By Sunil Jhamb, Founder & CEO of WL Payments

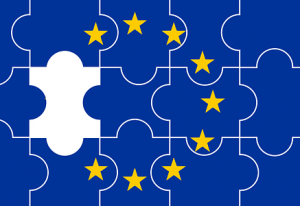

The e-commerce sector has grown steadily over the past few years, while international transactions have also become a regular phenomenon, especially in Europe where 23% of e-commerce[1] is cross-border. The COVID-19 crisis has further exaggerated these trends and presented many opportunities for companies that expand their online presence to emerge as market leaders.

However, any business that decides to enter a new market should be aware of the most popular digital payment methods in that country, as ultimately customers should be able to pay with their preferred method. The five biggest European e-commerce markets are a good place to start, as it provides a good overview of the European payments landscape.

UK is EU’s largest e-commerce market

Starting with the largest e-commerce market in Europe, the UK takes the top spot with the market size of €200 billion ($236.7 billion), and 91% of the British population being online shoppers[2]. Much of e-commerce sales are completed on a mobile device, which could explain why digital wallets are becoming increasingly more popular and growing at a much faster pace than credit cards.

The leading digital wallet in the UK is Paypal, which remains de facto unchallenged by competing wallets. Still, credit cards remain the most widely used payment method, as they have a long history of usage and are familiar to British shoppers. Lastly, it is noteworthy to mention that direct debits are also growing in popularity and so becoming increasingly more relevant.

France e-commerce growing quickly

France has Europe’s second-largest e-commerce market, valued at €103 billion ($121.9 billion) [3]. It was forecast that e-commerce growth in France, and other mature markets, would slow down, but evidently the global pandemic reversed this trend. Regarding payment devices, French customers are more conservative and prefer to pay via desktop, however, the m-commerce market is rapidly expanding, which is worth bearing in mind.

When it comes to payment methods, cards remain the most widespread, with the French Cartes Bancaires being the most popular one. Following this, are the digital wallets where PayPal is dominating the market once again. Lastly, bank transfers are on the rise, especially regarding payments for more expensive items.

Germany slower to adopt innovative payments

Third on the list is Germany with close to €71 billion ($84 billion) in e-commerce sales[4], most of it completed on a laptop. German consumers have been reluctant to adopt many payment innovations, due to particularly high safety concerns which can explain why open invoices remain the preferred payment method.

The appeal of open invoices also lies in the fact that customers can pay after receiving the goods, while this is a disadvantage for merchants as the probability of returns is higher. Besides this, Giropay and Sofort are favored real-time bank transfer options. Finally, unsurprisingly Paypal triumphs in the digital wallet market.

Spain e-commerce grew 25% in 2019

When it comes to Spain, Europe’s fourth-largest e-commerce market of €48.8 billion ($57.7 billion) [5], the country is experiencing rapid e-commerce growth. In 2019, the Spanish e-commerce market grew by 25% compared to the previous year, which was considerably higher than the European average of 13.6%[6]. Additionally, 40% of Spanish internet[7] users made an online purchase via a mobile device, indicating a rise in m-commerce.

This was also accompanied by a rise in digital wallets, which are becoming increasingly more popular and forecast to overtake cards, such as Visa and Mastercard, in the near future. What’s more, Paypal reigns in popularity, but new entrants such as Apple Pay and Google Pay are seen as real competitors. Lastly, bank transfers remain prevalent, but the Spanish banks’ common project, Bizum, has brought some changes and shaken up the payments scene.

The Netherlands is fastest-growing EU market

Last, but not least is the Netherlands, which ranks as the fifth largest e-commerce market with the size of €25.8 billion ($30.5 billion) [8]. Dutch shoppers have embraced digital retail and together with high smartphone penetration, this has put the country on the map as the fastest-growing European m-commerce market. This is also illustrated by the fact that almost 70% of all iDeal payments, the most popular payment method in Holland, are made via mobile[9].

Since iDeal captured more than half of all e-commerce transactions in 2019[10], other payment methods like credit cards and Paypal have a relatively small market share. However, the growing demand for alternative payment methods indicates this distribution is likely to change and that new entrants have the potential to disrupt the market with innovative payment solutions.

When comparing payment methods in the five largest European e-commerce markets, only one common thread emerges – PayPal’s dominant position. However, even this is not guaranteed as there are many potential competitors that can turn the tide in the near future. Besides this, there is much disruption in the online payments landscape, both in terms of the most popular payment methods and preferred shopping channels. Since customer preferences are diverse, shaped by cultural attitudes, and constantly changing, it is crucial to be aware of these differences. After all, “one size fits all”, certainly does not apply to online payments, particularly in the EU.

Sunil Jhamb is the Founder & CEO of WL Payments, a leading global white-label payments provider headquartered in Amsterdam. He previously founded Newgen Payments and formerly worked at GlobalCollect (now Ingenico) as director of global planning and strategy.