By Jeff Domansky, April 28, 2021

It looks like new online shopping habits by consumers could ring up $4.2 trillion in e-commerce sales globally this year, an increase of 20% over 2020.

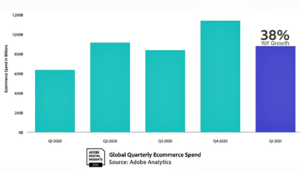

Adobe’s Digital Economy Index report showed a surge in online purchasing in March thanks in part to US stimulus checks and vaccinations.

According to Adobe estimates, US consumers spent $8 billion more online compared to projections for the period. That approached the $9 billion spent on Black Friday in November 2020.

New shopping habits hard to break

Researchers analyzed more than 1 trillion visits to retail sites and over 100 million SKUs in more than 100 countries and consumer interviews in the US, UK, and Japan.

The projected $4.2 trillion in online sales represents a 39% year-over-year growth in Q1. After more than a year in lockdown and working from home, consumers grew accustomed to ordering online and will likely continue their new shopping habits.

“The changes we’re seeing are things that are going to carry forward for generations,” said Jason Woosley, vice president, commerce and developer experience, at Adobe. “There’s just too much momentum and durability.”

US online sales up 39% in Q1

In Q1 2021, US online sales reached $199 billion, up 39% over the year previous. US consumers spent $78 billion in March, an increase of 49% last year.

The recovery seems well underway, and US online sales will be a big part of it. Adobe projects US e-commerce sales of between $850 billion and $930 billion in 2021, reaching more than $1 trillion in 2022.

Products most popular with consumers included toys, home furnishings, video games, and automotive parts. Online grocery sales grew 17% between March 7-21 in the US compared to a similar two-week period in August 2020.

US travelers are also taking advantage of low prices, booking 9% more flights for Thanksgiving and 17% for the Christmas holidays compared to 2019.

In another sign of things to come, buy now, pay later (BNPL) sales in the US jumped 166% in March over last year, according to Adobe’s analysis. Florida, Washington, and Colorado were the biggest BNPL buyers, while the least interested were shoppers in New Mexico, Hawaii, and Wyoming.

UK online spending jumped 66%

UK shoppers jumped into online shopping with both feet, spending $39 billion in Q1 2021, +66% growth over the same period last year. Half of the online spending occurred on smartphones, up 6% over last year.

More than two-thirds (39%) of UK consumers shopped online for groceries monthly compared to 27% in the US and 24% in Japan.

As many as 15% of UK online shoppers never purchased online before March 2020, with 9% new in the US and 8% new online shoppers in Japan. “This is a brand-new audience for e-commerce,” Woosley said. “It’s likely these consumers are here to stay.”

Japanese retail sales were up 15%, with $5 billion more spent online in Q1 2021.

Can the supply chain meet demand?

While out-of-stock messages were rare before the pandemic, last year saw product shortages and supply chain challenges. The big question for merchants is, will their supply chain stand up to demand?

Adobe reports baby and toddler products carried out-of-stock messages 3.2 times more than average, followed by grocery (3.1 times) and jewelry (2.8 times).

All in all, the economic recovery seems to be firing on all cylinders if retailers can respond to inventory, shipping, supply chain, and other logistical challenges this year.

You can download a free copy of Adobe’s Digital Economy Index report here.

Check out other recent PaymentsNEXT coverage of online spending:

Intuit QuickBooks survey: US Small business recovery building momentum

$1400 stimulus check won’t cover one month of bills

Covid-19 spending: Mortgages mattered most in US

LET’S CONNECT