By Jeff Domansky, April 27, 2021

It’s financial results season, and it’s not just big business seeing an economic recovery underway.

A new report from Intuit QuickBooks by economist Susan Woodward shows US small businesses are on the road to financial recovery from the impact of COVID-19.

Even some of the hardest-hit businesses are now finally showing signs of recovery.

Sudden impact

COVID’s impact on small business revenue was most severe in April 2020, immediately after the onset of the pandemic. Nationally, 28 out of 74 industries analyzed (38%) saw annual revenue go down during the pandemic. Revenue dropped by 22% nationwide — equivalent to $4.6 billion during that month alone compared to before the pandemic.

The hardest-hit businesses included recreation, travel, restaurants, beauty and personal care service providers, and fashion retail.

Personal care businesses (barber shops, beauty salons) saw a 52% drop in monthly revenue when the pandemic first hit. Barbershops were the worst hit, down by 82% (~$12,000 per business) in April 2020. Encouragingly, in nine of the last ten months, the service providers have been down less than 20%. In March 2021, they were 16% above pre-pandemic revenue.

At the end of March 2021, bowling alley annual revenues are down by 33% – a drop of more than $250,000 per business – compared to pre-pandemic levels. This is followed by theaters (-51%, minus $144,000 per business) and gyms (-15%, minus $32,000 per business).

Seven hardest-hit industries

The seven biggest industries hardest hit by one year (April 2020 10 March 2021) of Covid 19 included the oil and gas industry (-20%), recreation (-20%), local transport (-19%), theaters (-15%), hotels and lodging (-12%), museums and attractions (-11%).

Businesses in high-density urban areas on the East and West Coast experienced more significant negative financial impacts than those in rural regions.

SMBs in New York City saw annual revenue drop by $58,000 per business compared to pre-pandemic levels. The other hardest-hit cities were San Francisco (down $36,000 per business) and Brooklyn, Honolulu, and Santa Monica, which each saw a decline of $26,000 per business compared to pre-pandemic levels.

An SMB survey from Alignable in March 2021 shows a large percentage of small businesses still struggling to keep their doors open, including minority businesses (58% lower revenue than pre-Covid), women-owned businesses (51% lower), and 49% of small businesses struggling to pay their March 2021 rent.

Intuit QuickBooks survey size is substantially more than one million businesses. There may be a built-in positive bias in the Intuit QuickBooks data because these companies use accounting software and technology and have proven faster to respond. Only time will tell if the recovery is as widespread as their data indicates.

Top performers despite Covid

The research shows 61% of industries saw annual revenues increase during the pandemic, following a largely sustained recovery since April 2020. These widely reported success stories during the past year included home improvement, groceries, and e-commerce broadly.

The seven most resilient industries after one year of Covid (April 20 22 March 2021) were finance and insurance (+14%, plus $69,000), agricultural services (+10%, plus $29,000), fishing and hunting (+10%, plus $10,000), building and garden materials (+10%, plus $41,000), forestry (+8%, plus $27,000), and crop production (+8%, plus $18,000).

Mortgage bankers saw a 30% increase in annual revenue (+$148,000), retail nurseries up 17% (+$75,000), and hardware stores up 14% (+$94,000). Motorcycle dealer revenue grew 17% (+ $55,000) while RV dealers were up 15% (+ $109,000) over the past year.

Despite widespread reporting of severe financial impact, some small cities saw revenue increases, including Gilbert, AZ (+ $15,000 per business), Boise, ID (+$13,000), and Colorado Springs (+$10,000).

Survivors recovering fast

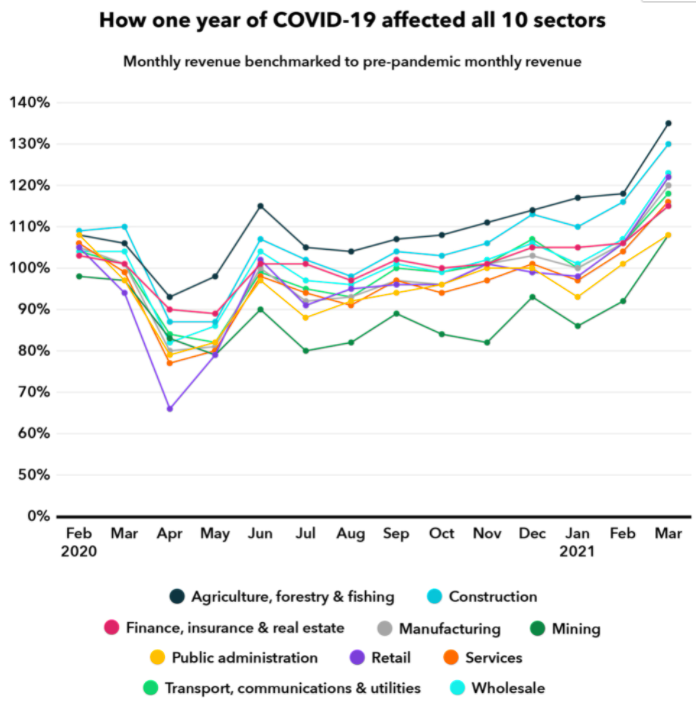

Despite the mix of bad news with good, the Intuit QuickBooks survey indicates a recovery may be well underway even for those US businesses hardest hit.

As report author Woodward notes:

“Most of the top-performing industries only saw their monthly revenues go down during April and May of 2020 compared to their pre-pandemic levels. By June 2020, six of these industries were not only back to their pre-pandemic monthly revenues; they were ahead of them. By September 2020, all seven were ahead. This was not a short-term blip. The upward trend continued for them and many other small businesses as well.”

By the end of March 2021, all ten sectors were back to their pre-pandemic revenues. But some public-facing businesses such as restaurants, bars, hotels, and recreation businesses may still need help. For nearly one-third of these businesses, revenue in December 2020 was 50% lower than in December 2019.

Overall, however, the recovery picked up speed as the new year began. “In January 2021, the recovery picked up speed more broadly again. And by February, even businesses that rely on face-to-face interactions hit 93% of the benchmark they set before the pandemic. By the end of March, they were at 107%,” Woodward writes.

So we’re hopeful. What didn’t put most of the survivors out of business has made them stronger. With the help of vaccinations, the Biden recovery plan, technology, and innovation, economic recovery appears on the horizon.

You can read an in-depth analysis of the survey of more than one million US businesses by Intuit QuickBooks here. It’s a valuable reflection on the past year and a look ahead at the potential for recovery.

Recent PaymentsNEXT coverage of Covid-19 impact on business chronicled the impact of the pandemic and how US businesses responded:

COVID-19 sales impact, biggest challenges, best business responses

US small business relief can’t come fast enough

COVID-19 crisis creates contactless payments growth

Navigating payments automation, COVID impact, and finding success

LET’S CONNECT