A new McKinsey report says post-COVID-19 business recovery could take five or more years depending on the size of business and sector.

The report highlights challenges faced by businesses in returning to pre-pandemic business levels including reduced customer demand for products and services, new consumer expectations, and operational challenges because of health, safety, and supply chain issues.

While the report may be discouraging to some business owners, McKinsey does have recommendations on business strategies to minimize impact and speed up recovery.

Five years or more recovery for most-impacted sectors

Recovery will take time depending on two scenarios – a “virus-contained” scenario or a “muted recovery.” In the US, the first scenario seems less likely every day as the largest states hit record levels of new coronavirus cases.

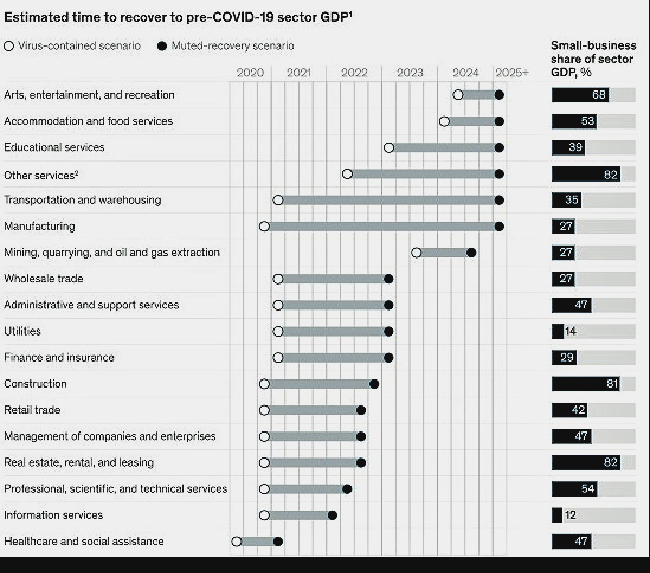

Based on the 2008 recession, the hardest hit business sectors will take from five to six years for full recovery in a muted recovery, depending on the severity, full impact, and duration of the pandemic as the following chart shows. McKinsey also predicts that small businesses will take longer to recover, and the chart also shows the percentage of each business sector that is made up of small businesses to highlight the scale of impact.

Worst case for smaller business is up to six years for a full recovery

In the worst-case scenario above, the slowest to recover (with percentage of small business in parentheses) will be arts, recreation and entertainment (68% small business), accommodation and food services (53%), educational services (39%), and other services (82%). Transportation and warehousing (35%) and manufacturing (27%) will also see a lengthy worst-case recovery time of more than five years.

For these hardest-hit business sectors, even the less likely, best-case scenario means lengthy delays between two and five years.

Best and worst-case scenarios for other business sectors range from one to three years for businesses including real estate, rentals, and leasing (82%), construction (81%), professional, scientific, and technical services (47%), management of companies and enterprises (47%), retail (42%),

Fastest recovery in healthcare and social assistance

Not surprisingly, the fastest sectors to recover will include healthcare and social assistance (47%) and information services (12%).

“After the 2008 recession, larger companies recovered to their pre-crisis contribution to GDP in an average of four years, while smaller ones took an average of six. How long it takes in the current recession will depend on both economic vulnerability to the COVID-19 response and the prevailing macroeconomic outlook in their respective industries. Across all businesses, that could take five years or longer under two scenarios that McKinsey Global Institute and Oxford Economics have modeled and that more than half of global executives surveyed see as the most likely to unfold.”

Recovery strategies vary

McKinsey says small businesses will need to respond at relatively higher costs and with fewer financial resources than larger competitors. Congress, are you listening?

Biggest expenses will include protecting the health and safety of employees and customers, adapting business models, investing in talent and technology, and adjusting staffing models and labor practices. Small businesses operate with generally smaller profit margins and McKinsey noted that as many as one-third of small businesses surveyed were running a loss or breakeven prior to the pandemic. These small businesses will find this investment an even bigger challenge.

