Yes, we know you’ve been watching the impeachment hearings but it’s time to get caught up on global payments news from around the globe. We start with PayPal’s acquisition of shopping and rewards technology company Honey and why it makes strategic sense. TransUnion takes a look at merchant fraud risk during the holiday season. Our guest post from PPRO looks at how businesses can expand into Latin America for the best results.

The news roundup is loaded with news you can use. US Department of Commerce said consumers spent $145.74 billion online with US retailers in Q3, up 17.3% while global e-commerce grew 18% to reach $2.86 trillion. Macy’s was hit with another data breach, the second in two months. 7-Eleven launched a voice delivery app providing 30-minute delivery in 34 US cities. Q3 e-commerce sales at Target jumped 31% thanks to fashion and same-day delivery initiatives. Worldwide payment fraud losses hit $27.85 billion according to the Nilson Report. Spending on US credit, debit and prepaid cards in the US will top $10.09 trillion by 2023.

PayPal seeks rewards gold in Honey acquisition

PayPal announced the acquisition of Los Angeles-based consumer shopping and rewards technology company Honey for $4 billion. Launched in 2012, Honey has 17 million active users who use the platform to find savings as they shop online at more than 30,000 participating online merchants in every product category. Honey says it has helped consumers save more than $2 billion since launching through its mobile shopping assistant, coupon codes, Honey Gold rewards program, and price-tracking tools and alerts. Read more…

TransUnion fraud survey highlights merchant holiday sales risks

With Black Friday and Cyber Monday approaching, online sellers are gearing up for the most important sales event of the year. Unfortunately, fraudsters are also gearing up and consumers are concerned. According to a new report from TransUnion, nearly half of consumers (46%) are worried about becoming a victim of fraud this holiday season, yet they also want a convenient online shopping experience. 68% say they want online retailers to protect both their Login IDs/passwords as well as their credit card information. Read more…

How to expand your business into Latin America

Latin America is a continent of contrasts – both culturally and economically. The region comprises countries whose per capita GDP compares favorably with mid-ranking European nations, but also those whose citizens are among the poorest globally. Despite the wide variation, consumers are buying online in increasing numbers and creating huge opportunities for businesses. But it’s a bit more complicated than simply opening up shop. The opportunities are far from uniform, as seen by e-commerce growth rates. The median rate of B2C e-commerce growth is 22.9%, yet there are outliers: Argentina at 46.9% and Chile at 28.2%. Read more…

US e-commerce sales rise 17.3% in Q3

Consumers spent $145.74 billion online with U.S. retailers in the third quarter, up 17.3% from $124.21 billion for the same period in 2018, according to retail data released Tuesday by the U.S. Department of Commerce. This is significantly higher than the year-over-year e-commerce growth registered in the first six months of the year when web sales in Q1 increased 11.6% and in Q2 jumped 13.6%. Last quarter’s rate also marks the highest quarterly growth since Q4 2011, when online revenue spiked 18.6% over the same period the previous year. Read more…

Global e-commerce sales grow 18% in 2018

Global e-commerce grew at a faster clip last year—18.0%—than online sales in the more saturated U.S. market, which Internet Retailer expects to increase 15.3% from 2017. Consumers worldwide purchased $2.86 trillion on the web in 2018, up from $2.43 trillion the previous year, according to our early projections. This would be a slowdown from 2017, when global web sales grew 21.3% year over year from $2.00 trillion in 2016, according to Internet Retailer’s estimates. Read more…

Macy’s suffers another data breach

Macy’s on Tuesday confirmed it had suffered a “highly sophisticated and targeted data security incident related to macys.com that affected a small number of customers during a one-week period in October.” It’s a blow to customer trust that comes at a particularly inopportune, and vulnerable, time. More than half of shoppers say it takes them a month or so to shop again with a retailer that has a breach, so “Macy’s may be missing half their customers this Black Friday/Cyber Monday,” website security firm SiteLock said. Read more…

7-Eleven’s delivery app now handles Alexa, Google Assistant orders

7-Eleven launched a voice-powered app that lets customers place delivery orders through their Amazon Echo or Google Home smart speakers. The 7Voice service lets customers in 34 major metropolitan areas use voice commands to order food, cosmetics, home goods, and other products for 30-minute delivery. Customers must link their smart speakers with 7Now, the convenience chain’s home delivery app. Read more…

Target’s Q3 online sales soar 31%

Target Corp.’s investments in e-commerce and same-day fulfillment options helped boost the retailer’s online sales 31% in the third quarter over the same period a year earlier. And, importantly, the rise in e-commerce sales didn’t weigh on profitability as it had in previous periods. The retailer’s gross margin compared with a year earlier expanded for the second straight quarter. Read more…

Payment card fraud losses reach $27.85 billion

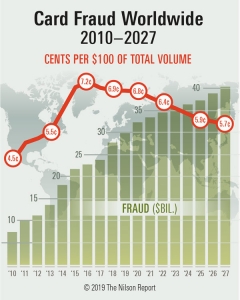

Fraud losses worldwide reached $27.85 billion in 2018 and are projected to rise to $35.67 billion in five years and $40.63 billion in 10 years according to The Nilson Report, the leading global card, and mobile payments trade publication. Gross fraud losses reached $27.85 billion in 2018, up 16.2% from $23.97 billion in 2017. However, fraud losses per $100 of total sales declined to 6.86¢ from 6.95¢ the prior year. Read more…

Spending on US credit, debit and prepaid cards to top $10 trillion

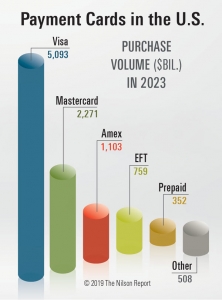

Spending for goods and services initiated by credit, debit, and prepaid cards issued in the United States, which totaled $7.266 trillion in 2018, is projected to reach $10.086 trillion in 2023 according to statistics released this week from The Nilson Report, the leading card and mobile payment industry trade publication. At the end of 2018, there were 6.96 billion credit, debit, and prepaid cards in circulation in the U.S. That total is expected to reach 8.02 billion at the end of 2023. Read more…

LET’S CONNECT