Credit Suisse predicts India’s payments market will be worth more than $1 trillion by 2023. Guess who’s already dominating this burgeoning payments market?

You might be surprised to learn that it’s two American companies that are leading the payments industry in India – Google Pay and Walmart-owned PhonePe (acquired in its $16 billion purchase of Flipkart in 2018).

Government-created payments initiative in 2014

The Indian government moved to create a new kind of bank to handle consumer payments and try to encourage less reliance on cash and more use of digital payments systems. That created a rush of new fintech companies backed by Indian billionaires and VCs as well as global players.

The result is that 70% of Indian consumers still use cash, five firms handling Interbank mobile and online payments have closed, and those remaining in the market are burning cash rapidly.

It could be three more years before a handful of survivors of the remaining 90 financial providers see a profit according to KPMG estimates, so you can expect consolidation, closures, and mergers as a result.

Losses mounting, deep pockets needed

According to a Bloomberg report, “Among the three major competitors that disclosed their financial results for the year ended on March 31, two of them —PhonePe and Amazon Pay —reported combined losses of 30.6 billion rupees ($430 million). Paytm Payments Bank, backed by China’s Ant Financial and Japan’s SoftBank Group Corp, swung to a profit of 190 million rupees ($2.66 million) after losing 207 million rupees ($2.89 million) a year earlier. Among the three major competitors that disclosed their financial results for the year ended on March 31, two of them—PhonePe and Amazon Pay—reported combined losses of 30.6 billion rupees ($430 million). Paytm Payments Bank, backed by China’s Ant Financial and Japan’s SoftBank Group Corp, swung to a profit of 190 million rupees after losing 207 million rupees a year earlier.”

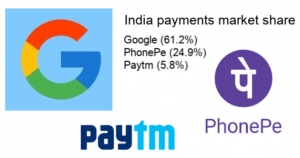

According to Indian payments processor Razorpay, in October Google Pay handled 61.2% of payments through the Unified Payments Interface (UPI), while PhonePe had 24.9% of payments, Paytm 5.8% and BHIM 3.7%.

Google has gained its dominant market share through partnerships with existing Indian financial institutions and payments processors. Amazon’s payments share is not publicly available but its strong e-commerce presence is a factor despite its reported losses and small payments market share to date.

India’s payments market

Next to China and the US, India is the world’s fastest-growing payments market.

A quick look at 2018/2019 data from JPMorgan shows the massive size of the countries e-commerce market:

- e-commerce market value $36.5 billion

- mobile market size $16.8 billion

- 36% of e-commerce conducted on mobile.

J.P. Morgan reports:

“India has the highest business to consumer e-commerce growth forecast out of all the countries included the JPMorgan 2019 Payments Trends – Global Insights Report series. With a forecasted compound annual growth rate of 26.5 percent to 2021, this market represents a fast-growing opportunity for the e-commerce industry. India’s online shopping sector is currently worth $36.5 billion, a value that has consistently expanded at double-digit rates in recent years. Sales have been driven by a rising disposable income, increasing smartphone penetration and the marketing efforts of both brands and the government to promote online shopping.”

Despite the tremendous growth, online shopping only makes up 2.9% of retail spending with annual average spending at a low $338.24 compared to other key global markets.

Limitations aside, India is a popular market for international e-commerce and payments as cross-border e-commerce totals 74% of sales. The most popular segments in e-commerce are travel (56%), consumer electronics (16.5%), and clothes and apparel (10.9%).

Mobile is massive in India

With 46% of e-commerce already happening via mobile devices, India is on track to mirror China’s adoption of mobile payments. Mobile commerce will grow at 31.2% annually, reaching a value of $49.8 billion by 2021. Compare that to US 2019 Q1 mobile e-commerce spending of $38.9 billion and you can see the potential for growth in India.

$16.8 billion was spent on e-commerce via mobile devices in India, $13.8 billion via mobile apps, and $3 billion in mobile commerce completed via a browser according to JPMorgan.

“Cards are currently the most-used method for paying online, representing 29 percent of transactions, or $10.6 billion in sales. This is despite the fact that on a national scale card penetration is low, at 0.64 per capita for debit cards and 0.02 for credit cards.40 This suggests that cards have the opportunity to take an even larger share as the use of cash declines. Card use is expected to rise at a compound annual growth rate of 53 percent to 2021,” JPMorgan reports.

Digital wallets make up 25% of e-commerce payments and growth is projected at 80% annually to 2021. Interestingly, cash on delivery still makes up 17% of e-commerce payments, simple fact of daily e-commerce in India at present.

When you add up this market scale and growth potential, it’s clear to see why global financial players with deep pockets are prepared to ensure short-term losses for huge upside profits in the future.

You can read more of JPMorgan’s “2019 Global Payments Trends Report – India Country Insights” here.

LET’S CONNECT