Don’t be too fast to write off bricks and mortar retailers during this holiday shopping season.

According to new research from Experian, 52% of consumers will shop in a retail store this year compared with 26% who plan to shop online and 22% on their mobile devices.

Holiday shopping strain

A large majority of US consumers surveyed (84%) say they’re motivated to improve their finances this holiday season with 66% paying for gifts in cash this year and 62% planning to pay off debt. Almost half (46%) of those surveyed will try to improve their credit score before the start of the new decade according to the national consumer survey.

Experian reports the lure of holiday shopping deals is hard to resist. Inexplicably, one in five Americans surveyed would risk becoming a victim of identity theft for a good Cyber Monday deal, and 56% would rather get a 10% discount at a store than improve their credit score by 10 points.

Although 60% of respondents said they spend too much during the holiday season, consumers are still planning to spend 78% more or an average of $1649 during this year’s holiday shopping season compared to $945 in 2018.

“Debt you can’t repay will certainly bring down one’s holiday spirit,” said Rod Griffin, Experian’s director of consumer education. “There’s often the temptation to overspend, but the best gift you can give yourself is being financially smart. Make sure to create a budget and stick to it while using credit wisely. The key is strategic use of credit — whether that’s using a card that provides low interest, rewards points or cashback — to improve the shopping experience and stretch your dollars.”

What consumers hate about holiday shopping

Since holiday shopping is all about spending, financial worries top the stress list for consumers. 48% do not want to add to their debt, 48% find it difficult to stay on a budget, and 44% said they did not have extra money to spend on gifts. 20% also said they did not have access to credit my gifts.

A surprising 39% of consumers said they ran out of money and one in five said they were denied credit. 31% of shoppers expressed frustration at the need to buy “unexpected gifts” including 24% who said they were frustrated by the need to purchase gifts for hosts or unexpected guests. Travel (12%), cost of sending gifts (11%), cost of gift delivery to when the self (9%), and purchase of new outfits for holiday parties (9%) rounded out the other biggest frustrations.

Still, that doesn’t seem to dampen the spending plans for most holiday shoppers.

Credit scores concern consumers

Thanks to the information and marketing programs of companies like Experian and its competitors, consumers are generally aware of their credit scores. 23% of consumers have checked their credit score as a result of holiday shopping in the past and 24% say they will check their credit score after holiday shopping this year.

Nearly half of consumers have tried to increase their credit score in advance of the holiday shopping season in order to get approved for a credit card or personal loan with 24% saying they will do so this year.

What’s a retailer to do?

While the news is positive for bricks and mortar retailers, they should be aware of some of the things shoppers hate about holiday shopping including crowds (24%), adequate cash or credit to buy gifts (18%), picking the right gifts (15%), sticking to a budget (13%), finding good deals (10%), and keeping gifts a secret (6%).

A small number (4%) were concerned about identity theft and 4% were also concerned about maxing out their credit cards. Tellingly, only 5% of shoppers said they found nothing stressful about holiday shopping.

Retailers need to reduce the friction for shoppers online and in-store, provide as much information as possible on sales prices, communicate gift ideas and suggestions and make sure staff are tuned up and ready for holiday shopping.

Ready to shop

Experian’s research offers a couple of final insights for this year’s shopping season. While 49% of shoppers say they have shopped without a budget in the past, only 24% say they will do so this year.

About 19% of consumers said they have taken a personal loan for holiday shopping in the past while 15% plan to do that this year, up dramatically from 6% in 2018.

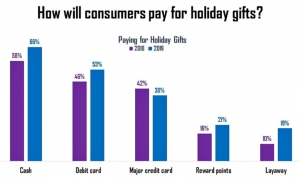

When it comes to how people will pay for their purchases, 66% say they will pay by cash compared to 58% in 2018, debit card 53% compared to 48%, credit card 38% compared to 42%, rewards points 21% compared to 16 %, and store credit cards 18% compared to 15% in 2018.

23% of consumers say they will open a new credit card to get retail store discounts (36%), to earn cashback rewards (35%), to get a no annual percentage rate card (28%), or maximize spending by getting travel rewards (25%).

Another 24% admitted they would open a credit card because they don’t have cash for holiday shopping while 21% said their other credit cards were maxed out, and 17% did not currently have a credit card.

Consumers do have good intentions with 49% planning to save more next year, improving their credit score (33%), creating a personal budget (31%), paying off their credit card entirely (26%), paying credit off over time (24%), paying their full credit card balance monthly (21%), and 20% saying they will not open new credit cards.

Make of it what you will, Experian presents a fascinating picture of US holiday shopper plans, frustration, friction points, and motivations behind the biggest spending event of the year.

You can read more about the Experian Holiday Survey 2019 here.