From online shopping with rising digital and contactless payments and the massive increase in home deliveries, retail online and in-store after the pandemic will never be the same.

Visa is out with a new study that looks at both shifting consumers’ preferences and small business responses during COVID-19 to get insight into the future as small to midsize businesses (SMBs) fight for their survival.

The study surveyed SMBs and consumers in the US, Brazil, Canada, Germany, Hong Kong, Ireland, Singapore, and UAE between June 12 and June 29, 2020. With a small business rescue plan under serious discussion in the US Congress, this study couldn’t be more relevant.

Consumer purchase path and preferences changing fast

First, a look at how consumers are responding to the challenges of coronavirus and it starts with their expectation of digital-first commerce.

“Consumers are putting COVID-19 safety measures at the top of their shopping lists and rewarding businesses that do the same,” said Suzan Kereere, global head of merchant sales and acquiring, Visa.

Here are more consumer research highlights:

- Safety first means touchless: Contactless payments have become a driving differentiator: nearly two-thirds (63%) of consumers would switch to a new business that installed contactless payment options.For close to half of global consumers (46%), using contactless payment methods is among the most important safety measures for stores to follow. Nearly half (48%) would not shop at a store that only offers payment methods that require contact with a cashier or a shared device.

- New normal means new habits: Nearly four in five (78%) consumers have made changes to the way they pay, including shopping online when possible (49%), using contactless payments (48%) and not using cash as much (46%). A majority (70%) of consumers have used a new shopping or payment method for the first time, including 26% who have used tap to pay for in-store purchases, shopping for groceries or household items online (34%), curbside restaurant pick-up (28%) and buying online then picking up in store (25%).

“Historically, we see behavior change at the point of sale as a gradual shift over time. But COVID-19 has created an immediate need for safer, more efficient shopping experiences both on and offline and consumers are responding by rapidly migrating to digital commerce. We want small businesses to know that Visa is here to help them navigate these new consumer needs and expectations, which will make their businesses stronger now and in the long run,” Kereere said.

But there’s still work to do for those small businesses. Just 9% of consumers say they shop exclusively at locally owned businesses, whereas 15% shop exclusively at larger retailers, with the largest number of shoppers using a mix of shopping strategies in between these two extremes.

While contactless payments were lagging in the US compared to many other countries, the pandemic seems to have been the spark for a fast shift in consumer payment preferences.

How are SMBs responding?

While 70% of consumers have changed how they shop and pay in recent months, 67% of small businesses have tried to keep up by adding or extending their e-commerce capacity or changing their point-of-sale technology.

Despite the unpredictable nature of the pandemic, 75% of SMBs remain optimistic about the future. 71% of global SMB owners say they’ve received support from their local communities through business referrals (33%) and favorable reviews (31%).

Globally, SMB owners expect at least six to 10 more challenging months before their business is fully operational. Their biggest immediate concerns include revenue declines (52%), attracting new customers (46%), and having to reduce wages or salaries (22%).

SMBs are taking action despite challenges

The pandemic has imposed a whole set of new requirements for businesses to accommodate and attract new customers.

More than a quarter of SMBs (28%) have tried advertising on social media or sold products or services online (27%). Another 20% have adopted contactless payments. One-third (33%) of SMBs report they have accepted less or stopped accepting, cash since COVID-19. Millennial SMB owners (41%) are significantly more likely to have accepted less or stopped accepting cash, compared to Gen X (31%) and Boomers (21%).

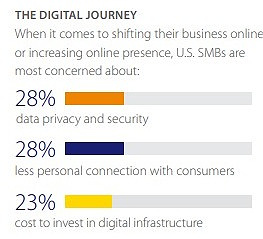

SMBs have concerns about shifting their business to online or increasing its online presence including data privacy and security (32%), followed closely by a less personal connection with customers (31%), and the cost to invest in digital infrastructure (28%). About three in four (74%) SMBs have concerns about shifting or increasing online presence.

The majority of SMBs are also very conscious of e-commerce and fraud risk with 53% likely to purchase a fraud management solution to protect their business. Good news for sellers of cybersecurity services.

In addition, as we’ve recently highlighted, other digital-first solutions such as accounts payable automation and real-time payments are selling like hotcakes.

SMBs responses vary throughout the markets surveyed

There are regional differences in how businesses in the eight countries surveyed are responding as a result of the pandemic.

In the United Arab Emirates (UAE), 44% of SMBs – compared to 20% globally – have enabled contactless payments for the first time since the start of COVID-19. Nearly 94% of UAE SMBs have pivoted to keep their business on track, compared to 67% globally. SMBs in Brazil (84%) and Hong Kong (87%) also are trying new approaches in large numbers, including selling online (50% in Brazil compared to 27% globally).

Consumers have real concerns about cash and keeping credit cards clean and businesses are responding. Two-thirds (67%) of consumers say they are taking some measure to keep their payment cards clean, with 33% saying they disinfect them.

An overwhelming majority of UAE (89%) and Brazilian (87%) consumers are taking some measures to keep their card clean, whereas Singaporean (50%), German (53%), Canadian (60%) and Hong Kong (65%) consumers fell below the global average.

In case you’re wondering how important small businesses are to our economy and local communities, consider this: SMBs account for 90% of global businesses and they drive between 50% and 60% of local jobs.

In some respects, with all the challenges they face, you have to admire the 75% of small businesses who remain optimistic about the future.

If you’re a small business looking for individual market insights, survival strategies, and tips on how other SMBs are responding or you’re just a curious consumer, you can read the Visa Back to Business Study here.

LET’S CONNECT