When it comes to payments across seven major countries in the Asia-Pacific region, new research from Rapyd tells us two key things. First, there is no single payment scheme that works best in all countries. Second, the use of banking and digital payments is higher and more widespread than previously understood with some interesting variations by country.

Rapyd’s 2020 State of Disbursements Asia-Pacific Outlook report surveyed 3,500 consumers in Japan, India, Indonesia, Malaysia, Singapore, Taiwan, and Thailand to provide important guidelines for how workers prefer to be paid; individual country payment preferences including digital wallets, bank transfers, and use of cash; and security and features concerns of consumers.

“While data about how consumers prefer to make payments is widely available, businesses struggle to make payouts to gig-workers, online sellers, and B2B partners using the methods that these beneficiaries prefer and often require. Through this report, we are able to provide actionable information to global organizations as they make critical business decisions impacting both the short- and long-term health of their companies,” said Brendan Miller, Head of Global Product Marketing at Rapyd.

Fast-growing economies

The region’s economy is growing quickly. By 2023, retail sales in the region will be the biggest in the world.

In 2018, 47% of B2C e-commerce sales were made through digital marketplaces compared to only 27% in 2009.

Payments complexity challenging

Navigating the complex combination of country-specific licensing, regulations, and payment infrastructure is a big challenge, particularly for new businesses entering the region. It can also be unnecessarily expensive, time-consuming, and slow for companies, consumers, and suppliers.

There are at least 20 real-time payment networks operating in the region. Networks like India’s UPI have seen seven times growth since last year.

In 2019, there were more than 2.1 billion e-wallets globally and their use is growing quickly in Asia-Pacific, particularly in India, Indonesia, and Malaysia.

It may be surprising to US businesses but only 18.4% of consumers globally have a credit card. “Many APAC countries are not set up for Visa Direct and Mastercard and it’s critical for digital leaders to think beyond the card, especially in Asia, as direct bank transfers dominate,” the report said.

Cash is still a popular form of payment throughout Asia and Japan, in particular, has lagged behind other countries in digital adoption.

Early adopters vs traditionals

Each country has its own views and preferences when it comes to new payments and technologies. For example, in Japan, 37% of consumers consider themselves innovators and early adopters while 41% are followers and 22% laggards when it comes to adoption of new payments and technology.

Contrast that with Indonesia where 70% are innovators and early adopters, 27% followers, and only 2.4% laggards.

“In India, three-quarters of the respondents said they either like being up to date on the latest billing and payments technology or at least they are likely to explore smarter technologies that make payments and billing better for them,” the report said.

Meanwhile, in the advanced economies of Japan and Taiwan, nearly two-thirds of consumers are less willing to be early adopters and innovators. In Taiwan, more than half of consumers simply prefer using their familiar payment methods.

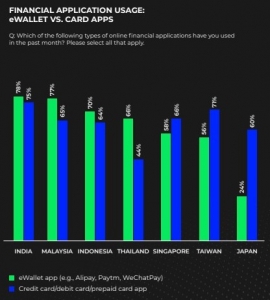

While 80% of consumers have a savings account and debit card across the region, many consumers are also making use of e-wallets. In the past 30 days, 78% of Indian consumers said they accessed an e-wallet followed by Malaysia (77%), Indonesia (70%), Thailand (66%), Singapore (50%), Taiwan (56%), and Japan with only 24%.

Security, speed, low or no fees

In four countries, security concerns were high including India (82%), Malaysia and Indonesia (75%), and 70% of Singaporeans who all said keeping personal data safe was the most important factor in receiving payments.

Speed of payments and low or no service fees were also highly desirable features mentioned by consumers.

Disbursement preferences vary by country

Depending on the use case, disbursement preferences vary considerably between countries.

Direct bank transfers were preferred by 70% of consumers across the region for salary transfers but were highest at 80% plus in Singapore and Malaysia.

“In Singapore, 89% of consumers receive their regular salary in the form of a direct bank transfer, but 49.5% will receive a repayment from a friend/family member via an e-wallet. In India, where freelance/gig and independent work is popular, nearly 60% who received payment from such work received it in the form of an e-wallet account,” the report said.

E-wallets are quickly growing in popularity for money transfers or payments with family and friends. 38% of Indians and 24% of Singaporeans chose it as their preferred option. E-wallets were favored by 38% of Indonesians for rebates compared to 30% of Malaysians and Thais for the sale of personal goods and services.

In Japan, 74% prefer to receive a bank transfer when getting paid by their employer, but when it’s an allowance/remittance from a friend or family member, 40% prefer to receive cash.

Planning for the payments future in Asia-Pacific

Miller said each country is unique in its preferences and digital leaders must be prepared to localize their payout experiences to drive beneficiary loyalty and engagement.

The report recommends three strategies to help business navigate complexity and cross-border payments in the region in the future:

- Let local preferences guide payment options and focus on security, speed, and choices.

- Optimize real-time bank transfers and payments now and for the future.

- Build payout partnerships rather than payout infrastructure.

“The payments market in the APAC region is diverse and changing fast. Keeping up with all the regulations, changing consumer preferences, and trends in every country require building and maintaining a vast technology infrastructure and internal compliance program. None of which is your core competency,” the report suggests.

The research provides additional in-depth data on preferences for payments and billing, disbursements, technology, and features in the seven countries surveyed. If you’re new to the region, it’s a valuable starting point.

You can download a free copy of Rapyd’s 2020 State of Disbursements Asia-Pacific Outlook report here.

Visuals courtesy of Rapyd