The weeks are sliding by slowly as we all stay at home and wait out the COVID-19 crisis. Today, on this Good Friday, we’ve got another big roundup of global payments, fintech, and e-commerce news. It feels like there are not quite as many clouds on the horizon, though we’re not anywhere close to getting back to normal soon. So, we read, write, plan, strategize, Skype and Zoom with friends, family, and colleagues. This Easter weekend will be unlike any other in recent memory. Be healthy and well and safe at home!

Top 10 coronavirus initiatives by fintechs

As governments and incumbent banks struggle to distribute the huge coronavirus aid packages they have announced, many fintechs have taken the opportunity to show their mettle. The likes of Square, Intuit, and Stripe have collectively written to US Congress to get involved in the country’s emergency government funding, as have UK fintechs been contacting the Treasury over recent weeks to get involved in similar opportunities. Read more…

Top 10 coronavirus initiatives by governments and regulators

As coronavirus continues to grip the world’s economies, governments and financial regulators have tried to minimize the damage done to individuals and businesses by rolling out various aid packages and funding schemes, in addition to relaxing or implementing new rules to help weather the storm. Here are FinTech Futures’ top ten picks from the news we’ve brought to you this past month. Read more…

The Fed is pouring $2.3 trillion into coronavirus fight

Corporate and municipal borrowers are getting more backup from the Federal Reserve in a series of initiatives the central bank says could make available as much as $2.3 trillion in new loans. In addition to an expansion of its corporate-lending facilities, the Fed’s latest moves include several new programs that extend central-bank support to corners of markets where it hadn’t been active, such as municipal bonds and high-yield exchange-traded funds. It will also provide extra support to banks that make small-business loans or participate in the Treasury’s Paycheck Protection Program, or PPP, programs that have so far struggled to get loans to businesses. Read more…

Singapore dangles $70M package to help fintech, FSI firms drive digital efforts

Monetary Authority of Singapore will set aside SG$125 million ($70.89 million) to help the financial services industry boost its digital capabilities and provide fintech firms better access to digital tools. The Monetary Authority of Singapore (MAS) on Wednesday said the package aimed to enable these businesses to enhance their digital infrastructure amidst the global economic slump and prepare them to tap potential growth spurt when the COVID-19 situation eased. Read more…

Chime pilots way to get $1,200 stimulus checks to users instantly after talks with Mark Cuban

Chime, the biggest U.S. digital bank start-up, is piloting a way for its users to receive their federal $1,200 stimulus checks instantly, weeks before the government is expected to send the payments. The San Francisco-based company said it randomly picked 1,000 of its customers to get the payments Thursday using a feature called SpotMe that typically allows members to go negative in their accounts without incurring fees. Read more…

Commercial payments and COVID-19

There is no way to fully assess the actual impact of the novel coronavirus (COVID-19) pandemic on commercial payments activity since the pandemic is unfolding in real-time with very fluid information about its effects and with inadequate data. The next two months will provide a clearer picture of the social and business costs that will ensue. There will certainly be severe short-term economic challenges followed by longer-term issues to be assessed in due time. Read more…

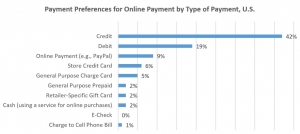

COVID-19 and debit and alternate payments products

The rapid spread of COVID-19 has affected nearly every individual on the planet in some way. In the United States, where one-quarter of the population is currently under orders to “shelter in place,” e-commerce and banking have certainly been altered. In this blog I take a look at the early indicators suggesting the level of impact the pandemic will have on products. Read more…

The cybersecurity posture of financial services companies: IIF/McKinsey Cyber Resilience Survey

A recent joint survey on cyber resilience by the Institute of International Finance (IIF) and McKinsey found significant concerns regarding third-party security, and our survey determined that 33 percent of financial-services firms do not have proper vendor remote-access management with multifactor-authentication controls. The survey was designed to provide an understanding of current and planned practices that financial firms are undertaking to enable and strengthen firm- and sector-level cyber resilience. Read more…

Europol: cybercrime is growing amidst pandemic

Since the start of the COVID-19 pandemic, cybercrime has grown more than any other criminal activity, a Europol report revealed on Friday. “With a record number of potential victims staying at home and using online services across the European Union (EU) during the pandemic, the ways for cybercriminals seeking to exploit emerging opportunities and vulnerabilities have multiplied,” it said. The mass increase in remote work across the world and reliance on digital networks has created fertile ground for cybercriminals to exploit through ransomware, phishing and Distributed Denial of Service (DDoS) attacks. Read more…

Online buying soars as coronavirus spreads around the world

With billions of people under stay-at-home directives during the coronavirus pandemic, e-commerce is booming across the planet. In North America, the number of online orders for web-only online retailers was up 52% year over year in the United States and Canada for the 2 weeks of March 22 through April 4, according to an online tracker from marketing platform Emarsys and analytics platform GoodData. Revenue for web-only retailers in the U.S. and Canada was up 30% year over year for the period. Read more…

Have consumers are playing the grocery delivery lottery during coronavirus pandemic

Across the country, millions of consumers are turning to Fresh Direct, Instacart Inc., Amazon.com Inc., Peapod and other services to fill their fridges via online delivery rather than brave going to a supermarket. But many are finding that the online grocery networks have been completely knocked flat by a triple whammy of unprecedented demand, unreliable inventory and unavailable employees. While early reports from the pandemic suggested that shuttered stores and shut-in consumers would be a boon for e-commerce, the sudden growth spurt has grocers scrambling to soothe harried shoppers and worried whether disgruntled first-time web shoppers will go back online once the crisis passes. Read more…

NMG: Latest survey shows retailers making the shift to digital as foot traffic slows and states close

Over the course of these first three surveys, the impact of government-issued stay-at-home orders has become abundantly clear both on the number of stores that have closed their doors, and the amount of foot traffic in stores that remain open. But this shift in shopping habits has provided retailers a new opportunity to make good on their digital investments. From a retail operations perspective, 29% of dealers report that they’ve closed their business — up from 5% in the first survey just two weeks ago. Of those who have closed, 90% were ordered to do so by their state or local government because of a stay-at-home order. Just 36% of dealers report maintaining normal operating hours, which is down from 67% in the first survey; another 30% have moved to reduced hours, which is up from 20%. Read more…

LET’S CONNECT