After a year of development and testing, Visa rolled out its new Tap to Pay mobile payment app that will let micro-merchants and sellers worldwide quickly and securely accept contactless payments on any NFC-enabled Android device without the need for any additional hardware. The new ...

Read more

Banking

Banking

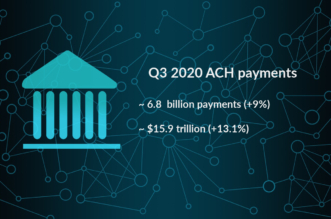

Nacha’s US Automated Clearing House Network (ACH) report for electronic funds transfers in the third quarter of 2020 showed exceptionally strong growth in volume and value despite the end of some government pandemic payments. ACH handled more than 6.8 billion payments in the third quarter, ...

Read more

Global payment card expenditure grew 13% last year, to reach $35 trillion, according to the latest industry research. Despite a frequent US and western-biased view that Visa and MasterCard hold the dominant global market share for payment cards, that’s not the case. While the two ...

Read more

While COVID-19 is spurring new entrepreneurial startups, San Francisco-based fintech Azlo has launched a new set of digital banking, invoicing, and back-office tools to help SMEs and freelancers manage their back-office financial functions more efficiently and less expensively. Azlo Pro is a new subscription-based set ...

Read more

Another new digital bank launched in the US and it’s aiming to provide innovative features for what it says is the underserved middle-class in America. Former Capital One senior vice president Brian Hamilton and former PayPal and Intuit CEO Bill Harris founded the new banking ...

Read more

With non-US-born residents making up nearly 15% of the US population, establishing credit is often a big challenge for these new immigrants, many of whom have excellent credit records in their home countries. It’s also a challenge for lenders who are keen to offer services ...

Read more

When it comes to instant payments, the international banking network SWIFT has been anything but fast in recent years. That’s about to change with the organization’s announcement of a two-year strategy to implement faster payments. “SWIFT Operations Forum Americas Conference at the Convene Center in ...

Read more

Here are 10 important insights you need to know about payments and the US economy during the pandemic. The data comes from recent Bankrate research and the August 2020 Liberty Street Economics report from the Federal Reserve Bank of New York. 35% have less savings ...

Read more

There’s one ballooning payments problem that simply isn’t going away soon. It’s the $1.6 trillion debt carried by an estimated 44.7 million American students. For years, policymakers and economists alike have recognized that growing student debt places a huge drag on the economy both for ...

Read more

There’s no question e-commerce is booming for many reasons during the global pandemic. There’s one other huge growth industry during this same timeframe. It’s something I call a “scamdemic” – a pandemic of payments and financial fraud that’s costing consumers and businesses billions of dollars. ...

Read more