Brazil’s central bank – Banco Central do Brasil (BCB) – launched testing of a new real-time digital payment system based on QR codes and is expected to go live by November this year. Use of the new payment system called PIX will be mandatory for ...

Read more

Blog

Walmart really is a tale of two channels. Annual sales grew 1.9%, reaching $524 billion for the fiscal year 2020 as the company wrestled with the same overhead and profit challenges of many of its retail competitors. The good news is e-commerce sales rose substantially ...

Read more

Money matters to consumers and the new Future of Money market research by Logica shows changes ahead in how we pay for things in the future. And those changes are coming fast. Digital payments are growing, but cards still are the leading payment method used ...

Read more

According to data from LearnBonds.com, the value of assets under management by Robo advisors will grow from $1.44 trillion globally this year, up 47% from last year, and could reach $2.55 trillion by 2023. Robo advisors debuted almost a decade ago with the launch of ...

Read more

While bitcoin has recovered value substantially in the past 30 days, rising last week above $10,000 in trading, adoption is also showing some encouraging signs based on the growth in bitcoin ATMs in the US and abroad. Bitcoin Depot recently reached 545 bitcoin ATMs in ...

Read more

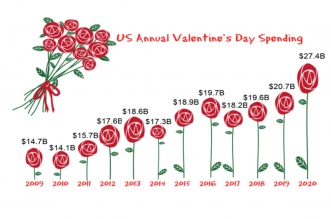

US consumers are expected to spend more than $27.4 billion this year on Valentine’s Day, an increase of 32% from last year. That’s enough to make many retailers’ hearts grow fonder for sure. The National Retail Federation (NRF) said US retail sales grew 2.7% in ...

Read more

One high-profile victim of Brexit is German digital bank N26 despite its notable success since launching less than two years ago in October 2018. By April 15, 2020, an estimated 3.5 million UK customers of the neobank will need to transfer deposits, move funds from ...

Read more

McKinsey & Company is out with a new analysis of the future of banking in Asia and it may be an eye-opener for some. Asian banks traditionally looked to the West for product and service ideas and business models. That’s definitely changed in the past ...

Read more

Point of sale financing platform ChargeAfter got a big boost with a strategic investment and network access to Visa’s network of sellers, acquirers and issuing banks. The new partnership provides Visa’s network of issuing banks access to ChargeAfter to offer Visa cardholders with more financing ...

Read more

The Indian e-commerce market is projected to grow more than 85% from $49 billion (INR3.4 trillion) in 2019 to $91 billion (INR6.3 trillion) in 2023, according to data and analytics company GlobalData. That compares to the estimated $586 billion-plus US consumers spent in 2019 on ...

Read more