Companies are struggling with the need to move their business online rapidly wherever possible in order to survive during the coronavirus crisis and to plan for new post-pandemic behaviors by consumers. New consumer purchase behaviors are evolving quickly including increased online shopping, heightened delivery expectations, ...

Read more

Blog

While most US small businesses are shut down, unable to operate online, and facing possible permanent closures, some companies have seen dramatic sales growth during the coronavirus pandemic. Initially, in March, consumers reacted with panic buying of essentials such as medical products, hand sanitizers, toilet ...

Read more

A large payments database owned by New York mobile payments processor PAAY left millions of credit card and other payments transactions exposed for more than three weeks before a security researcher found the security failure. Security researcher Anurag Sen discovered the database on PAAY’s server ...

Read more

New research from business news site The Manifest shows 15% of US small businesses suffered a hack (7%), virus attack (5%), or data breach (3%) in 2019. The good news is nearly two-thirds of business owners and managers claimed they will increase their cybersecurity resources ...

Read more

Word surfaced on the weekend that Google is working on plans to introduce a smart debit card to the marketplace to complement its Google Pay service. From Apple Pay, Twitter co-founder Jack Dorsey’s Stripe, and Google Pay, Silicon Valley has been targeting the financial/fintech sector ...

Read more

The week raced by with payments, fintech and e-commerce news from around the world mostly revolving around coronavirus with some interesting standouts in addition. Here are the key payments industry stories you need to know. Is the coronavirus killing off cash?Tech firms see the opportunity ...

Read more

Last week, both the FBI and the IRS issued warnings of increased business and consumer fraud during the COVID-19 pandemic. Research from security experts at Proofpoint shows the problem is Business Email Compromise (BEC) has been growing exponentially in the past year and accelerating during ...

Read more

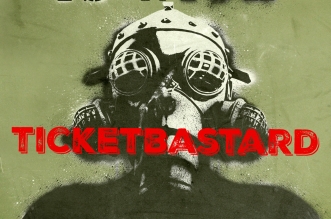

In a headshaking, tone-deaf move especially during the coronavirus pandemic, the brain trust at Ticketmaster has decided to add to the misery of consumers who bought tickets for concerts now canceled, postponed or delayed indefinitely due to the COVID-19 crisis. If you need a refund ...

Read more

A new report by payments company Flywire says 67% of international students are concerned if they can’t use their tuition payment method of choice at UK universities. While the report has a direct impact on the recruitment of international students by universities in the UK, ...

Read more

The weeks are sliding by slowly as we all stay at home and wait out the COVID-19 crisis. Today, on this Good Friday, we’ve got another big roundup of global payments, fintech, and e-commerce news. It feels like there are not quite as many clouds ...

Read more