Since the onset of COVID-19, we’ve been living with a shopping and e-commerce reality that industry analysts and trend watchers have dubbed the “new-normal.”

Signifyd’s latest Pulse Report for E-commerce indicates the idea of “new-normal” is already an outdated concept and we really should now be thinking in terms of the “now-normal.”

New-normal implied that we’d someday return to more familiar shopping habits and the tried-and-true ways of payments. With the seismic shift in consumer preferences, what’s normal now is a new reality for merchants and sellers.

What’s “now-normal” shopping look like?

When it comes to e-commerce and omnichannel retail, the safety and convenience of shopping online during the coronavirus crisis was initially a necessity. With shelter-in-place orders, a transition to work-from-home for millions of employees, and a myriad of health and safety concerns, consumers had no choice but to change habits and shift shopping preferences.

Research shows the consumer journey is forever changed. Now that newcomers have tried e-commerce, consumers tell researchers they’re likely to keep many of their new online shopping habits.

Most product categories had higher online sales

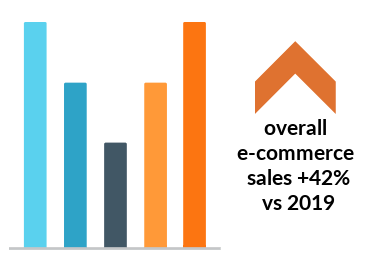

According to Signifyd data, global e-commerce sales jumped 46% in March from the previous year and peaked at a 126% year-over-year increase in May before falling back to an 87% year-over-year increase in July. The real story is in sales within the various e-commerce product categories they analyzed.

For example, sales of alcohol, tobacco, and cannabis products peaked in April at a level 112% higher than the previous April before retreating in July to settle at 45% higher than the previous year’s figure. Auto, parts, and tires sales were 133% higher in May than in May 2019, before falling back to a level 93% higher than year-ago sales. In July, beauty and cosmetics peaked at 93% above its year-ago spending, then declined in June to a level 42% higher year over year and tapering off again slightly in July, hitting spending that was 32% above its year-ago level.

Business supplies spending in January was running 51% higher than at the same time in 2019, which was about where it was in March before a precipitous decline found July spending in the category running 16% below where it was in July 2019. The fall was due in part, no doubt, to the widespread impact of small and midsized business closures around the world. Commodities and collectibles performed well in the early months of the pandemic with spending up 39%, 80%, 44% and 56% over year-ago spending in March, April, May and June respectively. In July, growth in the category took off, recording sales that were 181% higher than in July 2019.

Consumer medical supplies and services started the year with sales 5% above where they were in January 2019, before peaking in May at a level 77% above year-ago spending. By July, the category was back near its high of the year, with sales at 75% higher than July 2019 Electronics and computer spending started the year in a deep hole, with sales down 72% from the previous January. After picking up slightly in March, sales came back stronger, peaking in May at 139% higher than May 2019, before falling to a level 119% above year-ago figures in July,

Grocery and household goods jumped in March to a spending level 112% above the previous year and remained just above or slightly below that figure through July. Leisure and outdoor products peaked at spending that was 226% higher in April than it was a year ago and declined to a 110% increase in July.

Luxury goods have taken a sawtooth journey between May and July, starting at a level that was 21% higher in May than the year before, then dropping to 6% higher in June and increasing to a spending level in July that was 40% higher than July 2019.

Signifyd’s E-commerce Pulse data showed “e-commerce sales were up 62% in June 2020 over June 2019. The monthly total continues a general trend line we’ve been following week-over-week since early March, just before the World Health Organization declared COVID-19 a pandemic.” Buying online and picking up in-store (BOPIS) was up 500% from January, peaking in April at 4% of sales before slowly declining back to 2% of sales though still up 300% from January.

Amazon’s North American Q2 sales reflected the marketplace shift, shooting up 43% while international sales grew 38.5% over the previous year. That’s a moonshot by anyone’s measure.

As the report noted: “It became apparent that consumers were establishing new buying habits. Shoppers who had never, or rarely, shopped online were turning to digital channels — and they were coming back repeatedly.” Welcome to the “now-normal.”

Payments preferences shifted too

Consumers also adopted digital payments out of necessity in the early days of the pandemic. Once they experienced the convenience, ease, and security, research shows they’re unlikely to go back to the good old days of cash and full contact payments. COVID-19 sparked quicker adoption of digital payments than the slower pre-pandemic path that was unfolding.

As we reported in Payments Next last week, a new global Visa study clearly shows the seismic shift in payments preferences:

“Nearly four in five (78%) consumers have made changes to the way they pay, including shopping online when possible (49%), using contactless payments (48%), and not using cash as much (46%). A majority (70%) of consumers have used a new shopping or payment method for the first time, including 26% who have used tap to pay for in-store purchases, shopping for groceries or household items online (34%), curbside restaurant pick-up (28%) and buying online then picking up in-store (25%).”

With health and safety concerns, contactless and digital payments are growing more quickly than before the pandemic. Three-quarters of small businesses have tried to keep up by adding or extending their e-commerce capacity or changing their point-of-sale technology according to Visa.

When it comes to e-commerce and payments, even with the expected reopening of nonessential businesses, the now-normal for retail is very much an omnichannel world.

You can read much more in-depth product category data and trends in Signifyd’s latest Pulse Report for E-commerce here.

Editor’s note: incorrect data originally published by Signifyd was updated.

LET’S CONNECT