Berlin, Germany-headquartered digital bank N26 has signed up more than 250,000 digital-only bank customers in just five months since launching in the US in August 2019.

One of the numerous challenger banks disrupting the traditional banking system in the US and abroad, it partnered with Axos Bank to launch services in the US.

It’s clear US consumers are warming up to the appeal of the features of N26 and other new digital-only banks.

Popular digital bank features

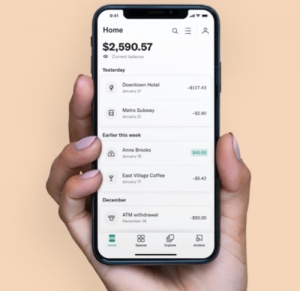

With no bank branches, N26 customers can open an account online or using a mobile app in less than five minutes. Features include instant money transfers to friends with MoneyBeam and easy setup of sub-accounts to meet savings goals using the Spaces feature.

N26 accounts have no hidden fees, no minimum balance, no maintenance charges, and no foreign transaction fees when you use your N26 card overseas. It offers access to a network of over 55,000 Allpoint surcharge-free ATMs and a popular feature lets customers get their pay up to two days sooner with direct deposits.

Using the mobile app, customers can access a range of security features, including setting spending limits, locking their card if lost, and enabling or disabling international charges.

N26’s debit card also offers cashback, discounts, and promotions in travel, wellness, entertainment, and more from popular brands including scooter company Lime, Booking.com, clothing at YOOX, Broadway tickets from Headout, and cashback from a growing list of other partners including Babbel, Blinkist, Aaptiv, TIDAL, Curology,. Headspace, and Luminary.

“American consumers are too reliant on traditional banks and face roadblocks to their financial health that have no place in the 21st century. N26 was founded to radically transform the industry and break down these barriers through the power of technology,” said Nicolas Kopp, US CEO for N26 Inc. “We’re incredibly proud to have reached a quarter-million U.S. customers in our first five months and we are just getting started. We have big plans to offer millions of future N26 users a feature-rich, easy-to-use banking experience.”

5 million global customers

In 2019, N26 more than doubled its global customer base, reaching five million customers in just five years since launch, making it one of the largest digital-only banks. In the UK, the neobank already has 3.5 million customers, an increase of 75% last year

“We are today, one of the biggest players in digital banking. But we have not forgotten our original mission – to challenge an industry that is ripe for change. N26 has proved that banking can be simple and intuitive through the use of technology,” added Valentin Stalf, co-founder and CEO of N26.

With 1,500 employees, it has 80 nationalities in offices in Berlin, New York, Barcelona, Vienna, and São Paulo. Last year, N26 raised $470 million to support launches in the US and Switzerland as well as the opening of a new Tech Hub in Vienna, Austria. It has now raised more than $670 million from investors, including Insight Venture Partners (US), GIC (Singapore), Tencent (China), Allianz X (Germany), Peter Thiel’s Valar Ventures (US), and Li Ka-Shing’s Horizons Ventures (Hong Kong).

US partner Axos Bank is a subsidiary of Axos Financial Inc and a Member FDIC with $11 billion in assets. It provides financing for single and multi-family residential properties, small, medium and large businesses, and specialty finance receivables across the US.

The growth of digital-only banks is just beginning. In 2020, expect more neo-banks to launch as well as mergers, acquisitions, and partnerships with traditional bankers as the financial industry adjusts to these disruptors.

You can read more about digital-only banks in our recent coverage:

Research: Digital banking on the horizon for most consumers

Why Neobanks are gaining ground with UK consumers and business

Welcome to Google Bank?

Research: What Gen Z wants is not their father’s bank

Report: UK challenger banks will triple size in 12 months

Research: Consumers opening their digital wallets in US, EU