Another new digital bank launched in the US and it’s aiming to provide innovative features for what it says is the underserved middle-class in America.

Former Capital One senior vice president Brian Hamilton and former PayPal and Intuit CEO Bill Harris founded the new banking app One in 2019 with a goal to provide a unique, digital bundled banking service for the 52% of US residents defined as “middle-class.”

In announcing its beta-test in March 2020, One Chairman Harris said, “There’s a gap in the market that’s not being met. Traditional banks cater mostly to affluent customers and new digital banks target younger individuals with simpler financial needs. Middle-class American families are being left out, and we built One specifically for them. One will combine the technology and convenience of challenger banks with a full suite of products that traditional banks offer.”

The app is designed to help users build healthy financial habits and emergency savings, earn interest on their savings, and get credit based on income rather than credit scores alone. All within a single banking app.

“Today, we’re proud to officially release One, the first digital banking service that seamlessly combines saving, spending, sharing, and borrowing into one account—with one card. You can use it jointly with anyone in your life, and there are no fees, overdrafts, minimums or “gotchas.” Just a fair transparent banking product, that hopefully helps to alleviate some of the financial anxiety that is permeating our lives these days,” said Hamilton, CEO of the new bank in its Sept 22 announcement.

New challenge for challenger banks

The bank says many neobanks offer only part of the financial services mix wanted by consumers today. With its official launch, the bank aims to provide just the right one-stop digital account services mix.

“It seems like the [neobank] space is almost overcrowded, but I don’t think they’ve cracked the nut of acquiring customers from traditional financial institutions,” Hamilton told American Banker. “There is more value having things in one place rather than going to different startups to get competitive savings … and a cool loan product.”

One says its bundle of features sets it apart from other challenger banks:

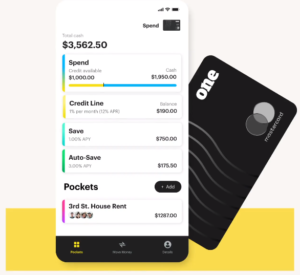

- debit and credit are wrapped into one account, with just one card to access both. One doesn’t charge monthly fees, overdraft fees, or NSF fees.

- each account has a line of credit and if overdrawn and repaid within the same month, no interest is charged; users with direct deposits also earn a higher line of credit.

- the primary savings “pocket” earns 1% on balances up to $10,000 and 3% on a portion of account holder paychecks deposited directly to their One account.

- users can set up and share funds from an unlimited pool or “pockets” of funds with no paperwork and more conveniently than transferring funds repeatedly through peer-to-peer payment services.

Pockets and credit lines

Hamilton explained Pockets can be used to stick to a budget, manage household expenses, keep roommate bill-chasing to a minimum, or help pool money in support of an older relative or personal cause.

“At One, some of us get creative when we name our Pockets (aka Burrito budget) and some of us are more serious when we name our Pockets (e.g. Mom healthcare). Whatever you decide to call them, Pockets are designed to give you clear visibility and more options when it comes to your money. And when you’re spending, you can tell the One app which pocket to use for each purchase when you use your card or send a payment,” he wrote in the company blog announcement.

Each One account also comes with an integrated Credit Line. Borrowers pay no interest if the credit is paid back within the same calendar month. Balances carried forward into the next month, cost 1% per month (12% APR) on any amount borrowed. “This is the most affordable and flexible overdraft facility we know of, and everyone deserves one,” Hamilton claims.

Since beta-testing in spring 2020, an estimated 10,000 or more customers have signed up for its services using a banking platform provided by Everett, WA-based Coastal Community Bank which has assets of $1.7 billion. San Francisco headquartered One has raised $26 million in funding from VCs including Foundation Capital, Core Innovation Capital, and Obvious Ventures.

Accounts can now be opened by US residents and you can learn more from the One website.

LET’S CONNECT