Lots of payments industry news, venture capital developments and global trends to review for the start of this week. We open with what could be a blockbuster financing by Paytm in India, reportedly seeking $1.9 billion from Japanese investor Softbank. If it goes ahead, Paytm would be valued at $9 billion and Softbank would own 20%. While currently only 1% of the world’s online market, India is poised to grow faster than China and the US in the next five years. PayPal followed Amazon and applied for a mobile wallet license in India.

PayPal will launch Pay with Venmo for millions of retailers later this year and will not require any additional integrations. Rumors are growing that Apple wants to bring P2P payments to the marketplace after giving it up several years ago. French Telecom company Orange plans to launch an online bank later this year with a wide range of standard banking features. 48% of Middle East GCC consumers prefer to shop online but have security concerns. Dubai startup Bridg hopes to make mobile payments much easier for MENA residents.

PayPal will launch Pay with Venmo for millions of retailers later this year and will not require any additional integrations. Rumors are growing that Apple wants to bring P2P payments to the marketplace after giving it up several years ago. French Telecom company Orange plans to launch an online bank later this year with a wide range of standard banking features. 48% of Middle East GCC consumers prefer to shop online but have security concerns. Dubai startup Bridg hopes to make mobile payments much easier for MENA residents.

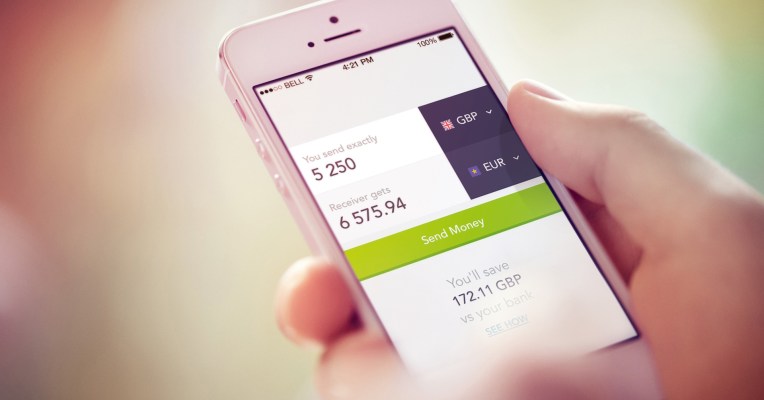

Global payments platform Payza introduced payments in Renminbi currency for Chinese residents. Cross-border startup TransferWise will expand its discount, cross-border payments service with a new regional Singapore office. Paris-based startup Snapay hopes it’s new mobile payments app will make an impact on the estimated two billion unbanked residents around the world.

Paytm to raise Rs 12,000 cr ($1.9Bn) from SoftBank in single largest e-commerce funding

In what could turn out to be the biggest single-round funding in an Indian e-commerce company, One97 Communications – the parent company of popular payments platform Paytm – is in advanced stages to raise up to Rs 12,000 crore ($1.9 billion) from Japanese media and telecom conglomerate SoftBank.

In what could turn out to be the biggest single-round funding in an Indian e-commerce company, One97 Communications – the parent company of popular payments platform Paytm – is in advanced stages to raise up to Rs 12,000 crore ($1.9 billion) from Japanese media and telecom conglomerate SoftBank.

According to media reports, the funding could materialise within the next three weeks, though the Paytm Founder and Chief Executive Officer Vijay Shekhar Sharma has made no comment on it.

The deal will value the Noida-based company at around $9 billion and provide a 20 per cent stake to SoftBank, Economic Times quoted two people familiar with the transaction as saying. “The deal was agreed on earlier this week and is now waiting for board approval,” said one person cited above.

The development comes at a time when Alibaba-backed Paytm is on an expansion mode and is said to be in discussions for a fresh round of funding as it begins its foray into banking, insurance and finance. Sharma already own a license for a payment bank and One97 is looking to earmark $1 billion to expand into these areas. Via indiatvnews.com

India’s E-commerce Impact Tiny But Not For Long

India has been the next bastion of growth for e-commerce companies, including Amazon and Alibaba, but the market is still in its infancy, accounting for just 1 percent of the world’s spending online.

India has been the next bastion of growth for e-commerce companies, including Amazon and Alibaba, but the market is still in its infancy, accounting for just 1 percent of the world’s spending online.

That’s according to Seeking Alpha which, in a broad report looking at the state of e-commerce in India, said the low penetration rate of e-commerce in the country is mainly due to the low number of Internet users compared to its total population.

With only 34 percent of India’s population online, it’s a tiny sliver when compared to the 90 percent of people who use the internet in the U.S. The number of people using the internet is also lower than China, where Seeking Alpha said the penetration rate stands at 52 percent. Seeking Alpha pointed out, internet usage was just 7.5 percent of the population in 2010, and it’s now at 34 percent, which marks a faster growth rate than China and even the U.S. Via pymnts.com

PayPal follows Amazon, applies for mobile wallet license in India

Global payments major PayPal wants a slice of the blossoming mobile wallet pie in India, according to reports. The California-based firm has applied for a prepaid payment instrument (PPI) in the country. This comes at a time when the payments space in India is abuzz with potential foreign investments, mergers and acquisitions.

