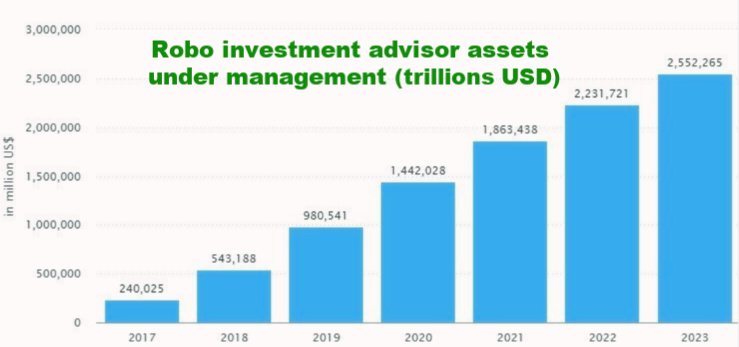

According to data from LearnBonds.com, the value of assets under management by Robo advisors will grow from $1.44 trillion globally this year, up 47% from last year, and could reach $2.55 trillion by 2023.

Robo advisors debuted almost a decade ago with the launch of Betterment and Wealthfront in the US. In 2017, assets under management by these algorithmic advisors were only $270 billion but the market quadrupled in just two years to reach $980.5 billion in 2019.

Number of users will triple by 2023

In 2017, there were only an estimated 13.1 million early adopters of Robo advisory services. In the past two years, the number has grown by 54% annually reaching 70.5 million users globally.

The number of assets under management averages $20,452 per user according to Statista. Research shows the number of users could reach 147 million by 2023, 11 times the number of users in 2017 double the number currently using Robo advisory services.

The market seems to be growing as a result of consumers’ desire for customized financial planning, increased familiarity with new, improved technology and investment tools, as well as the lower cost structure for such services.

Biggest markets for Robo investment advice

Deloitte estimates there are more than 100 Robo advisors operating in 15 countries around the world.

The US is by far the biggest market for Robo advisors with 75% of the global market share or $1.05 trillion in assets under management this year already. Industry leaders including Betterment, Wealthfront, Personal Capital, Nutmeg, FutureAdvisor, and The Vanguard Group.

China is the second-largest Robo advisory market with an estimated $312 billion in assets under management, followed by the UK with $24.4 billion, Germany $14 billion, and Canada despite its small population at $8.2 billion.

Others significant players in the industry include WiseBanyan, SigFig Wealth Management, Schwab Intelligent Portfolios, SoFi Wealth, Wealthsimple, Axos Invest, Bambu, and Ellevest.

What’s ahead for Robo advisors?

This growth has not only sparked technological innovation and competition, but it’s also now creating the emergence of hybrid Robo advisory services that offer the option of support from personal financial advisors.

Since the fast adoption of Robo advisory services in the past several years, analysts expect to see consolidation among independent players on the horizon as Robo advisors look for improved profitability through scalability and by increasing the value of assets under management.

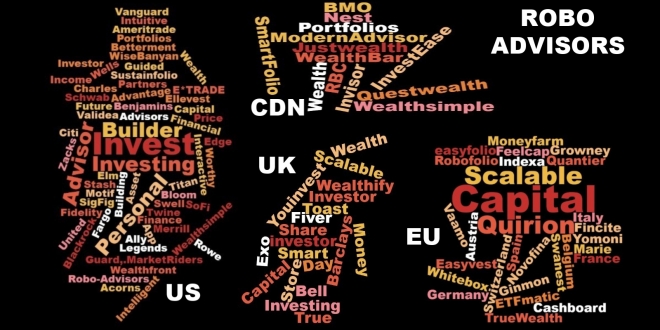

90 top Robo investment advisors

We’ve compiled a list of 90 of the better-known Robo advisors by region for reference.

US: Vanguard Personal, Charles Schwab Intelligent Portfolios, TD Ameritrade, Fidelity Go, Betterment, Wealthfront, Personal Capital, Ellevest, Wealthsimple, SoFi Invest, Future Advisor by Blackrock, Ally Invest, Acorns, United Income, T Rowe Price, RebellionResearch.com, Citi Wealth Builder, E*TRADE Robo-Advisors, Wells Fargo Intuitive Investor, SigFig, M1 Finance, Stash, Bloom, Worthy, Swell Investing, Interactive Advisors, Asset Builder, Building Benjamins, Elm Partners, Financial Guard, MarketRiders, Merrill Edge Guided Investing, Motif, Sustainfolio, Titan Invest App, Twine, Validea Legends Advisor, WiseBanyan, Zacks Advantage

UK: Nutmeg, Scalable Capital, Moneyfarm, Wealthsimple, Wealthify, Wealth Horizon, BestInvest, Moola, Evestor, True Potential Investor, AJ Bell Youinvest, Barclays Smart investor, The Share Store, Fiver a Day, Money on Toast, Exo Investing

Canada: Wealthsimple, Nest Wealth, BMO SmartFolio, Questwealth Portfolios, Invisor, WealthBar, Justwealth, ModernAdvisor, RBC InvestEase

EU: Fincite, Vaamo, Growney, Ginmon, Scalable Capital, Quirion, Robofolio, Whitebox, easyfolio, Cashboard, (Germany); FundShop, Marie Quantier, Yomoni (France); TrueWealth, Quirion (Switzerland); Indexa Capital, Feelcap (Spain); Novofina, Scalable Capital (Austria); Easyvest (Belgium), Moneyfarm (Italy), Swanest, ETFmatic

LET’S CONNECT