Highlights from Squawk Alley anchor Carl Quintanilla’s Nov 10 CNBC Evolve Summit interview with Visa Chairman and CEO Alf Kelly By Jeff Domansky, Nov 10, 2020 Between the pandemic, new competition, and a looming US Department of Justice antitrust lawsuit, let’s just say Visa, along ...

Read more

Payments Trends

Payments Trends

By Jeff Domansky, Nov 9, 2020 It’s no secret payments and shopping habits have changed around the world as a result of the global pandemic. Recent data from Lithuanian and UK cross-border payments provider Wallter.com shows three unmistakable payments trends in response to the COVID-19 ...

Read more

What a week! While the US waits for a clear election winner, the payments world was busy as usual. Here’s a fresh news roundup to keep you informed on the latest developments in the global payments industry. Top companies in the news include Visa/Plaid, Ant ...

Read more

By Jeff Domansky, Oct 29, 2020 New developments and improvements in voice technology are already driving customer service, bot automation, and even investments in the banking and payments world. Juniper Research estimates that over 4.2 billion digital voice assistants are in use on devices worldwide ...

Read more

By Jeff Domansky, October 27, 2020 Editor’s update: CNBC reported today (Nov 3) that “Ant Group’s controller Jack Ma, executive chairman Eric Jing and CEO Simon Hu were summoned and interviewed by regulators in China, according to a statement Monday from the China Securities Regulatory ...

Read more

In the first seven months of the pandemic, more than half of American consumers (57%) have unfortunately seen a reduction in their income, and 42% have missed at least one bill payment as a result. These and other results from a new survey of US ...

Read more

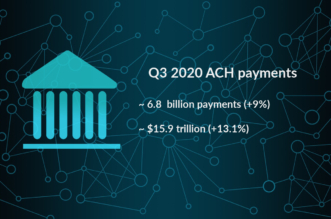

Nacha’s US Automated Clearing House Network (ACH) report for electronic funds transfers in the third quarter of 2020 showed exceptionally strong growth in volume and value despite the end of some government pandemic payments. ACH handled more than 6.8 billion payments in the third quarter, ...

Read more

New research suggests 58% of US consumers will stop using cash after the coronavirus pandemic ends. According to the September 2020 study by Travis Credit Union (TCU), consumers are now twice as likely to use a debit or credit card instead of cash to purchase ...

Read more

There’s so much going on in the payments world, it’s time for a roundup of quick news bytes and links to news you can use if you’re in the payments industry. Accelerating winds of change in global payments – McKinseyThe COVID-19 public- health crisis and ...

Read more

While COVID-19 is spurring new entrepreneurial startups, San Francisco-based fintech Azlo has launched a new set of digital banking, invoicing, and back-office tools to help SMEs and freelancers manage their back-office financial functions more efficiently and less expensively. Azlo Pro is a new subscription-based set ...

Read more