Lots of breaking and positive news this week, and this quick roundup will keep you up to speed on the payments industry news you need to know.

April US retail sales grow 23.3% as trends point to a recovering economy

Total US retail sales sprung into another month of double-digit growth in April, according to Mastercard SpendingPulse, which measures in-store and online retail sales across all forms of payment. US retail sales increased 23.3% year-over-year in April and 10.8% compared to April 2019. Online sales in April grew 19.9% and 95.6%, respectively. Retail sales continue to benefit from stimulus payments, coupled with warmer weather and broader reopening across the country. Read more…

COVID triggers changes in payments habits among 8 in 10 consumers

More than eight in ten consumers (86%) say that their payments habits have changed since the start of the pandemic, with 59% trying a new payment method for the first time – rising to 77% among the 18- to 24-year-old age group. That’s according to new research released by leading specialized payments platform Paysafe, in which 8,000 consumers were surveyed for the company’s latest Lost in Transaction report. Read more…

Paysend now offers fast money transfers from US to Canada

Global payments provider Paysend announced that US consumers can now electronically send money via mobile app to friends and family in Canada. The expansion allows US residents to transfer funds to 70+ different countries in their respective currencies. Funds are sent to Canada in CAD via Interac for deposit within hours to the recipient’s Canadian financial institution. Read more…

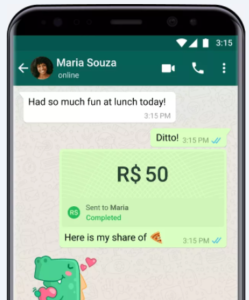

Mastercard cardholders can now send and receive money using WhatsApp in Brazil

Mastercard cardholders in Brazil can now send and receive money to and from friends and family through WhatsApp. Mastercard debit cardholders with cards issued by Banco Inter, Itaú, Nubank, and Sicredi can use the P2P WhatsApp service enabled by Facebook Pay and processed by Facebook Pagamentos and Cielo. Brazil Central Bank officially granted a Payment Initiator license to Facebook Pagamentos do Brasil Ltda and approved Mastercard’s new transfer scheme. Read more…

Splitit opens new installment payment opportunities for merchants

New York-headquartered Splitit launched a new buy now pay later service with a simpler way to manage the installment payment process and reconciliation. Splitit Plus enables merchants of all sizes to offer payment installments to their customers in minutes. Any merchant can activate Splitit through the Splitit Plus gateway or more than 90 integrated gateway partners. Read more…

Veridium partners with Jumio to deliver biometric identity verification to fight fraud and streamline electronic KYC initiatives

Veridium signed a strategic partnership agreement with Jumio, a leading AI-powered end-to-end identity verification, and eKYC solution provider. The partnership brings flexibility and stronger security for eKYC (Know Your Customer) use cases, allowing organizations to apply industry-leading capabilities for facial, document, and fingerprint biometric recognition for identity verification. Read more…

Square Online courts bars and brewers with delivery via DoorDash

Square continues to build out delivery services for its Square Online platform with the addition of liquor delivery. Merchants that sell liquor using Square Online can offer customers the option to purchase alcohol from the store’s website and have the order fulfilled through Square’s delivery partner DoorDash. Square expects the new service will appeal to restaurants, bars, breweries, liquor, and convenience stores. Read more…

PaybyPhone announces 43 million registered users

PayByPhone, a leading global provider of mobile parking payment solutions, celebrated 43 million registered users and 20 years in business. It now operates in over 1,000 cities, recently launching in 30 new communities, including the City of Denver, and successful partnerships with cities like Miami and Paris. PayByPhone is currently offered in 13 languages and 14 countries and is owned by Volkswagen Financial Services AG. Read more…

$4.2 trillion projected for global e-commerce in 2021

It looks like new online shopping habits by consumers could ring up $4.2 trillion in e-commerce sales globally this year, an increase of 20% over 2020. Adobe’s Digital Economy Index report showed a surge in online purchasing in March thanks in part to US stimulus checks and vaccinations. According to Adobe estimates, US consumers spent $8 billion more online than projections for the period. That approached the $9 billion spent on Black Friday in November 2020. Read more…

Zelle springs into 2021 with more than $100 billion sent in Q1

Zelle reported $106 billion sent through the Zelle Network on 392 million transactions during Q1 2021. Year-over-year sent payment values increased by 74%, while payment transactions increased by 61%. Zelle Small Business continues to be one of the fastest growth areas for the Zelle Network, with transactions rising 180% year-over-year. Consumers in nearly 8,000 financial institutions use the Zelle Network. Read more…

Intuit QuickBooks survey: US Small business recovery building momentum

A new report by economist Susan Woodward shows US small businesses are on the road to financial recovery from the impact of COVID-19. Even some of the hardest-hit companies are now finally showing signs of recovery. 61% of industries saw annual revenues increase during the pandemic, following a sustained recovery since April 2020. These widely reported success stories during the past year included home improvement, groceries, and e-commerce. Read more…

US small business Covid-19 payment perspectives

TSG found 92% are open, partially open, or planning to reopen soon. Researchers found 13% of businesses were closed temporarily in April 2021 compared with 25% in April 2020, while 8% of companies were closed indefinitely in April 2021 compared with 13% in April 2020. Since the pandemic began, 15% of small businesses added an e-commerce store or capability. Read more…

Allstate Identity Protection finds 17,000% increase in unemployment fraud in 2020

According to data collected by Allstate Identity Protection (AIP), unemployment fraud skyrocketed more than 17,000%, and tax fraud grew 258% year over year. Both are likely to continue rising in 2021, with unemployment fraud cases expected to more than triple again this year. The US Department of Labor estimates scammers collected $36 billion in fraudulent UI claims and represents 70% of the fraud cases resolved by AIP. Read more…

PDI acquisition of GasBuddy changes the loyalty landscape in convenience retail

PDI acquired GasBuddy, a mobile app that tracks gas prices at more than 150,000 North American locations. GasBuddy reaches the entire convenience and fuel retail channel with over 5 million active users interacting with its app, which has been downloaded nearly 90 million times and is one of the highest-rated apps in the history of the Apple App Store. Read more…

New research: Luggage packed, business travelers raring to go

Despite the impact of Covid, 84% of business travelers are keen to travel with proper pandemic protection. New research shows 93% of business travelers reduced travel for work by 60% or more during the past year. Those over age 55 reduced business travel by 70%, according to a new report from Amadeus. Frequent travelers highlighted five key safe travel measures, including information sharing, contactless payment technology, and comprehensive medical insurance. Read more…

LET’S CONNECT