As business and consumers start to raise their heads from months of prolonged lockdowns due to the coronavirus crisis, the US payments industry is finally seeing growth in the use of contactless and automated payments. Traditionally, the US had lagged behind earlier adopters in SE Asia, the UK, and the EU.

Payments provider PaySimple saw some notable shifts in payment preferences and practices by US consumers from February through early May 2020 as businesses scrambled to provide a safe and secure payment system to meet the new reality of living in a pandemic.

Seismic shift in payments offers

PaySimple research showed some interesting changes in how the payments landscape has been impacted by the pandemic:

- The number of online payments such as payment forms, embeddable “buy now” buttons and online stores increased across PaySimple’s portfolio with significant increases starting in April and continuing through May.

- The home services industry segment is surpassing pre-COVID-19 levels driven by the transition to online payment forms and mobile payment solutions for in-field services.

- Professional services such as accounting and legal firms continue to process more by online payment forms than they did prior to COVID-19 shutdowns.

Some of these new practices seem destined to remain in place post-pandemic and in the event of a second wave of the virus.

“Despite the many downsides of COVID-19, the pandemic has proven the necessity for businesses to rethink their payments processes and we are pleased to be able to help our customers navigate new strategies during these unprecedented times,” said David Sharp, President of PaySimple. “With businesses opening up in most states, I’m optimistic about what the future holds and how businesses are pivoting to digital payment processes and adjusting their cashflow management strategies in a way that will bring benefits both now and in the long term.”

Contactless mobile payments growing

Previously seen as a narrow niche with tepid growth, contactless mobile payments have raced ahead during the pandemic. Consumers, nervous about catching coronavirus from cash and credit card terminals, are now seeing cashless as a safer way to pay.

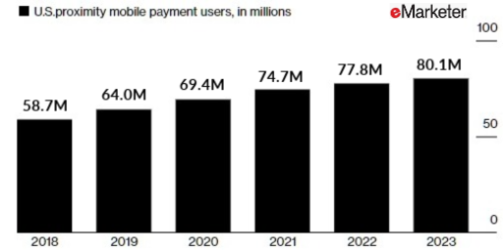

eMarketer data shows a slow but steady growth in contactless payments which has now accelerated

Richard Crone, CEO of mobile-payment research firm Crone Consulting expects contactless payments to see growth between 10% and 20% of transactions at stores and ATMs and P2P services like PayPal, Venmo and Zelle should grow as well, Crone told Bloomberg in a recent interview.

Research by the Strawhecker Group and the Electronic Transactions Association found 27% of US small businesses had seen an increase in mobile payments like Apple Pay and Google Pay.

Publix Super Markets posted signs at its grocery checkouts encouraging customers to pay for purchases with contactless payments. At Walmart, the retail giant adjusted its self-checkout terminals to go completely contactless when shoppers use Walmart Pay.

P2P payment app Zelle which is supported by banks including Bank of America and JPMorgan Chase, saw some users buying groceries for their neighborhood and then using the mobile app to recoup payments from neighbors according to spokesperson Meghan Fintland.

“People don’t want to handle cash, especially at this time, so they are looking to mobile payments as the best alternatives,” Fintland told Bloomberg.

In March, mobile payments company Square launched new ways for its restaurant owners to take contactless payments for take-out and meal deliveries.

Some experts say the new payment preferences by consumers are here to stay this more people become familiar with mobile payments.

“It’s behavior that’s going to stick after stay-at-home ends,” 451 Research analyst Jordan McKee said. “There will be muscle memory about paying, and consumers will use it going around their daily life.”

Facebook launches WhatsApp payments in Brazil

Earlier today, Facebook announced it was enabling payments using its WhatsApp messenger service where it has more than 120 million users including a large number of underserved or unbanked consumers.

While merchants will pay a 3.99% fee for using the service, it will be free for consumers to pay for goods or send money to friends and family. Facebook is partnering with prominent payments processor Cielo SA to process transactions.

WhatsApp Chief Operating Officer Matt Idema said Brazil is its first full-scale rollout of its payments feature in partnership with three banks initially including Banco do Brasil, Nubank, and Sicredi.

In April, Facebook invested more than $5.7 billion in Reliance Jio one of India’s most popular services which also operates e-commerce platform JioMart although the deal received strong pushback from regulators. The company also bought into Gojek, Indonesia’s popular ride-healing service which has quickly evolved into a payments platform as well just like Uber.

While the coronavirus crisis has been a public health disaster, it has been good for contactless payments as e-commerce takes on a more prominent role in consumers’ daily lives in the new-normal.