US B2B payments automation was gaining wider adoption last year and early into the new year. The obvious appeal to business owners and CFOs was cost savings, faster payments by clients and for suppliers, potential faster-pay discounts, quicker automated reconciliation, and a greatly reduced burden of paperwork.

When the pandemic struck in March, suddenly the payments world was turned upside down and digital payments became a necessity.

Fintech and Payments-as-a-Service provider Finexio started to see a big jump in new client interest as businesses faced the reality that the old way of doing payments was no longer possible.

“The almost immediate need for digital adoption is a major impact of COVID-19 on businesses, bringing about non-manual payment solutions, touch-free payments, as well as products and services that can be accessed remotely,” Finexio founder and CEO Ernest Rolfson told Payments Next in an interview. “During the pandemic, CFOs have been looking for immediate cost reductions, cashflow improvements, and more visibility and control on their payables and their working capital.”

New partnership with Billtrust speeds payments and tracking

Yesterday, Finexio announced a new partnership with Billtrust, a leading B2B order-to-cash solution that provides faster digital payments to suppliers with its extensive supplier network. Billtrust’s Business Payments Network (BPN) enables B2B payments by connecting buyers and suppliers on a simple, single platform which increases the number of suppliers that can now be paid electronically through Finexio’s network.

“The expansion of our supplier network through this partnership with Billtrust enables us to better serve our customers as we continue to scale,” Rolfson said. “We’re excited about Billtrust’s ability to reduce our efforts in making payments to their network of large and complex suppliers as part of our ongoing commitment to provide a complete suite of B2B payment services to our customers.”

While Finexio helps small to midsize businesses automate their invoicing, digital payments, tracking, and reconciliation, the new larger Billtrust supplier network also means cost and time savings.

“As Finexio experiences impressive growth, its collaboration with BPN can further increase its electronic spend and continue to bridge the overall B2B payments gap,” said Nick Babinsky, vice president and general manager of BPN at Billtrust. “Every supplier has their own preferred payment method, and this partnership allows for more seamless transactions and fewer delays.”

Finexio finds growth even during pandemic

Rolfson said during the past two quarters his company’s revenue has grown 159% year-over-year partly due to the coronavirus crisis.

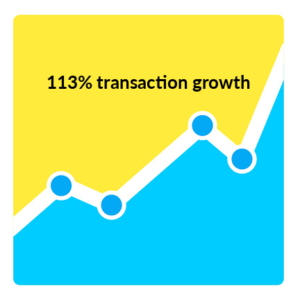

“Since the immediate shock of COVID-19 in Q2 2020, Finexio has seen a 113% increase in transaction volume due to the addition of net new customers. Businesses continue to spend less due to the pandemic and recession, but more customers are looking to adopt electronic B2B accounts payable payment solutions,” he said.

In 2019, Orlando Florida headquartered Finexio handled nearly $3 billion annually in customer payments to over 60,000 global suppliers. The new Business Payments Network sets the course for further growth this year and in the future.

What’s ahead for the payments world?

On the horizon, Rolfson expects to see further integration of modern consumer tools that will make it into the B2B payment world after the pandemic subsides. He says this will include user interface and user experience improvements for mobile and dual-factor authentication on security.

“We are definitely going to see fewer paper checks. I also think we’ll see banks pull back from lending, especially to smaller and middle-market companies,” he said. “This will leave room for nimble fintech players, like Finexio, to take market share from banks to provide a more comprehensive solution around payments and working capital management.”

As we noted recently with AvidXchange and other fintechs, Finexio is poised to build its market share at the expense of traditional banks and to the much-needed benefit of small to midsize businesses.