Manufacturing, retail, and restaurants make up 30% of small business jobs in the US economy. Prior to the crisis, profit margins were typically 5% or less for small retailers selling staples such as groceries and less than 10% for small businesses selling discretionary items. Many retailers typically carry 90 days of inventory, often seasonal, causing severe financial pressure. Their average cost of servicing debt is 30% so it’s a risky survival scenario.

Restaurants also have tight margins and the shift to off-premise sales and food delivery increases packaging and operating costs while reducing the opportunity to sell higher profit items such as alcohol and desserts. McKinsey says 40% of restaurants before the pandemic were operating at a loss or barely breakeven.

Lower sales, higher cost of goods, higher operating costs, continued fixed costs and salaries, higher advertising and promotion costs, and higher health and safety costs are a restaurant business reality. Social distancing will also affect business operations and cost. These are costs also shared by retailers and manufacturers who must take care of customers and employees as well.

In the first week of June 2020, a survey by the US Census Bureau found that 50% of manufacturers saw a decrease in revenue. Consumers are beginning to reduce spending on nonessential goods and services. As government support for consumers and businesses runs out, spending will constrict even further.

Adopting new business and operations models

Businesses have tried their best to respond. Many have ramped up e-commerce and new sales channels and promotions. An estimated 60% of restaurants pivoted quickly to offer pickup, take out and curbside delivery services as did grocery stores as up to 30% of customers were first-time users of these services.

Despite lower traffic in stores and restaurants due to social distancing, merchants also responded with new payment methods and apps which also have development and technology costs.

McKinsey estimates 56% of fashion retail products were on sale at the end of April 2020 compared with 47% in April 2019. Smaller businesses may find deep discounting an unsustainable strategy.

Factories have implemented a number of new practices including remote work, protected workstations and work pods, plexiglass shields between workers and customers, regular health and safety testing – all of which increase overhead and become harder to manage for smaller businesses.

Disruption creates opportunity

Between 15% and 20% of customers have switched stores during the pandemic because of disruption in the marketplace, changing purchase patterns, availability of products and services, and other factors. Millions of customers are up for grabs.

Half of those who switched stores expect to continue shopping at their new stores. Customers are taking fewer trips, increasing the size of their average order, and shopping more online, which may be a challenge, especially for smaller businesses. Local businesses may need to highlight their hyper-local advantages or unique features and products, compete more heavily on customer service instead of price, and work hard to build greater customer loyalty. Again, all at a cost.

New technologies will impact business forever

Think of just a few of the new business practices and operational changes made in the past several months. Contactless payments have grown. Online sales have jumped dramatically and increased in new sectors such as groceries. Same-day or next day delivery is expected, and free shipping is a distinct competitive advantage.

New payment and logistic technologies have sprung up and been adopted quickly as a result of COVID-19. The business of home delivery is booming both by businesses as well as new delivery contractors. As McKinsey notes:

“Among retailers, too, those that have performed well since the beginning of the crisis were those that leveraged their superior digital capabilities. Target, for example, saw comparable store sales grow by more than 10 percent in the first quarter of 2020, reflecting a 141% increase in digital sales, while physical-store sales rose less than 1%. While the barriers to sell online are low, competition from large retailers is also fierce.”

McKinsey estimates between 40% and 50% of US manufacturing assets will require upgrading for digital readiness. They also say smaller to midsize manufacturing companies have as much as 40% lower productivity than larger competitors. Again, a factor of available capital and other resources.

A new payments landscape

It goes without saying the payments landscape has changed dramatically in just the past four months. Witness the growth in contactless payments and a shift towards the use of debit cards and a decrease in the use of cash. New services such as automated accounts receivable, invoicing, payments as a service and automated collections have all shown revenue growth. Ditto many logistics and delivery operations.

The only thing we can be certain about at this point is every new day will look different than the day before and business managers will need to continue to adopt new technologies, adapt business models, and make fast shifts in how they operate. We live in exciting times.

You can read McKinsey’s report here.