While COVID-19 is spurring new entrepreneurial startups, San Francisco-based fintech Azlo has launched a new set of digital banking, invoicing, and back-office tools to help SMEs and freelancers manage their back-office financial functions more efficiently and less expensively.

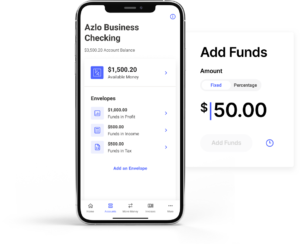

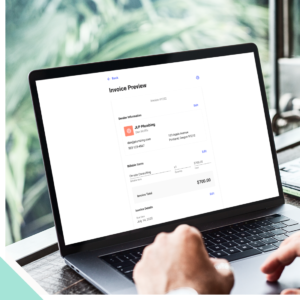

Azlo Pro is a new subscription-based set of tools and services designed to help entrepreneurs save time and money by automating financial back-office tasks and reducing the cost of instant transfers. Automated features such as scheduling and sending invoices, and automatically budgeting using unlimited digital “Envelopes” save time and ensure funds can be earmarked and set aside for crucial expenses like payroll, owner draws, and expenses.

“A silver lining of the pandemic is that we’ve seen a remarkable surge in entrepreneurship,” says Cameron Peake, CEO and co-founder of Azlo. “We recently surveyed our new account holders and found that 97% of these new businesses are founded by people who’ve always harbored a desire to start a company and are first-time founders. We’ve created Azlo Pro to help these entrepreneurs – whether it’s their first business or their 10th – automate tasks related to budgeting and invoicing. This allows them to focus on doing what they do best, and survive the often-tough first year.”

New features increase efficiency, reduce costs

New features in Azlo Pro include automation of recurring back-office tasks such as invoicing, payments and account management; instant transfers between internal and external accounts; a 50% reduction in transfer fees; and enhanced sending and tracking of invoices within the account.

One feature proving popular is Azlo’s digital “envelope system” which helps business owners allocate and manage funds simply and easily. For example, account holders can create and automatically set aside a portion of revenues to cover recurring expenses such as quarterly tax payments.

The Azlo Pro service costs as little as $10 per month and can be canceled at any time, providing business owners with both value and flexibility in managing future company growth.

Azlo growth ahead

Peake said her company is serving a growing list of SMEs. “Azlo serves a wide range of small businesses working across many industries. Professional services and retail and commerce, make up more than half of account holders, with categories including the arts, entertainment and recreation, health and beauty, education, and government making up a significant segment of our customer base. Construction, travel, and food services are all included in our customer base.”

Recent research by the company with 1000 of its account holders showed 39% of founders either already have employees, or are planning to hire in the near future; 50% said that they have had time to get their new enterprise going because other activities were put on hold due to the pandemic; and over a third (37%) of entrepreneurs said the coronavirus outbreak created a market opportunity for them.

“Azlo is focused on meeting the current needs of our users and helping them power the COVID economy that we’ve seen emerging with new business starts,” Peake added.

Azlo grew it’s business 500% in 2019 and despite the impact of COVID-19 on the economy, the company has doubled its customer base in the first three quarters of 2020.

The company, co-founded by CEO Cameron Peake and payments industry veteran Brian Hamilton, launched in 2017 and banking services are provided in partnership with BBVA USA.

You can find out more information about Azlo Pro services here.

Visuals courtesy of Azlo

LET’S CONNECT