By Douglas Hall, Publisher, PaymentsNEXT

A new report from The Strawhecker Group (TSG) and the Electronic Transactions Association (ETA) reflects the impact of the pandemic on payments and the plans for US small businesses to respond to the new consumer payment preferences evolving.

Of the companies surveyed, TSG found 92% are open, partially open, or planning to reopen soon. Researchers found 13% of businesses were closed temporarily in April 2021 compared with 25% in April 2020, while 8% of companies were closed indefinitely in April 2021 compared with 13% in April 2020.

Since the pandemic began, 15% of small businesses added an e-commerce store or capability.

Businesses surveyed covered a wide range of most common merchant types across the US, with revenues ranging from $50,000 to $5 million. The result is an emerging picture of new payment preferences and how small businesses plan to respond.

Perspectives from pandemic payments landscape

Highlights from the report show the impact of Covid-19 and a payments picture that contrasts April 2021 with April 2020:

- 43% think digital payments are somewhat or more important than before the onset of the pandemic

- 42% of SMB’s not accepting card payments in April 2020 are currently or planning to investigate accepting credit/debit cards

- 16% more businesses saw an increase in debit card use in April 2021 compared to April 2020

- 15% of small businesses added an e-commerce store or capability since April 2020.

When it comes to payment types, 77% accepted credit/debit cards, followed by cash (64%), digital wallets such as Apple Pay, Google Pay or PayPal (44%), check (32%) buy now pay later (13%), and other payments such as wire transfers or direct deposits (8%).

Small business owners made some shifts to accommodate: 22% accepted payment by a terminal or computer in-store in April 2021 (compared with 15% in April 2020), 16% over the phone (20%), and 20% took payment at the point of service with a mobile terminal (14%).

Contactless payments are growing: 34% saw increased use of contactless payments, up 7% over last year. Surprisingly, 13% still did not support contactless payments in April 2021.

Fragile small business recovery

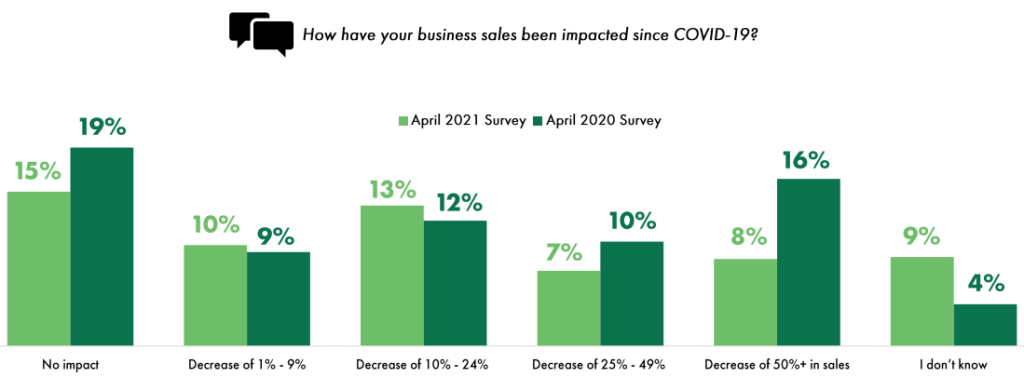

While many bigger businesses have experienced a strong rebound, TSG found only 38% of small businesses reported some increase in sales since the pandemic started compared to 31% last year.

38% of businesses said they had decreased sales since the pandemic began compared to 47% last year. 13% experienced sales decreases between 10% and 24% in April 2021, with 8% showing a decline of more than 50% in sales compared to 16% in April 2020.

Researchers found more than half (53%) of small businesses said the pandemic had a very negative or somewhat negative impact on their business. In comparison, 29% said it did not affect, 12% claimed a slightly positive effect, and 7% a very positive effect.

Optimism is lower in April 2021 compared to April 2020 with 48% optimistic compared with 63% last year, 28% pessimistic compared to 14% last year, and 25% unsure compared to 23% last year. In the light of vaccination growth in the US, we hope optimism will improve.

It’s clear that small businesses are still finding their way through the minefield of economic recovery.

Creative responses, omnichannel growing

Small businesses worked hard to stabilize or grow revenue with a variety of creative business strategies:

- 26% said they added new products or services during the past year (compared to 25% in April 2020)

- 26% diversified or added new sales channels (17%)

- 18% increased marketing (25%)

- 19% created unique promotional offers (20%)

- 18% changed their business model (17%) while 17% promoted gift card sales (15%)

- 17% changed their product fulfillment methods (11%)

- 20% presold products or services at a discount for future fulfillment (14%).

Interestingly, 21% did “nothing” in the past year compared to 33% in April 2020.

It all adds up to a fascinating picture of payments developments during the past year.

The free report provides new perspectives on pandemic payments from a survey of more than 500 US small businesses. You can see a summary of The Strawhecker Group and Electronic Transactions Association US SMB Covid 19 Perspectives report here.

Recent coverage on business response to the pandemic:

Intuit QuickBooks survey: US Small business recovery building momentum

Covid-19 spending: Mortgages mattered most in the US