By Jeff Domansky, Nov 24, 2020

Based on data from more than 12 million payments processed annually through the AvidPay Network, research shows middle-market spending is recovering to a positive trajectory after two quarters of growth interrupted by the COVID-19 pandemic.

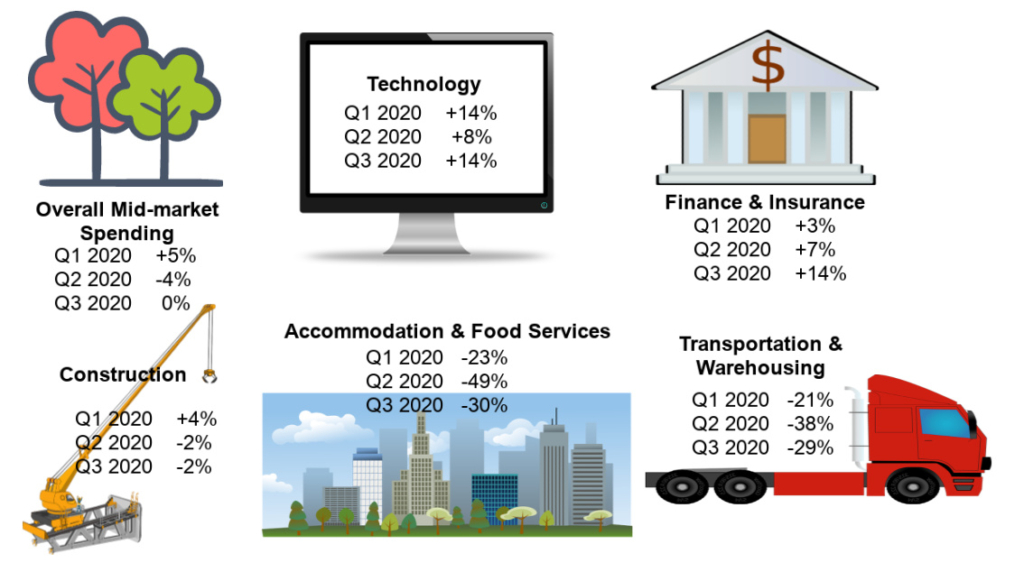

Overall spending by middle-market companies (annual revenue between $5 million and $1 billion) was down 4% in Q2 2020 compared to Q2 2019 but rebounded in Q3 to reflect no growth year-over-year. That said, there’s also hope on the horizon for several key sectors of the economy.

“No industry is exempt from the unusual circumstances of 2020, but the insights in this report speak to the resiliency of the middle market and how businesses have learned to grow amidst the uncertainty,” said Michael Praeger, Chief Executive Officer and Co-Founder of AvidXchange. “Our spending data indicates a positive outlook for the middle market as a whole in the year ahead, with several industries beginning to recover and getting back to work in our new normal.”

Who’s recovering, who’s still struggling?

AvidXchange analyzed spending trends across five major industries: technology, finance and insurance, construction, transportation and warehousing, and accommodation and food services, and the insights are valuable in projecting future directions for the economy.

Overall spending recovered from -4% in Q2 to 0% or equal to Q2 2019. Several sectors are showing signs of recovery. While technology dropped to +8% in Q2, by Q3, spending on technology recovered to +14%.

“Technology leaders reported a median additional spend of five percent to deal with the COVID-19 crisis, totaling about $15 billion spent per week to support the sudden move to remote working,” the report said, highlighting a KPMG study.

According to the research, financial and insurance services were +7% in Q2 and up 14% in Q3. A Deloitte report also confirms consistent increases in spending levels in the finance market, noting that the global banking system “continued its positive streak, with profitability increasing to new post-crisis levels” at the end of last year and the start of this year.

In the construction sector, spending was down -2% in both Q2 and Q3 over 2019. Not a bad performance, all things considered, but still the sharpest four-month contraction in construction spending in 10 years.

While transportation and warehousing were down -38% in Q2, there was recovery underway by Q3 when the industry improved to -29% over last year, mostly reflecting the negative impact of the pandemic on retail spending.

Travel, accommodation, and food services industries remained heavily impacted as business travel, tourism, restaurants, and entertainment suffered through the effects of COVID-19. Accommodation and food services improved by 19% from Q2, where they were -49%, but were still -30% in Q3 compared with Q3 2019.

With hopes of several vaccines available and a new President in the Oval Office in the first quarter of 2021, and as overall spending recovers in key sectors, there is finally some hope on the horizon for the US economy.

Get more insight into AvidXchange’s Middle Market Spending Trends or download the report here.

Recent PaymentsNEXT coverage of economic recovery:

Intuit QuickBooks survey: US Small business recovery building momentum

McKinsey: Post-COVID-19 business recovery could take 5 years

LET’S CONNECT