By Jeff Domansky

Understandably, PayPal’s new payment pricing strategy attracted a lot of attention. After all, the company is one of the biggest in the payment industry, with $21.4 billion in revenue in 2020 and $936 billion (+31.5%) in transactions processed.

Its biggest payment processing competitors pale in comparison except for Worldpay, which handled $1.7 trillion in transaction volume. Other major competitors include Stripe with $350 billion in transactions (+133.3%) in 2020, followed by Square ($112.3 billion, +6%), Paysafe ($92 billion), Payoneer ($44.4 billion, +57%), and Dwolla ($20 billion, +80%).

Merchants using BNPL and Venmo payments will not be pleased with the rate increases effective August 2, 2021.

Price increases ahead

PayPal will increase charges for some of its “newer” products, including:

- 3.49% plus $0.491 per transaction for PayPal digital payments with its PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, and Checkout with crypto.

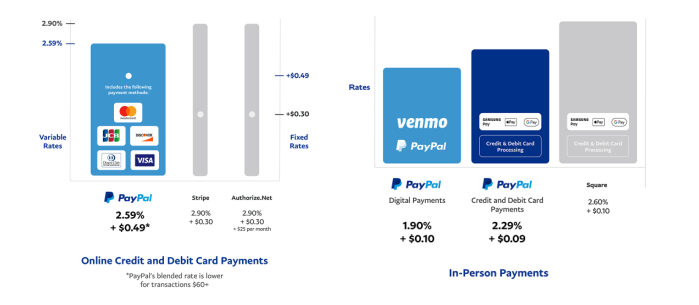

- For in-person payments with PayPal and Venmo QR code transactions over $10, the rate will be 1.9% plus $0.10, and for transactions $10 and less, the rate will be 2.40% plus $0.05. For some in-person debit and credit transactions, the rate will be 2.29% plus $0.09.

- Rates for online credit and debit card transactions will be 2.59% plus $0.491 per transaction without its chargeback protection and 2.99% plus $0.49 with chargeback protection.

- Charity transactions will be 1.99% plus $0.49.

For US merchants with custom, non-standard pricing, rates will remain the same.

With 392 million active users, that’s a lot of small change really to flow to the bottom line.

“We are making changes to our published rates in the United States to better align our pricing with the value that our products and services provide,” Dan Leberman, SVP, SMB and Partners, rationalized in a blog announcement.

“As PayPal has been evolving our business alongside our merchant business partners, we have accelerated the rollout of products, features, and capabilities, delivering more benefits than ever before. With this, PayPal has become more than just a button or payment processor to be a full commerce platform capable of driving growth for businesses of all sizes online or in person,” Leberman added.

Competitive comparison? Some good news

PayPal provided several charts to convince merchants it has their interests at heart. “Consumers are nearly three times more likely to complete their purchase when PayPal is available at checkout,” Leberman asserted.

The announcement did have one bit of good news for US merchants.

For in-store transactions paid by Visa and Mastercard, PayPal will lower its fee to 2.29% of the transaction price plus a $0.09 fixed fee, and online payments rates will decrease to 2.59% of the purchase price plus a $0.49 fixed fee.

It should help soften the blow for some bricks-and-mortar and online retailers with a large volume of credit and debit card transactions.

Strategy behind price increases

There is a strategy behind these payment fee increases. Visa and Master card earlier announced plans to increase transaction charges but postponed implementation until April 2022. PayPal hopes to get out ahead of its competitors.

“It’s more than just pricing,” Aaron Press, an analyst at research company IDC told Reuters. “They are making sure the market understands that they should be thinking of PayPal as a comprehensive payments strategy and not just one form of payment.”

“Especially post-pandemic, that has become very, very important,” Press added.

During the first quarter of 2021, PayPal processed more than $285 billion in transactions, increasing 49% over the previous year.

The market also seemed to like PayPal’s new pricing announcement, trading up 2.56% at the close on Friday.

If you want a real merchant headache, you can read through the many pages of the complete list of PayPal Merchant Fees. However, in many cases, PayPal charges among the industry’s most competitive transaction rates and fees. But the list of additional merchant fees shows you how much additional revenue is on the table, regardless of which payment processor you choose as your partner.

In an industry with razor-thin margins and dozens of new fintech competitors, segmenting pricing between commodity and high-value products and services makes perfect sense with PayPal’s global scale.

Expect it to continue to dominate with more growth ahead.

Recent payment industry coverage:

New Dwolla low-code API integration saves time, money

Record: PayPal’s big, no VERY BIG year

LET’S CONNECT