Nacha’s US Automated Clearing House Network (ACH) report for electronic funds transfers in the third quarter of 2020 showed exceptionally strong growth in volume and value despite the end of some government pandemic payments.

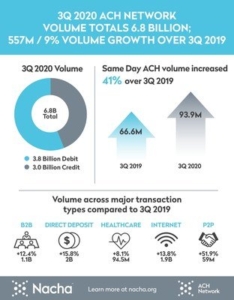

ACH handled more than 6.8 billion payments in the third quarter, up 9% from the same period in 2019. The value of payments reached $15.9 trillion, a 13.1% increase.

Commercial ACH value grew

The value of payments handled by the ACH Network through private sector financial institutions increased by 9.6%. Business-to-business (B2B) payments grew 12.4%. With the reopening of medical and dental offices, more than 94.5 million healthcare claim payments were handled, an increase of 8.1% from the previous year, and up 18.8% from Q2 2020.

“The modern ACH Network serves the American people and businesses by delivering stimulus payments on time, and by enabling safe, remote electronic payments,” said Jane Larimer, Nacha President and CEO, in the Q3 report.

For the second consecutive quarter, there was a 24% decline in check conversion payments where a consumer’s paper check is handled as an electronic payment. Federal Reserve data also indicated a 10.7% decline in the volume of commercial checks processed in the second quarter this year, the largest percentage drop since Q1 1994.

Shift to electronic payments

Partly in response to the pandemic and the increase in e-commerce, the continued shift away from paper payments to electronic payments was notable in several categories during the third quarter:

- Direct deposits increased by 15.8% to two billion payments

- Person-to-person (P2P) transfers jumped 52%

- Internet-initiated payments and transfers increased by 14%.

“Electronic ACH payments are the proven way to make payments for wages and salaries, expenses, benefits, B2B and so much more,” said Larimer.

Same-day payments grew 41%

Increased adoption of Same Day ACH continued, with 93.9 million payments in the third quarter, up 41% over the same period last year. The average dollar amount per Same Day ACH payment rose 31%, continuing a trend that began with the March 2020 increase in the dollar limit per transaction to $100,000.

Nacha is the steward of the ACH Network payment system that connects all US bank accounts and facilitates the movement of money and information. In 2019, 24.7 billion payments and nearly $56 trillion in value were processed by the ACH Network.