New research by SmallBusinessPrices.co.uk analyzes how neobanks are on the rise and why they’re so popular with a growing number of UK banking customers compared to traditional banks.

For traditional banks in the US, it’s also a sign of the banking customer disruption brewing and already underway in North America too.

By mid-July last year, neobanks had raised more than $2.5 billion in VC financing globally, a sign that investors can certainly see the writing on the wall when it comes to the impact of fintech on traditional banking services.

Features and convenience make the difference

With handy features, spending trackers and savings tools, neobanks allow customers to take control of their finances and make better decisions compared to the old days of going to a branch, standing in line or dealing with out of date information and time-wasting applications and requirements.

Now it’s type, tap, click, verify and you’re done. All using your mobile phone and some pretty attractive neobank services and app features.

Ian Wright of SmallBusinessPrices says, “Over the past two years, we’ve seen an influx of consumers choosing neobanks or challenger banks as an alternative to traditional banks that we are all so familiar with. With consumers preferring to avoid the hassle of bank branches and paperwork, neobanks are becoming increasingly popular with banks such as Revolut and Monzo showing huge market share growth in just a few years.”

It’s still early days for digital banks with 34% of UK bank customers using only one bank and 35% using two financial institutions. But many bank customers are starting to test out digital banks with 18% banking with three institutions, 6% at four banks, and 4% claim to use five banks.

The convenience of online banking and these fully-featured apps are pulling in new neobank customers by the millions.

Impressive growth numbers

Growth of neobanks in the UK is impressive according to the researchers.

Revolut is the most popular neobank in the UK and saw its customer base grow from 3 million users in 2018 to 8 million In 2019 – an increase of more than 166%.

Picture the user numbers and annual growth of these new UK digital banks in 2019:

- Revolut – 8 million users + 166.67%

- Monese – 1.4 million, +100%

- Starling – 800,000, +100%

- Yolt – 900,000, +80%

- N26 – 3.5 million, +75%

- Tide – 85,000, +51.79%

- Monzo – 3 million, +50%

- Pockit – 500,000, +25%

- Tandem – 500,000, 0%.

In neobanks we trust

If the hyper-growth isn’t enough to get VCs hyperventilating, just look at the trust scores measured by SmallBusinessPrices: Revolut (4.7), N26 (3.9), Monzo (4.4), Monese (4.4), Yolt (4.4), Starling (4.5), Pockit (3.9), Tandem (3.5), and Tide (4.2).

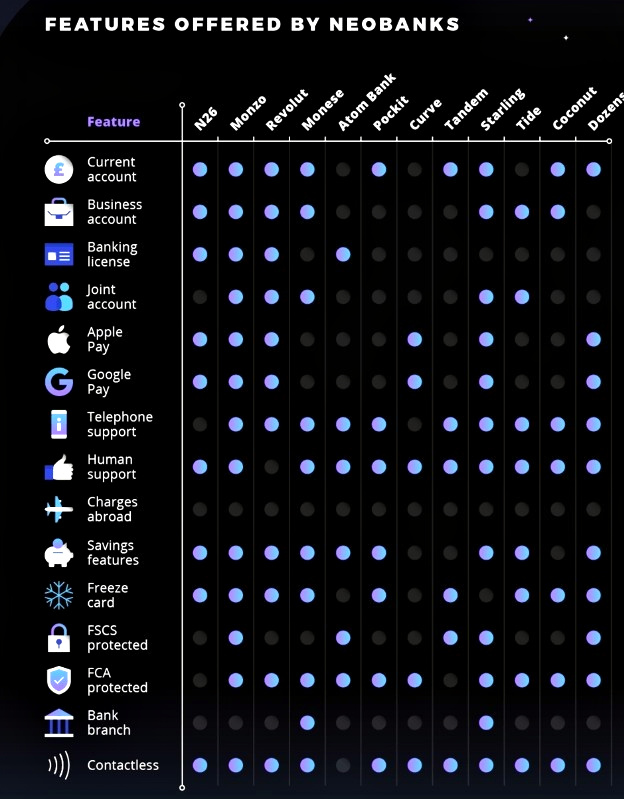

These challenger banks are not just for consumers either. Of the 12 banks reviewed, seven offer business accounts including Revolut, Monese, Monzo, N26, Starling, Tide, and Coconut.

All but three offer current accounts or savings features. Five digital banks offer joint accounts. All of the neobanks except Atom Bank are contactless and none charge fees overseas. For safety and security, all but three of the banks offer the ability to freeze the card.

Monese and Starling bank even offer bank branches, and all are FCA protected with the exception of N26 and Tandem. Only Revolut does not offer human support and only N26 and Curves do not provide telephone support.

The chart below from SmallBusinessPrices provides full details of the services currently offered by each of the neobanks surveyed.

Growth and new markets ahead

Several of these UK challengers have already launched abroad and many others have plans to expand outside of the UK to the US, EU and elsewhere.

For North American bank customers and the new US neobanks like Cleo and Booyah, the substantial VC investment, the appealing digital bank features, and the fast adoption by UK customers are signs of what’s on the horizon.

You can read more of SmallBusinessPrices’ UK neobank research findings here.

Visuals courtesy of SmallBusinessPrices.co.UK

LET’S CONNECT