Global payments major PayPal wants a slice of the blossoming mobile wallet pie in India, according to reports. The California-based firm has applied for a prepaid payment instrument (PPI) in the country. This comes at a time when the payments space in India is abuzz with potential foreign investments, mergers and acquisitions.

Earlier this month, Amazon received a PPI licence from India’s federal bank that now enables it to operate Amazon Pay services. WhatsApp too is reportedly looking at launching payments here — its biggest market in the world.

The highly competitive mobile wallet market is presently dominated by Paytm which has 200 million users. Other players include Mobikwik, PhonePe, owned by India’s biggest online retailer Flipkart, the newly launched Jio Money that belongs to the country’s richest man, Freecharge which might soon be integrated into Paytm, and wallets operated by telecom carriers, Airtel and Vodafone. Via mashable.com

PayPal Will Open Pay With Venmo to ‘Millions’ of Merchants This Year

From “select users” to “millions of merchants,” Venmo is about to make some serious strides into e-commerce.

From “select users” to “millions of merchants,” Venmo is about to make some serious strides into e-commerce.

PayPal announced yesterday that it will fully roll out the Pay with Venmo feature to PayPal merchants, said CEO Dan Schulman:

PayPal made Venmo available as a payment option on the Braintree platform. Select merchants can already enable Venmo as a payment method, with no additional integration required on their end, Schulman said during the company’s earnings call yesterday. Via bankinnovation.net

Apple, Inc. Wants to Help You Pay Your Friends

Back when Apple (NASDAQ:AAPL) first launched Apple Pay in 2014, it was able to avoid a bit of regulatory oversight since the service could not store money and could not be used to send funds to other people on a peer-to-peer (P2P) basis. Storing funds opens up a whole can of regulatory worms, in part to adhere to anti-money-laundering regulations. At the time, it made sense to leave P2P to other companies while focusing on the relatively harder challenge of pushing adoption of contactless payments among both merchants and consumers, or person-to-business (P2B).

Back when Apple (NASDAQ:AAPL) first launched Apple Pay in 2014, it was able to avoid a bit of regulatory oversight since the service could not store money and could not be used to send funds to other people on a peer-to-peer (P2P) basis. Storing funds opens up a whole can of regulatory worms, in part to adhere to anti-money-laundering regulations. At the time, it made sense to leave P2P to other companies while focusing on the relatively harder challenge of pushing adoption of contactless payments among both merchants and consumers, or person-to-business (P2B).

All the while, P2P has seemed like an opportunity for Apple Pay to expand into. Recode reports that Apple is indeed working on such a service (again).

Try, try again

The company has reportedly been in talks with partners in the payments industry to introduce a P2P service that would compete with PayPal (NASDAQ:PYPL) and its subsidiary Venmo; eBay acquired Venmo parent Braintree for $800 million in 2013, which was included in the subsequent PayPal spinoff in 2015. The new P2P service could be announced as soon as this year, but that timing could change. There had been earlier reports from 2015 that Apple was putting together a P2P service. Via fool.com

Orange is launching a bank because reasons

French telecom company Orange is launching a bank this Summer in France. Orange CEO Stéphane Richard listed some of the features behind Orange Bank this morning at a press conference. And let’s just say that it doesn’t sound as groundbreaking as the company thinks.

French telecom company Orange is launching a bank this Summer in France. Orange CEO Stéphane Richard listed some of the features behind Orange Bank this morning at a press conference. And let’s just say that it doesn’t sound as groundbreaking as the company thinks.

Just like N26, Revolut and others, you’ll be able to control your payment card directly from your phone. Transactions will show up instantly in the app and you’ll be able to block and unblock the card in a couple of taps in case you can’t find it.

You’ll also be able to send money with a text message. So you can expect a peer-to-peer payment service like Lydia, Venmo, etc. Finally, Richard hinted at NFC payments with your phone. Orange already supports NFC payments on Android with Orange Cash, and using Apple Pay on iOS.

You’ll be able to create an account in an Orange store or online. Creating an account is free and you don’t have to be an Orange customer. You won’t pay any monthly fee as long as you regularly use your account and card. Customers will be able to open a checking account with overdraft, a savings account and will get a Visa card. Via techcrunch.com

48 percent of GCC residents prefer to shop online but payment security is still a concern

The Arab Federation for e-Commerce (AFEC) revealed last month that the region’s current share of the e-commerce market only represents one percent of the global market; however, the survey results highlight the increasing opportunity for e-commerce in the region.

The Arab Federation for e-Commerce (AFEC) revealed last month that the region’s current share of the e-commerce market only represents one percent of the global market; however, the survey results highlight the increasing opportunity for e-commerce in the region.

