By Jeff Domansky, Feb 11, 2021

Uber really does want to be all things to all people. As part of its growth strategy, last week it purchased Boston-headquartered alcohol delivery firm Drizly for $1.1 billion in cash and shares.

At first glance, it looks like a perfect fit for both companies. Drizly gets access to the world’s largest food delivery and ridesharing platform and mobile technology expertise. Uber adds another potentially profitable product line to its delivery services menu.

“Wherever you want to go, and whatever you need to get, our goal at Uber is to make people’s lives a little bit easier. That’s why we’ve been branching into new categories like groceries, prescriptions, and, now, alcohol. Cory and his amazing team have built Drizly into an incredible success story, profitably growing gross bookings more than 300 percent year-over-year,” said Uber CEO Dara Khosrowshahi in a news release.

“By bringing Drizly into the Uber family, we can accelerate that trajectory by exposing Drizly to the Uber audience and expanding its geographic presence into our global footprint in the years ahead,” Khosrowshahi added.

Drizly growth snapshot

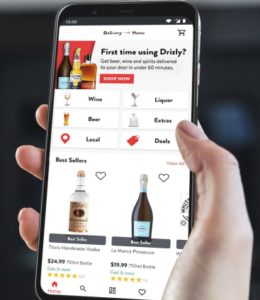

Drizly delivers beer, wine, and spirits from 4,000-plus local merchants to consumers in under 60 minutes, a service proving wildly popular during the pandemic. During 2020, the company’s merchant network doubled from 2,000.

Launched in 2012, the company serves more than 1,400 cities with more than 100,000,000 customers of legal drinking age in the US and Canada. It opened most recently in January in Atlanta.

Drizly saw sales growth of 350% in 2020, and its average order value increased by 30%. Thirst-quenching numbers by any measure.

“Drizly has spent the last eight years building the infrastructure, technology, and partnerships to bring the consumer a shopping experience they deserve. It’s a proud day for the Drizly team as we recognize what we’ve accomplished to date but also with the humility that much remains to be done to fulfill our vision. With this in mind, we are thrilled to join a world-class Uber team whose platform will accelerate Drizly on its mission to be there when it matters—committed to life’s moments and the people who create them,” said Drizly co-founder and CEO Cory Rellas.

Independent alcohol sales growing

A recent report by Drizly showed 70% of independent alcohol retailers experienced higher in-store sales since COVID-19 became widespread, while 78% saw online sales increase.

Nearly half of these retailers said online sales were less than 5% before COVID, while 56% said online sales represented 11% of total sales since the pandemic started. 17.3% of alcohol retailers saw online growth of 30% or more.

Research by the company projects online alcohol sales could reach 20% of adult purchases in the next five years. 72% of consumers said they expect to make half of their alcohol purchases online in 2021.

As part of a shift to at-home drinking, sales of bartending essentials like liqueurs, cordials, and schnapps jumped 600% in 2020 compared to 2019. Hard seltzers, Tequila, and Mezcal sales will grow, and wine has a sparkling future as well.

Uber loads up on services & technology

Since 2015, Uber has made 13 substantial acquisitions in its drive for growth. They include delivery, technology, and software companies. Among the most notable:

- Drizly – US alcohol delivery service; Feb 2021, $1.1 billion

- Postmates – US food delivery service; Dec 2020, $2.7 billion

- Autocab – UK mobile taxi booking and dispatch platform; Aug 2020, (undisclosed, regulatory review underway)

- Routematch – US transit technology & software; July 2020, (undisclosed)

- Cornershop – Chile & Canada grocery delivery service; Oct 2019 (undisclosed)

- Mighty AI – US autonomous vehicle data & computer modeling; June 2019, (undisclosed)

- Careem – Dubai, UAE rental car app; $3.1 billion, Mar 2019

- Otto – US autonomous trucks; Aug 2016, $680 million.

Since its launch of Uber Eats in 2014, its growth strategy has been a mix of acquiring related delivery services and strategic investments in technology, software, and related cloud services. Under CEO Khosrowshahi, the execution of the strategy is focused and looks on target.

We’ve covered some of the up-and-coming companies and trends in home delivery services and logistics recently. The Drizly acquisition puts Uber on the road to a strong position in a competitive market.

Uber’s roadmap for the future

Drizzly will continue operating as a stand-alone brand initially when the deal is completed in the first half of this year. VC investors backing the company included Polaris Ventures, Avenir Growth Capital, and Tiger Global Management.

With more than 16,000 global employees and operations in 65 countries, Uber has raised more than $25.2 billion in funding over 28 rounds. Despite its losses, it hopes to finally reach profitability in 2021 despite the drag on profits by Uber Eats.

Is it on the road to growth, and can Uber be all things to all people in the future? Uber Eats and Drizly seem like the perfect, profitable dinner companions.

LET’S CONNECT