By Jeff Domansky

As excitement builds regarding a return to “normal,” it’s helpful to look around the globe and see which economies are poised to rebound the fastest.

During 2020’s year of Covid, global consumers made many new buying decisions and tested new shopping and payment habits. Many new patterns are here to stay, particularly when it comes to payments.

The SE Asian economies were supercharged and growing fast before the pandemic. Like many economies, they constricted. A new report from PPRO suggests these Asian tiger economies are ready to rock ‘n roll in 2021 and 2022.

Global economic snapshot

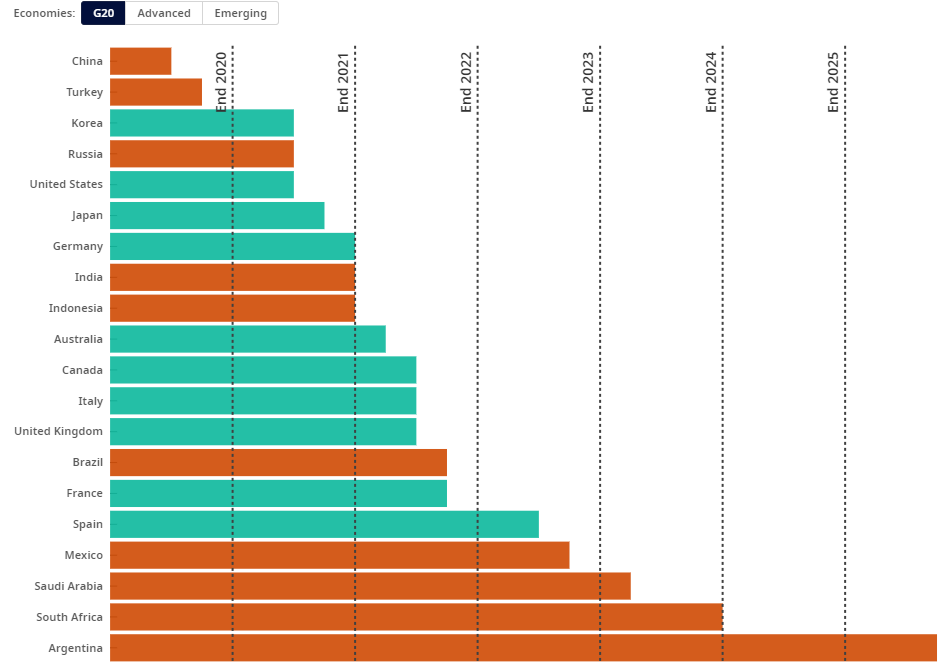

This is not the usual recovery, according to the OECD. “Prospects for the world economy have brightened, but this is no ordinary recovery. It is likely to remain uneven and dependent on the effectiveness of vaccination programs and public health policies. Some countries are recovering much faster than others. Korea and the United States are reaching pre-pandemic per capita income levels after about 18 months. Much of Europe is expected to take nearly three years to recover. In Mexico and South Africa, it could take between three and five years.”

SE Asia sagged but fared relatively better

The Asian Development Bank (ADB) said growth across SE Asia fell 4.0% in 2020. Not that bad a picture compared to the Eurozone (-7.9%), UK (-10.1%), the US (-3.5%), and the global economy (-4.5%).

During 2020, growth in the region struggled though not as bad as many other parts of the world: Indonesia (-2.1%), Malaysia (-5.6%), Philippines (-9.6%), Singapore (-5.4%), and Vietnam (+2.9%).

The pandemic pushed SE Asian consumers to adopt e-commerce quickly, and these economies are ready to roar again as growth regains momentum.

Here’s what the ADB predicts for 2021/2022 growth in the region: Region (+4.4%/ +5.1%), Indonesia (+4.5/+5.5%), Malaysia (+6%/+5.7%), Philippines (+4.5%/+5%), Singapore (+6%/+4.1%), and Vietnam (+6.7%/+6%).

Indonesia will lead regional recovery

According to PPRO’S report, pre-pandemic, the economies of the five major SE Asian countries grew 27.3%.

Consulting group Redseer said Indonesia’s e-commerce economy reached $40 billion, third-largest globally and surpassing India in 2020. During the pandemic, online shoppers reached 85 million, up 10 million since last year in Indonesia.

The Jakarta Post cited a 2019 study by Google, Temasek, and Bain & Company showing e-commerce has overtaken online travel to become the biggest sector of the internet economy in Southeast Asia and should exceed $150 billion GMV by 2025. Indonesia is predicted to gain more than half of the GMV share at $82 billion of the regional value.

When it comes to payments, only 5% of Indonesians have a credit card which accounts for one-third of online purchases. PPRO research shows shoppers pay for most transactions with bank-transfer apps (29%), e-wallets (17%), cash schemes (13%), and a range of minor payment methods (7%).

Most popular payment methods include e-wallet GoPay with over 100 million users; e-wallet OVO which has grown 267% partly because of its attractive cashback offers; and e-wallet Dana, with 50 million users and three million transactions daily. Also popular is the payment processor DOKU with more than 2.5 million users. It handles payments by e-wallet, internet banking, bank transfers, and cash.

Malaysia rebound will be substantial

ADB projects Malaysia’s economy will grow 6% to 2021 and 5.7% in 2022. The pandemic saw substantial e-commerce growth, with 2020 Q1 growth of 149% alone.

Some products saw massive growth, including women’s undergarments (+909%), latex gloves (+888%), kitchen appliances (+880%), and home fitness and carpets (+100%).