“The existing appetite for online shopping in the Middle East poses a promising opportunity for international and regional investors in the e-commerce sector. The Arab Federation of e-commerce will play a central role in supporting and advising the public and private sectors in the Arab states to ensure continuous growth and further development of e-commerce in the region, as we strive to capture a fair share of the global digital industry,” said HE Dr. Eng. Ali Al Khouri, First Deputy Chairman of the Arab E-commerce Union, and Chairman for the Supreme Committee.

Despite the willingness of Gulf Cooperation Council (GCC) residents to fully embrace e-commerce, 34 percent of survey respondents claimed that a lack of confidence in payment security deters them from shopping online. 29 percent of UAE respondents still feel that offline shopping is more secure, with only 31 percent considering online shopping equally as safe. Via cpifinancial.net

This Dubai Startup Wants to Free Mobile Payments From the Internet’s Tyranny

No matter how much noise that has reached your ears recently, there is no denying that in this part of the world, fintech is still in its infancy.

No matter how much noise that has reached your ears recently, there is no denying that in this part of the world, fintech is still in its infancy.

For any fintech entrepreneur trying to break into this space in the Arab world, they must first and foremost grapple with several unknowns—regulatory, cultural, and institutional.

Even so, the market is there. Take online payments. In 2015, the MENA region saw a visible growth in the online payments industry: The acceptance ratio jumped from 70% in 2014 to 78% the following year. Moussa Beidas and Nadim Jarudi, the duo behind Bridg, a mobile payments app that was two and half years in the making, know that they have such numbers on their side going forward. Via incarabia.com

Payza Opens Online Payment Platform to Chinese Market

Payza, a leading global online payment platform, announced that Payza members in China can now load their Payza e-wallets using popular local options WeChat, UnionPay, and ePayLinks. Chinese Payza members can also perform online transactions in Chinese Yuan Renminbi (CYR).

Payza, a leading global online payment platform, announced that Payza members in China can now load their Payza e-wallets using popular local options WeChat, UnionPay, and ePayLinks. Chinese Payza members can also perform online transactions in Chinese Yuan Renminbi (CYR).

The company has offered basic services in China since 2012, however, this is the first of several targeted initiatives being developed by Payza to support the country’s growing e-commerce landscape. Chinese Yuan Renminbi deposits are processed within 2 business days for a 5% fee. These new deposit options aim to meet the daily e-commerce needs of shoppers in China.

“This is the fourth specialty deposit option Payza has launched this year, following Boleto in Brazil, Oxxo in Mexico, and Paysafecard deposits, which are available in over 40 countries,” explained Firoz Patel, Global Executive VP for Payza. “We are committed to delivering local deposit and withdrawal options specific to our customers’ preferred method by region and these new services in China are an important step in that direction.” Via marketwatch.com

TransferWise moves into Asia-Pacific with opening of regional HQ in Singapore

TransferWise, the billion-dollar valued startup that reduces the cost of cross-border payments, has taken a big step to globalizing its service after it opened an Asia Pacific office in Singapore.

TransferWise, the billion-dollar valued startup that reduces the cost of cross-border payments, has taken a big step to globalizing its service after it opened an Asia Pacific office in Singapore.

The UK-based service was started in 2010 by Estonian entrepreneurs Kristo Kaarmann and Taavet Hinrikus, its CEO, as a method for sending money from country to country more efficiently. It banishes hidden fees — which banks typically disguise with sub-market exchange rates — and offers near-market rates coupled with a transaction fee. Money is sent near-instantly when sender and recipient are both in supported markets, but for others it can take a few working days to process.

The firm has raised $117 million from investors to date, and was last valued at $1.1 billion. It claims that over one million people use its service to send over £1 billion each month. Beyond catering to consumers, TransferWise operates a business service that is focused on SMEs. Via techcrunch.com

Snapay aims at the unbanked with an app which replaces cash

There are two billion unbanked people in the world today. Unfortunately the banking industry isn’t very interested in these people, so they are forced to use cash. But even though 4.5 billion people have cell phones, including many of the unbanked, the distribution of access to cash via a mobile is at 1%, more or less. As you can see, there’s a problem to be solved here. Yes, Square, Apple Pay and iZettle all play in this field, but they require hardware.

There are two billion unbanked people in the world today. Unfortunately the banking industry isn’t very interested in these people, so they are forced to use cash. But even though 4.5 billion people have cell phones, including many of the unbanked, the distribution of access to cash via a mobile is at 1%, more or less. As you can see, there’s a problem to be solved here. Yes, Square, Apple Pay and iZettle all play in this field, but they require hardware.

Snapay is a new startup out of Paris that wants to solve this, but without requiring hardware and squarely aiming at the unbanked. Right now it’s accepting sign-ups for its public release.

The company says it works in 50 countries and six currencies, with an app which poised is to be launched on the Android/Google Play store. Via techcrunch.com

LET’S CONNECT