By Jeff Domansky, April 1, 2021

With so much happening in the global payments industry, we’ve prepped a news roundup to quickly get you up to speed as the week comes to a close. Among the highlights: Visa Direct Payouts and crypto payments, Paysafe merger and Knect rewards, Walgreens bank?, OLB QR codes, Emburse-Mastercard expense management, TymeBank 3 million customers, and much more.

Visa Expands global money movement capabilities beyond the card with Visa Direct Payouts

Visa announced the expansion of Visa Direct, a real-time push payments platform, with the introduction of Visa Direct Payouts. The new solution allows Visa’s clients and partners worldwide to use a single, simpler point of connection to push payments to eligible cards for domestic payouts and eligible cards or accounts for cross-border payments. Read more…

Paysafe completes business combination with Foley Trasimene Acquisition Corp II

Paysafe and Foley Trasimene Acquisition Corp completed their planned merger and now trade on the NYSE as Paysafe Limited. The consumer and merchant payments network enables payment processing and digital wallets, including the Skrill and Neteller brands, and online cash solutions including Paysafecard and Paysafecash. Read more…

Walgreens Bank? Coming soon to pharmacies near you

Nine thousand new bank branches will open soon in the form of US in-store and online financial services courtesy of Walgreens. The US drugstore chain announced that pharmacy customers would soon be able to open a Walgreens bank account with a MetaBank Mastercard debit card in conjunction with a freshly updated myWalgreens rewards program. Read more…

Visa moves to allow payment settlements using cryptocurrency

Visa said it would allow the use of the cryptocurrency USD Coin to settle transactions on its payment network, the latest sign of growing acceptance of digital currencies by the mainstream financial industry. The company told Reuters it had launched the pilot program with payment and crypto platform Crypto.com and it plans to offer the option to more partners later this year. Read more…

OLB Group simplifies contactless payments with dynamic QR-Codes

Merchants can now offer customers another contactless payment option at the POS using transaction-specific QR-codes. The dynamic QR-code provides a unique payment record with all transaction details. Merchants utilizing OLB’s QR-code service can select various funding sources, including Apple Pay® and Google Pay®, multiple cryptocurrency wallets, and other digital payments. Read more…

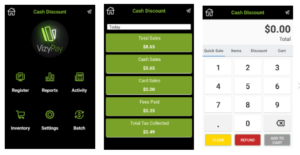

New VizyPay app streamlines data-driven insights from POS transactions

VizyPay’s new VizyPOS App helps merchants streamline and manage all aspects of the payments process, including inventory management and in-depth analytics. Key features of the point-of-sales analytical App: cash discount program (CDP) tender, merchant inventory ranking for higher profit margins, detailed transaction tracking and analytics, and CDP implementation. Read more…

Emburse and Mastercard partner to help financial institutions deliver robust corporate expense management capabilities

Emburse is collaborating with Mastercard to provide card-issuing financial institutions (FIs) with in-depth expense management capabilities. Mastercard-issuing FIs can now offer a custom-branded version of Emburse and deliver an integrated solution that empowers corporate clients to capture, verify, and reconcile corporate card spending easily. Read more…

Paysafe’s NETELLER launches Knect customer reward program

Paysafe launched NETELLER Knect, a loyalty program that rewards customers for making payments with their NETELLER digital wallet in over 100 countries. Customers earn points for using their wallet or prepaid Mastercard to exchange for e-money, discounts with participating merchants, gift cards for leading retailers, or interests in cryptocurrency. Read more…

TymeBank has reached a three-million cloud customers

Launching just two years ago, South African digital bank TymeBank reached a three million customer milestone as one of the world’s fastest-growing digital banks. According to a report, the bank is onboarding between 100,000 and 120,000 new customers each month. TymeBank has no physical branches and operates through a website, mobile App, and ATM network. Read more…

FICO-free TomoCredit Mastercard launches

Are you struggling to get approved for a credit card? Poor credit score or no credit history? Hate paying high credit card interest rates? That pretty much describes millions of young US consumers or new immigrants without a US credit history. The new TomoCredit Mastercard could solve the dilemma for millions of consumers unable to get a traditional credit card without a credit history. Read more…

The most popular (and atypical) business expenses of 2020

Ever wonder what companies spend T&E money on when the “T” is on pause? When TripActions launched its fintech payments solution, TripActions Liquid™, in February of 2020, nobody could have guessed how interesting the year would become. Liquid provides a fascinating look at how customers spent money during a unique year for businesses. While some of these purchases may surprise you, they were approved within that company’s policy. Read more…

Spring Clean Your Finances with Quadpay: Introducing Money Mondays & our Consumer Bill of Rights

BNPL leader Quadpay intros tips and tactics: “The official purpose of this event is “to raise awareness about the importance of financial literacy and the need for effective financial education”—in other words, it’s a chance to get smarter with money by brushing up on the fundamentals of budgeting, saving, and spending.” Read more…

If you’re planning to celebrate Easter, enjoy your weekend and reflect on positive things ahead.

LET’S CONNECT