By Jeff Domansky, April 15, 2021

According to new research, when it comes to consumer spending priorities during Covid-19, mortgages mattered most, followed by car loans and credit cards.

TransUnion researchers found the pandemic had a pronounced effect – in a short period – on how people paid their debts, particularly when faced with financial stress. The changes occurred across multiple credit products in the US, with consumers prioritizing their mortgage loan payments over car loans and credit cards.

TransUnion has tracked payment preferences for more than a decade.

“This study is unique in that it highlights how and why payment dynamics changed in different countries as a result of the COVID-19. These insights will better equip both financial institutions and consumers, fostering more trustworthy interactions between them as the world begins to normalize and recover from the pandemic,” said Charlie Wise, head of global research and consulting at TransUnion.

Global differences in payment preferences during Covid

The study looked at consumers with at least one credit card and one personal loan to identify changes in payment preferences in the US, Canada, Colombia, India, and South Africa.

The study found that US consumers prioritized paying personal loans such as mortgages and auto loans when they had multiple credit cards. The gap between delinquency rates narrowed during the pandemic, however. Similar trends occurred in Canada and India, suggesting credit cards are essential during the pandemic as consumers focused on keeping their cards in good standing by making timely payments.

Interestingly, in South Africa, credit cards were prioritized over personal loans, reversing the pre-pandemic hierarchy in favor of personal loans.

Clinging to credit cards

Consumers tried to keep their financial options open when using credit cards to help pay expenses, particularly when they owned only one credit card.

“Cash was clearly not king during the early parts of the pandemic. Millions of people opted to use their credit cards to make digital transactions from the safety of their home for groceries, clothes, or other everyday items,” said Matt Komos, TransUnion’s head of research and consulting in the US.

“If you only have one credit card and you were worried about visiting stores at the height of the pandemic, there’s a strong likelihood you will preserve that card to continue spending and making digital transactions. If you possess three cards, though, it’s far more likely that you will go delinquent on one of them before you do so with a personal loan if you are facing financial hardship, as many consumers can continue to get by as long as they have access to at least one card.”

Consumers appear to understand the negative impact of a missed payment on credit cards and personal loan holders’ credit scores. Approximately 68% of credit card holders and 65% of consumers with personal loans said a consequence of a missed payment would lower their credit score. Comparatively, consumers with auto loans (55%) and mortgages (57%) were less aware of this consequence.

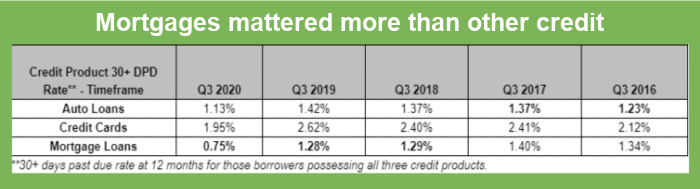

Mortgages mattered most in the US

Approximately 27.8 million consumers held all three loans as of Q3 2020, and mortgages were a priority over the other credit products. “Mortgage is once again the clear priority for US borrowers,” said Komos.

“The mantra, ‘you can’t drive your home to work’ doesn’t have the same effect when millions of Americans are waking up, showering, eating breakfast, and taking only a few steps to their home office,” he added.

Thousands of mortgage borrowers took advantage of accommodation programs to delay payments and protect their home equity as they worked from home while home values continued rising.

For those consumers with just one credit card in the US, consumers valued it more than their car loan beginning in Q2 2020. This shift suggests the growing importance of maintaining access to at least one credit card as e-commerce and digital transactions became a daily necessity for many households.

“The pandemic has changed so much in the world, but understanding why consumers are making important credit decisions only serves to better help the lending ecosystem in the future,” Komos said.

For more information about TransUnion’s Global Payment Hierarchy Report, please click here.

More PaymentsNEXT coverage of pandemic spending follows:

Post-Covid consumer payment & fintech strategies

How have payments changed in the past 10 months?