Not only is COVID-19 wreaking havoc on the health and finances of consumers around the world, but scammers are also having a field day, surging past $105 million in fraud losses this year to date in the US alone.

The US Federal Trade Commission (FTC) has an extensive database of reports of consumer scams updated daily, and the coronavirus scams are piling up fast.

For example, 83,858 COVID-19 fraud scams mentioning COVID, stimulus, N95, and related coronavirus claims were reported to the FTC between January 1 and August 9, 2020. The total value of these coronavirus fraud scams was in excess of $105.7 million with a median value of $280.

The number of COVID-related scams reports included online shopping (24,403 complaints), travel/vacation (18,667), credit cards (5,577), banks, savings & loans, and credit unions (4,230), and mobile text message complaints (3,608).

Scams are numerous and imaginative

The types of scams are many and, if anything, they’re very imaginative. Among the most common consumer scams between March and August were those involving online shopping usually in the form of price gouging, non-delivery scams, low-quality or non-compliant products, free groceries, and coronavirus cure scams.

Stimulus check scammers used robocalls, email scams, phony text messages, identity theft, Google search scams with fake websites, phony IRS calls, and third-party stimulus check scams.

Not to mention the usual phishing emails emanating from sweatshops around the world including ever popular Third World countries like Nigeria and India.

Who’s getting scammed the most?

The 10 US states with the largest number of complaints in July compared to March 2020 (in parentheses) included California with 10,930 complaints (+110%), Florida 7,244 (+124%), New York 6,677 (+134%), Texas 6,427 (+122%), Pennsylvania 4,245 (+201%), Illinois 3,232 (+132%), New Jersey 3,195 (+131%), Ohio 3,174 (+171%), Massachusetts 3,147 (+83%), and Washington 3,119 (+80%) as highlighted by Social Catfish.

The 10 states with the fastest growing number of complaints in July compared to March 2020 included Maine +422%, Pennsylvania +201%, North Dakota +182%, Ohio +171%, Louisiana +170%, Connecticut +161%, Hawaii +150%, Tennessee +150%, Nebraska +148%, and North Carolina +147%.

Nature of contact & value lost

Scammers are using a wide range of ways to contact consumers, although their methods are quite familiar and include telephone (9,608 contacts), website (9,015), email (8,368), consumer-initiated contact (6,273), other contacts (896), and mail (584).

The largest value losses were from email ($17.83 million) followed by websites ($17.11M), telephone ($14.48M), consumer-initiated contact ($10.07M), other contacts ($5.07M), and mail ($1.04M).

Credit & debit card scams most popular

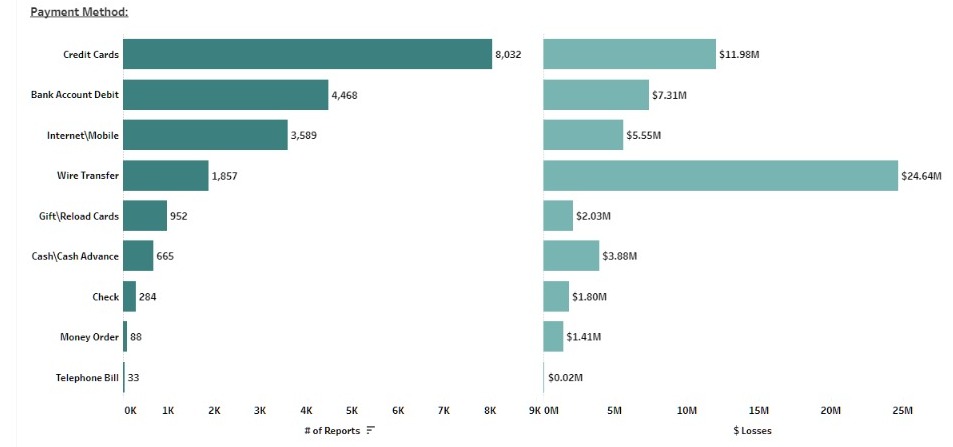

When it comes to the ways consumers are scammed, the most popular payment types are credit cards (8,032 reports), debit cards (4,468), internet/mobile (3,589), wire transfers (1,857), gift/reload cards (952), cash/cash advances (665), checks (284), money orders (88), and telephone bills (33).

Not surprisingly, the highest value payment scams included wire transfers ($24.64 million) followed by credit cards ($11.98M), debit cards ($7.31M), internet/mobile ($5.54M), cash/cash advances ($3.88M), gift/reload cards ($2.03), checks ($1.8M), money orders ($1.41M), and telephone bills ($0.02M).

Fraud losses by demographic

An estimated 50.4% of reported scams included actual dollar value lost by consumers.

The losses to scammers by demographics present an interesting picture. The number of fraud reports by age and value include under age 19 (1,033 reports, $0.5 million), age 20-29 (4,490, $4.2M), age 30-39 (6,139, $9.0M), age 40-49 (5,509, $12.2M), age 50-59 (5,011, $10.3M), age 60-69 (4,466, $9.4M), age 70-79 (2,137, $5.2M), and over age 80 (564, $2.4M).

Generally, older consumers tended to have a larger median value lost to scammers. The median value of reported scams included under age 19 ($95), age 20-29 ($200), age 30-39 ($180), age 40-49 ($178), age 50-59 ($191), age 60-69 ($153), age 70-79 ($205), and over age 80 ($554). Clearly, in some cases, the average value lost to scammers could be substantial.

Common business scams

Businesses have not been immune from coronavirus scams either. Scammers have used calls, robocalls, phishing and phony emails, phony invoices, work from home scams, and fake websites to carry out fraud against small to midsize and large businesses.

Also involved are hundreds of efforts to promote phony stimulus checks or nonexistent loan payments with scammers often impersonating IT departments, business customers, large e-commerce companies, payments providers, health and community groups, state and federal government agencies, and even the IRS.

Some of the same tactics used against consumers have also been used to scam businesses including phony or non-compliant products, fake health testing, non-delivery of products, as well as phony regulatory information requests, false inspections, payments in advance for services never provided, and much more.

Businesses need to educate customers and employees about the risk of scams and remain diligent in verifying invoices, claims, and requests for confidential business and employee information.

Just imagine if all of the creativity, resources, and energy wasted on scams was channeled into COVID-19 solutions instead of preying on consumers and business?