During lockdown, the country’s three most popular e-commerce sites were Shopee Malaysia, Lazada, and Food Panda. PPRO noted four of every ten online purchases are made with merchants outside Malaysia.

“Malaysians pay for almost half of their online purchases using bank-transfer apps. E-wallets account for a further 6% of all online payments and cash a sizable 11%. Unlike many countries in the region, all the cards in common usage are from international brands. Local card schemes do not have a significant presence,” PPRO reported.

Boost is a popular e-wallet with cashback rewards for consumers and is accepted at more than 120,000 Malaysian locations. The GrabPay super app and e-wallet has more than 20 million Malaysian users and is accepted by 30,000 participating merchants. Ant Financial-backed Touch n’ Go is used by more than 15 million shoppers, more than half of Malaysians. Bank transfer app Financial Process Exchange (FPX) is also popular.

Philippines hardest hit, but recovery will return

ADB reports the Filipino economy fell -9.6% in 2020, but it forecasts a rebound of +4.5% in 2020 and 5.5% in 2021.

The Star reports the number of online businesses in the Philippines grew 40 times from March 2020 through September 2020 despite a 12% growth in vacancies for bricks and mortar retailers.

Overall, in the first six months of the pandemic, e-commerce group 376% in the Philippines. PPRO reported 70% of Filipinos bought groceries online in 2020, followed by health products (50%) and household cleaning products (34%).

While cash is a factor in each of the SE Asian countries, it is “wildly popular” with Filipinos. The majority purchased online with cash, and yes, you read that correctly.

“The most common form of payment in The Philippines, used in 37% of online transactions, was cash. Customers use services such as Dragonpay to obtain a transaction code at the online checkout. They pay cash in-store, at a participating retail outlet, using the code to match the payment to their online purchase,” PPRO said.

Once the barcode payment is made in cash, online merchants ship the product. It’s ideal for consumers who don’t have a bank account, credit card or have privacy and security concerns.

Dragonpay has more than 14 million users and has completed more than 100 million transactions since opening in 2010. Not to be confused as an e-wallet, this unique online payment platform remains popular with consumers. Ant Group-backed GCash is the top e-wallet with 10 million downloads in the first nine months of 2020. GCash lets users pay for online purchases, pay bills, send money, and more. PayMaya is the most popular mobile banking app, processing 300% more payments in September 2020 than the same month a year earlier.

Singapore digital payments and e-commerce booming

While Singapore’s economy sagged -5.4% in 2020, ADB projects 6% economic growth in 2021 and 4.61% in 2022. The government of the modern city-state pumped more than $100 billion in aid during the pandemic softening the financial impact.

Singapore’s five biggest e-commerce platforms saw traffic grow between 10% and 82% during the pandemic. The average order value of online purchases increased 52% over 2019. Nielsen reported nearly 40% of Singaporeans started doing more online shopping, and 70% now buy food and other household items online. 76% of consumers said they would not return to pre-pandemic purchase habits.

“At first glance, Singapore looks like the exception in this report. Shoppers pay for 75% of all online purchases using credit or debit cards, in stark contrast to the other markets under review. So, an easy market for cross-border merchants to enter? Not so fast,” PPRO advises.

It says 54% of the 75% of online purchases bought with a card were paid for using something other than Visa, Amex, or Mastercard. Usually, this is a local card that non-Singaporean merchants don’t support and a substantial barrier to foreign merchants. Other popular payment methods were bank transfers (10%), e-wallets (10%), and cash (4%).

GrabPay is also popular in Singapore, with more than 4 million users and 75% of consumers using it daily. Real-time bank transfer payment method PayNow is available to customers of nine participating banks in Singapore, covering 98% of the market. Popular buy now pay later (BNPL) solution Hoolah saw triple-digit growth in 2020.

Vietnam grew 1.8%, with more growth ahead

Vietnam’s economy actually grew 1.8% in 2020, one of the few countries to experience economic growth during the pandemic. ADB expects market-leading growth of 6.7% in 2021 and 7% in 2022, partly due to growing supplier chain status with the US.

And then there’s e-commerce. Before the pandemic, Vietnamese e-commerce grew at a staggering rate of 26% annually. Average order value in the first six months of 2020 rose 31%, including online grocery shopping (+42%) and cosmetics and healthcare (+21%).

Local payment methods dominate Vietnamese e-commerce. “65% of all online transactions in Vietnam are paid for using something other than a credit or debit card. And of the 35% paid for by card, 90% are bought using something other than one of the global-brand credit cards with which most people are familiar,” PPRO noted.

Cash remains important in payments at 21% of transactions, followed by bank transfers (26%) and e-wallets (14%). Again, using locally preferred payment methods can help merchants gain e-commerce market share.

VTC is a popular payment method allowing bank transfers, e-wallets, and international credit cards. With 2.5 million users, e-wallet and over-the-counter remittance and payment platform MoMo processes millions of transactions daily. Messenger app and mobile e-wallet ZaloPay is even more popular than WhatsApp.

Ready for recovery?

These five SE Asian economic tigers are ready for recovery. With younger, mobile-savvy consumers and the growing popularity of e-commerce, economic growth is underway with the region’s 250 million residents.

The question is can international merchants find ways to participate in this exciting opportunity and economic recovery?

You can download a free copy of the PPRO report Southeast Asia: The New E-commerce Frontier here.

Graphic chart courtesy OECD

Recent PaymentsNEXT coverage of SE Asia:

Pandemic pushes dynamic e-commerce growth ahead in SE Asia

Rapyd Asia payments research report: One size does not fit all

Decoding Asia-Pacific’s payments & e-commerce landscape

LET’S CONNECT