently (+14%), mobile transactions are growing faster (+171%)

- bot attacks are growing quickly, particularly aimed at financial institutions

- 73,000 devices were involved in fraud, indicating the of the problem; the largest individual network analyzed spanned six countries, including all three core industries (financial services, e-commerce, and media), with $12.5M exposed to fraud in one month

- the scale of global fraud transactions is huge: 5% were new account creation attempts (870 million); 77% were login attempts (13.6 billion); 18% were payment fraud attempts (3.2 billion).

The global scale of fraud and the size of the cybercriminal networks are just part of the growing problem.

Types of COVID-19 fraud

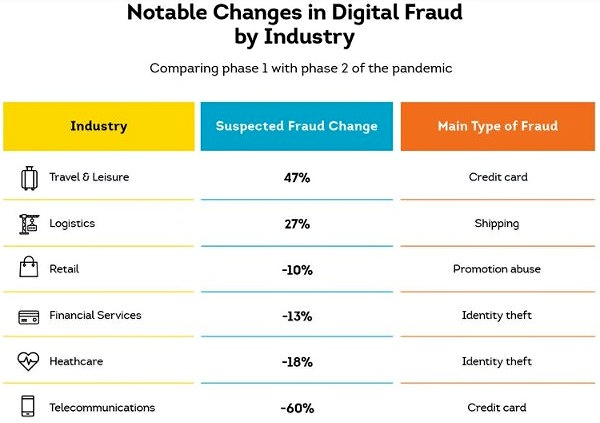

TransUnion analyzed key industries for a change in the level of suspected fraud against them, comparing the periods of March 11-May 18 and May 19-July 25.

Travel and leisure attracted the biggest attention of fraudsters, showing a 47% increase in suspected fraud, mostly involving credit cards. The logistics industry also saw a 27% increase mostly related to shipping fraud.

Other business sectors showed decreases in the number of fraud attempts during the second three months including telecommunications (-60%), healthcare (-18%), financial services (-13%), and retail (-10%).

“It appears fraudsters assume travel & leisure companies are scrutinizing transactions less in order to capture more revenue as the pandemic continues to severely negatively impact their business,” said Gaddis.

“Another interesting note is that telecommunications, e-commerce, and financial services companies – all industries that have fared relatively well during the pandemic – were targeted with the most digital fraud early in the pandemic but are now among the least targeted. This shows us that fraudsters initially targeted the hottest industries with the most money to be had early in the pandemic in order to hide behind the rush of transactions but have now made an obvious shift,” Gaddis added.

Fraud is a global business

When it came to consumers targeted by fraudsters in the region they live, Hong Kong and South Africa led the pack at 39% each, followed by the US (31%), Canada (30%), Colombia and UK (27% each), and the Dominican Republic (23%).

Globally across industries, TransUnion found the countries with the highest percentage of suspected fraudulent transactions were: 1) Kazakhstan, 2) Greece and 3) Cyprus.

In the US, researchers found the cities with the highest percent of suspected fraudulent transactions were: 1) Livonia, Mich. 2) Akron, Ohio, and 3) Jackson, Miss.

That’s a whole lot of fraud going on in just about every region around the world and it’s not getting any better. Business and consumers need to stay vigilant, monitor transactions closely, and be aware of unusual account or transaction activity.

You can find out more about fraud transactions at TransUnion’s COVID-19 resource center.

Visuals courtesy of TransUnion and LEXIS-NEXIS; masthead photo by Josh Hild from Pexels

Author: Douglas Hall is publisher of PaymentsNEXT and a leading expert on the global payments industry.

LET’S CONNECT