Here are the payments industry news stories we’re reading this week along with the payments trends and innovations we’re watching from around the world.

PayPal and Temasek invest $125m in India’s Pine Labs

PayPal’s shopping spree continues as the US behemoth makes its third investment in a fortnight, joining with Singapore’s Temasek to pay $125 million for a minority stake in Indian digital retail payments platform Pine Labs. The deal comes in the wake of PayPal’s recent agreements to buy Sweden’s iZettle for $2.2 billion and AI-based merchant marketing outfit Jetlore. Read more…

PayPal’s shopping spree continues as the US behemoth makes its third investment in a fortnight, joining with Singapore’s Temasek to pay $125 million for a minority stake in Indian digital retail payments platform Pine Labs. The deal comes in the wake of PayPal’s recent agreements to buy Sweden’s iZettle for $2.2 billion and AI-based merchant marketing outfit Jetlore. Read more…

Mary Meeker: Payments & e-commerce trends – what’s ahead

Mary Meeker’s annual Trends Report is closely examined for its comprehensive analysis and predictions. We’ll take a look at her report, particularly the relevant highlights for e-commerce trends and the payments industry. Read more…

Mary Meeker’s annual Trends Report is closely examined for its comprehensive analysis and predictions. We’ll take a look at her report, particularly the relevant highlights for e-commerce trends and the payments industry. Read more…

Amazon Echo reverberates with sales

A new research report from InfoScout and Alpine.AI, shows consumers increased the frequency of their consumer package goods (CPG) spending on Amazon by 29% after purchasing an Amazon Echo device. This compares to a 19% increase in frequency of purchases by non-Echo buyers. Read more…

Amazon Dash integrates WePlenish smart containers

WePlenish, which makes smart containers that automatically reorders kitchen pantry items when a user’s supply is running low, has become the first smart container company to integrate its product with Amazon’s Dash Replenishment program. Read more…

WePlenish, which makes smart containers that automatically reorders kitchen pantry items when a user’s supply is running low, has become the first smart container company to integrate its product with Amazon’s Dash Replenishment program. Read more…

Walmart divests Brazil operations

Private equity firm Advent International has agreed to invest an 80% majority stake in Walmart Brazil, with Walmart retaining the remaining 20%, the companies said on Monday. The transaction, expected to close later this year, is subject to regulatory approval in Brazil. Read more…

Alibaba Knows No Boundaries

Alibaba ended fiscal 2018 with revenues growing 58% to RMB250.3 billion (~$39.9 billion) driven by an impressive 60% growth in core commerce revenues. It ended the year with non-GAAP free cash flow of RMB99.4 billion (~$15.8 billion), recording a 44% growth over the year. Alibaba expects to end the current year with revenues growing 60% over the year. Read more…

US app-based bank Chime passes one million customer mark, raises $70m by Menlo Ventures

The new round of funding comes just weeks after the three-year old bank passed the one million customer mark, with growth attributed to its no-fees policy and user-friendly banking app. The company says it is adding 100,000 customers a month for the service, which provides an accompanying debit card – on which the business earns interchange revenue – and auto-savings account. Read more…

The new round of funding comes just weeks after the three-year old bank passed the one million customer mark, with growth attributed to its no-fees policy and user-friendly banking app. The company says it is adding 100,000 customers a month for the service, which provides an accompanying debit card – on which the business earns interchange revenue – and auto-savings account. Read more…

Banks will have to develop PFM tools under FCA high-cost credit reforms

UK banks will be forced to develop alerts for customers who may be about to slip into the red as well as a range of prompts and PFM tools that make it easier to keep on top of finances following a review by the Financial Conduct Authority into the high-cost credit market. The watchdog says it is proposing a number of “radical” options to protect millions of people who use overdrafts and high-cost credit. Read more…

UK banks will be forced to develop alerts for customers who may be about to slip into the red as well as a range of prompts and PFM tools that make it easier to keep on top of finances following a review by the Financial Conduct Authority into the high-cost credit market. The watchdog says it is proposing a number of “radical” options to protect millions of people who use overdrafts and high-cost credit. Read more…

Our Digital Future

Money has for centuries been central to human relationships. Loss of faith in its value can result in economic and political instability, even war. In the past few years, financial technology—fintech for short—has caught the world’s imagination by offering alternatives to traditional means of payment. Will digitalization redefine money? Read more…

Money has for centuries been central to human relationships. Loss of faith in its value can result in economic and political instability, even war. In the past few years, financial technology—fintech for short—has caught the world’s imagination by offering alternatives to traditional means of payment. Will digitalization redefine money? Read more…

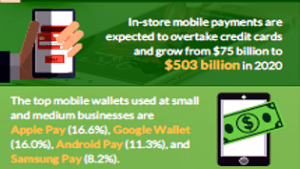

7 trends for the future of payment processing

Cutting-edge payments and software company SpotOn that looks at seven key trends for the future of payments processing including mobile payments, mobile wallets, blockchain technology, millennial banking preferences and biometric identification innovations. Read more…

LET’S CONNECT