By Jeff Domansky, March 18, 2021

Are you struggling to get approved for a credit card? Poor credit score or no credit history? Hate paying high credit card interest rates?

That pretty much describes millions of young US consumers or new immigrants without a US credit history.

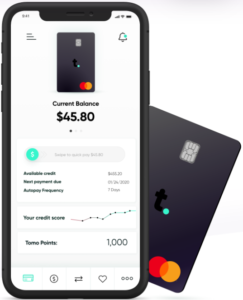

The new TomoCredit Mastercard could solve the dilemma for millions of consumers unable to get a traditional credit card without a credit history.

No credit history? No problem with big data

“Young consumers have been reluctant to open new credit cards due to fears of missing payments and overspending. TomoCredit is different; we help them avoid common credit card mistakes and build healthy financial habits,” said Kristy Kim, CEO at TomoCredit.

The company uses a proprietary underwriting system that analyzes over 50,000 dynamic data attributes, including monthly income, savings, stock portfolio, and spending patterns, to assess applicants’ suitability and credit limit.

A customer can get approved for a $100 to $10,000 credit limit after completing a simple application process that takes under two minutes via TomoCredit’s online or mobile app.

Immigrant challenge led to challenger bank startup

Ten years ago, Kim immigrated from South Korea to the US to attend university. She landed an investment banking job with a six-figure salary. But, without a credit history, she was rejected for a car loan five times.

Kim estimates that legacy lending policies prevent 40 million people from accessing credit, the building blocks to wealth, including cars and homes.

In 2019, while working toward her MBA at The Haas School of Business at UC Berkeley, she launched TomoCredit, a startup that offers credit for those without a credit history.

The company recently raised $7 million from investors including KB Investment Inc. (KBIC) – a subsidiary of South Korean consumer bank, Kookmin Bank – along with support from VCs including Barclays, Passport Capital, Ulu Ventures, and Techstars.

What you need to know about this credit card

TomoCredit leverages open banking through Finicity, a Mastercard company, to offer a rapid, proprietary assessment for people with no credit history. Pre-approval is quick, but there is a lag time of up to several weeks for the more detailed follow-up application information depending on the number of applicants.

While no credit check is required, Applicants must link a bank account to their credit card. They must also agree to repayments every seven days for card purchases before the end of the month.

The corresponding mobile app and website enable the weekly autopay feature to motivate customers to spend responsibly and encourage on-time payments via electronic ACH from their linked bank accounts. These timely payments prevent customers from over-spending against their approved credit limit.

This eliminates standard credit card fees and interest because no balance carries forward. After three months of card use and successful repayments, it’s possible to move to regular monthly payments.

Did we mention rewards? Cardholders can earn 1% cashback on their purchases.

New immigrants may get approved

New or student immigrants to the US may also get approved even without a Social Security number by applying with their passport information like the Jasper Mastercard® and the Deserve® EDU Mastercard for Students.

“TomoCredit is meeting a critical need faced by so many in the United States with this next-generation credit offering,” said Sherri Haymond, executive vice president, Digital Partnerships at Mastercard. “By tapping Mastercard’s network and embracing Finicity’s powerful platform, TomoCredit is reimagining how consumers build and manage their financial habits.”

The mobile app is initially available on iOS devices, and TomoCredit has pre-approved over 300,000 US customers with plans to issue another 500,000 additional cards by year-end. TomoCredit’s mission is to build an “open credit” environment and help millions of underserved individuals and families.

Another outcome of new open banking trends that continue to disrupt the formerly intractable financial services landscape.

You can find out more about the new Mastercard at the TomoCredit website.

Other challenger bank cards and accounts we’ve covered:

New banking app hopes to be the One for middle-class Americans

N26 hits 250,000 digital-only US bank customers in 5 months

Finally, a BFF bank app for Gen-Zennials

LET’S CONNECT