Point of sale financing platform ChargeAfter got a big boost with a strategic investment and network access to Visa’s network of sellers, acquirers and issuing banks.

The new partnership provides Visa’s network of issuing banks access to ChargeAfter to offer Visa cardholders with more financing options and flexibility in point of sale payments when buying goods and services in-store or online.

“By combining ChargeAfter’s financing platform with Visa’s global reach, we have created one of the largest networks of global Point-of-Sale financing,” said Meidad Sharon, CEO of ChargeAfter. “We are very excited about the new collaboration and investment. Visa and ChargeAfter share a common vision to make payments quick, convenient, safe and accessible. ChargeAfter’s vision is to help every consumer, worldwide, gain access to financing options that best fit their unique needs, and that are available to the consumer when and where they are ready to purchase – online, in-store and over the phone.

Filene Research Institute estimates the annual size of the POS finance market in the US at $391 billion – about 3.5% of annual consumer spending – with healthcare, electronics, and home furnishings products as the most popular consumer categories. The global POS finance market is estimated at $6 trillion. According to Visa, installments represent a $1.2 trillion global opportunity.

Sharon said ChargeAfter is determined to democratize credit, by putting payment options and flexibility in payments back into the hands of the consumer. “We are creating the next wave of credit,” he added.

How ChargeAfter works for consumers

Instead of paying the full price upfront on a credit card with sky-high interest for larger ticket items, shoppers can get what they want now with immediate approval for a payback plan with much more reasonable financing costs.

“Our platform’s decisioning engine uses one single easy to use application that only requires four easy pieces of the consumer’s details to match the consumer with the best offer or financing loan from the best lender for them based on their personal information. The entire process takes 1-2 seconds and happens live on the merchant’s site or POS,” Sharon explained.

A potential purchase is checked against prime lenders and if not approved moves down the “waterfall” to subprime, lease-to-own, and other financing options.

By choosing from several offers, the consumer potentially saves significant money when buying higher ticket products such as computers, furniture, and other more expensive consumer goods.

Benefits to business and retailers

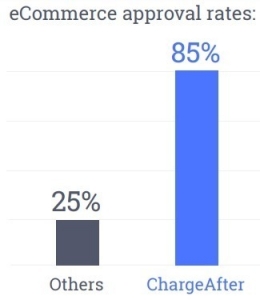

ChargeAfter says merchants can approve up to 85% of applicants in real-time compared to a single lender option that averages between 20% and 25%. This can help merchants increase sales by up to 45% by utilizing ChargeAfter’s growing network of global lenders.

Financing options are proving popular with consumers and help merchants lower shopping cart abandonment by offering flexible payment terms at checkout for all types of credit scores.

“Consumers increasingly demand more choice and flexibility when making a payment, whether for their everyday needs or high-value items. Working with ChargeAfter, we aim to make it easier for sellers and financial institutions to offer a range of tailored, personalized financing options at the point of sale, allowing consumers to manage their payments in a way that works for them,” said Shahar Friedman, Head of Visa Innovation Studio Tel-Aviv.

Sharon says, “In 2019 we processed financing in the hundreds of millions of dollars and in 2020, we’re aiming to break the $1 billion mark in financed point of sale loans.”

This new partnership also looks positive according to Roi Ben Daniel who heads partnerships and ventures at Visa who said, “How serious is Visa about this partnership? ChargeAfter was featured yesterday in our Investor Day, the one major event Visa does every four years for the benefit of its investors, as an instrumental partner in bringing new credit solutions to point of sale.”

Founded in 2017, ChargeAfter has offices in Sunnyvale, CA, New York and Tel Aviv backed by leading VCs including PICO Venture Partners, Propel Venture Partners, BBVA, Synchrony, and Plug and Play VC. You can read more information about ChargeAfter’s POS lending program here.

Visuals courtesy of ChargeAfter

LET’S CONNECT