A new study by global card provider Marqeta shows many US and UK consumers are poised to pick digital-only banking as a financial services option.

The Marqeta Digital Banking Survey shows digital-only banking–mobile banking apps have surpassed physical branches as the most critical touchpoint of consumers’ banking experience. In a telling insight, only 33% of Americans and 23% of UK residents would be “inconvenienced if their bank closed all of their physical locations tomorrow,” according to the study.

Not exactly a ringing endorsement of bricks and mortar bank branches.

Digital is gaining ground with UK and US consumers

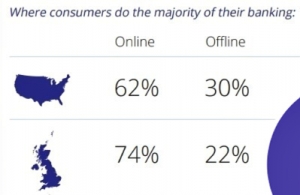

Marqeta says 66% of Americans already do the majority of their banking online, and only 31% in the US say they primarily bank in person. In the UK the numbers are even higher for banking online (74%) vs in-branch (22%).

Almost half (48%) of US consumers and 43% of UK consumers said they find the appeal of a more modern banking option attractive.

Researchers noted 36% of UK consumers and 30% in the US have considered changing banks in the past 12 months and 75% of respondents say they will consider a digital-only bank when changing banks in the future.

Consumers expect banking to be very different in the next decade: 43% of US consumers and 40% of UK consumers said they expect to spend significantly less time visiting a bank in person and making even more digital transactions.

Bank branches were not a factor even when customers were asked about fixing problems with their accounts:

“28% of UK consumers and 23% of US consumers said it was important for them to be able to visit a bank in person to fix a problem, while 54% of US consumers and 51% of UK consumers said it was simply more important that it was fixed quickly, through whatever channel necessary,” the report said.

Why will consumers switch?

Consumers are prepared to switch banks for a variety of good reasons including higher interest rates (57%), more modern banking options (46%), cash incentives (26%), dissatisfaction with current bank service (20%), and current bank errors (17%).

The services consumers want most are also important: no ATM fees (74%), instant access to funds (74%), and real-time fraud alerts (71%).

Barriers to growth?

While research is encouraging for fintechs and banks with a strong digital and mobile strategy, the industry still faces some barriers to consumer adoption.

Digital-only banking has not yet taken off as fast as predicted, especially with millennials. At this early stage, many consumers are hedging their bets by maintaining a traditional bank account while trying out competing digital bank services. In fact, 45% of digital bank customers limit the amount of their deposits.

“Only 14% of US consumers, and 10% of UK consumers, said that they use a digital-only bank as their primary banking option,” the report said.

53% of those surveyed see digital-only banking as a riskier option than traditional banking. Recent high-profile system failures by digital-only banks like Chime have made consumers understandably aware and nervous about potential problems.

Four key concerns about signing up for digital banks were highlighted by the study:

- Customer Service: 43% of US and 30% of UK consumers expressed concern about digital-only customer service.

- Market track record: 30% of UK and 15% of US consumers listed a lack of established market track record as a concern.

- Deposit Volume: 22% of US and 18% of UK consumers said a lack of deposit volume was a concern.

- Staying power: 17% of US and UK consumers said uncertainty about which digital banks will remain in business long term held them back from making a switch.

For now, many consumers say it’s just too much work to change banks (26% UK, 20% US); it interrupts their bank services (25% US, 22% UK); and some say it’s simply too confusing or heart to know where to start in changing banks (15% US, 12% UK).

But this research indicates more consumers are poised to go digital-only in the future with the help of more education, awareness, increased reliability, and attractive service choices.

The survey of 2,000 adult consumers in the US and the UK was conducted by Propeller Research on behalf of Marqeta in October 2019, and you can download a copy of the Marqeta Digital Banking Survey at no charge here.

LET’S CONNECT