By Brian Geier, VP of Business Intelligence, Recurly

Insights drive business decision-making, and Recurly has a unique subscription industry perspective. We have an invaluable view of hundreds of millions of subscribers across thousands of industry-leading consumer subscription brands. Something interesting popped on Recurly’s radar during the first quarter of 2023.

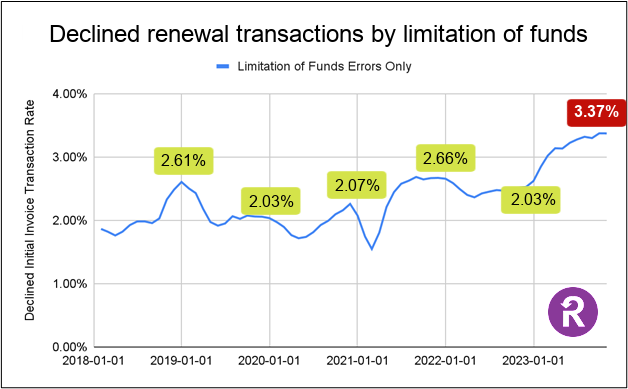

Transactions are being declined due to the limitation of funds (both insufficient funds or reaching credit limits) at an increasing rate. And this trend has persisted through the year. Renewal invoice decline rates due to a limitation of funds are up 70% in November 2023 vs. pre-COVID trends.

Note: This error (declined renewal transactions due to limitation of funds) is specifically related to limitation of funds – a subset of total renewal invoice decline rates—and is only one of many decline reasons.

Understanding the macro-economic factors

An increasing rate of renewal transactions being declined due to limitation of funds highlights the stress consumers are under. Essentially, a transaction is rejected because the customer either does not have enough money in their bank account or has hit the limit on their credit card.

Several factors are likely at play leading to this increase:

- Interest rates and inflation: The rising cost of living affects consumers’ budgeting decisions, and many are still reeling from the 8% inflation of just a few months ago. The steep cost of living adjustments, from rent to groceries, has caused stress on consumer’s budgets.

- Mounting debt levels: Consumers are burdened by increasing debt loads. In Q1 2023, Americans’ debt surpassed $17 trillion for the first time, and consumer credit card balances remained flat for the first time in 20 years.

- Americans are running out of savings: The lower 80% of Americans by income have depleted their excess savings from COVID and associated stimulus. Meanwhile, 37% of consumers cannot cover an unexpected $400 bill—up from 32% last year.

What can subscription businesses do?

Limitation of funds is the second most common reason transactions are declined, so having a solid revenue recovery strategy is essential. For instance, many companies leverage static rules, yet at Recurly, we leverage AI, and every type of declined transaction has custom retry logic developed from years of transaction data.

This custom retry logic helps our customers recover more revenue. Combining years of data with AI-powered transaction retry models and other options like card vaulting, wallet and dunning best practices improves invoice success rates. On average, across all decline reasons and strategies, subscription businesses should be able todouble their recovered revenue after putting enhanced recovered revenue strategies into practice.

And, remember: any revenue retention strategy should start with the subscriber and focus on building long-term relationships over time. Consumers are becoming more intentional about their spending habits – and their spending ability may change over time. There are ways to keep subscribers engaged and extend these important relationships – think about introducing a lower-priced tier, offering additional promotions for these subscribers, or even the ability to pause until circumstances change. These solutions make a difference when you consider brand reputation and loyalty.

Conclusion

An uptick in a limitation of funds within consumer subscriptions will necessitate proactive measures to retain subscribers in this challenging economy. Align yourself with a partner who can optimize your subscriber relationships and provide a recovered revenue strategy to retain revenue.

About the Author

Brian Geier is the VP of Business Intelligence at Recurly, where he helps leverage his ten years of analytics experience at subscription businesses to drive meaningful insights for Recurly’s customers. His previous experience includes management roles with Naked Wines USA, Sling TV and Dish Network.

Recent PaymentsNEXT news:

Navigating the embedded finance revolution: Strategies for simplifying legacy bank technology