We’ve got the latest on payments and fintech companies disrupting the industry and making fintech news and noise around the globe. Barclays announced Europe’s largest fintech innovation center, located in London and designed to complement others in New York, Manchester, Mumbai, Cape Town, Vilnius and Tel Aviv. A new PwC report predicts fintech growth in cloud applications, blockchain technology and customer personalization, It also expects a decline in retail payments technology, robo-advisors and payments rails.

London fintech startup Flux hopes to help business people get rid of paper receipts easily. Au Bon Pain will take the pain out of ordering and paying ahead with its new ABP Pickup mobile app. With 140,000 new clients monthly, no-fee stock trading app Robinhood just raised new VC funding of $110 million.

London fintech startup Flux hopes to help business people get rid of paper receipts easily. Au Bon Pain will take the pain out of ordering and paying ahead with its new ABP Pickup mobile app. With 140,000 new clients monthly, no-fee stock trading app Robinhood just raised new VC funding of $110 million.

Currencycloud CMO Todd Latham talks about fintech trends and new companies to watch. Ripple is leading the tidal wave of blockchain payments solutions with 10 new financial institutions joining its global payments network. Goldman Sachs online bank deposits are only $12 billion or 10% of its $124 billion in deposits, but the growth trend is clear.

Currencycloud CMO Todd Latham talks about fintech trends and new companies to watch. Ripple is leading the tidal wave of blockchain payments solutions with 10 new financial institutions joining its global payments network. Goldman Sachs online bank deposits are only $12 billion or 10% of its $124 billion in deposits, but the growth trend is clear.

The ATM Industry Association says anti-cash advocates are peddling “fake news” and hindering the benefits of cash and ATMs to help more than 2 billion people who have no bank account. Ben Robinson, Chief Marketing Officer of Temenos. says a “pretty app” is just a start. New digital banks also need to master new technologies, big data and more personalized engagement with customers.

When you visit a Calgary ATB bank branch, you may end up speaking with a 48-inch robo-advisor named Pepper whose goal is to engage customers. At Chick-fil-A, there’s no question which came first – it’s definitely the chicken. But with more than 2 million users monthly, the mobile order and pay app is running a close second in customer popularity. Credit Suisse is using 20 robots to speed up employee work on regulations and related tasks according to CEO Brian Chin.

When you visit a Calgary ATB bank branch, you may end up speaking with a 48-inch robo-advisor named Pepper whose goal is to engage customers. At Chick-fil-A, there’s no question which came first – it’s definitely the chicken. But with more than 2 million users monthly, the mobile order and pay app is running a close second in customer popularity. Credit Suisse is using 20 robots to speed up employee work on regulations and related tasks according to CEO Brian Chin.

Barclays opens Europe’s largest fintech site

Barclays has opened an innovation centre in London’s hipster capital Shoreditch housing internal banking and technology teams alongside more than 40 fintech startups. The bank says its new site is Europe’s largest co-working space dedicated to fintech and will play host to more than 200 hours of learning, workshops, hackathons and networking on a monthly basis.

Barclays has opened an innovation centre in London’s hipster capital Shoreditch housing internal banking and technology teams alongside more than 40 fintech startups. The bank says its new site is Europe’s largest co-working space dedicated to fintech and will play host to more than 200 hours of learning, workshops, hackathons and networking on a monthly basis.

It is part of the Rise initiative, which has seen Barclays set up centres in New York, Manchester, Mumbai, Cape Town, Vilnius and Tel Aviv to create products, services and platforms along with startup partners. Among the projects at the centres is the Barclays Accelerator, powered by Techstars, which has seen the bank go on to sign contracts with numerous participants in areas such as blockchain, AI and big data. Barclays opens Europe’s largest fintech site

These are the fintech segments most likely to grow in 2017

These numbers indicate which areas of the fintech industry have the most growth potential in 2017, which are reaching maturity as indicated by fewer new startups, and which exhibited steady development between 2015 and 2016.

Three fintech segments saw the largest growth in the overall share of applications. These were cloud and core processing solutions, which grew from 14% in 2015 to 22% in 2016; “smarter, faster machines” (i.e. artificial intelligence (AI), machine learning, and blockchain technology), up from 12% to 16%; and “shifting customer preferences” (i.e. customer segmentation and product personalization solutions), up from 11% to 14%. Application growth in these areas is probably in part the result of evolving technology in such segments, as well as growing consumer willingness to interact with their financial services providers in different ways.

Three segments saw a decline in the overall share of applications. These were “cashless world” (i.e. digital retail payment solutions), which fell from 19% in 2015 to 17% in 2016; “empowered investors” (e.g. robo-advisors), down from 17% to 11%; and emerging payments rails, down from 11% to just 3%. These declines suggest that fintechs already operating in these areas, particularly in payments, have established their positions and are discouraging startups from attempting to challenge them. Via businessinsider.com

Flux, a fintech startup founded by ex-Revolut employees, wants to make paper receipts obsolete

Flux, a London-based fintech startup founded by three early employees of foreign exchange and banking app Revolut, is on a mission to make store receipts truly digital.

Flux, a London-based fintech startup founded by three early employees of foreign exchange and banking app Revolut, is on a mission to make store receipts truly digital.

The company, which is de-cloaking this week with a pilot in East London, has built a software platform that bridges the gap between the itemized receipt data captured by a merchant’s point-of-sale (POS) system and what little information typically shows up on your bank statement or mobile banking app.

“Paper receipts are a pain, they are easy to lose, a hassle to keep hold of and a waste of resources. We think it’s insane that today we can go from using 21st Century technology of contactless payments to 100 BC tech of paper receipts,” explains co-founder and CEO Matty Cusden-Ross, who was previously Revolut employee number two and the company’s CMO. Via techcrunch.com

Au Bon Pain’s New Service Lets Guests Skip the Line

The Au Bon Pain team values their guests’ time and is rolling out the technology to prove it. Putting the ‘fast’ in fast-casual, Au Bon Pain announced the launch of ABP Pickup— a new service for customers to save time and skip the line.

The Au Bon Pain team values their guests’ time and is rolling out the technology to prove it. Putting the ‘fast’ in fast-casual, Au Bon Pain announced the launch of ABP Pickup— a new service for customers to save time and skip the line.

Available via the new Au Bon Pain mobile app and at aubonpain.com, ABP Pickup allows guests to place their order when they have a few free minutes, select a convenient pick-up time at their preferred Au Bon Pain location, pay ahead, and skip the line when they pick up in café. Once registered, customers can save their orders, easily choosing favorites when it is most convenient, making it perfect for skipping the line during the morning coffee rush hour or grabbing lunch on-the-go between meetings. Via qsrmagazine.com

Robinhood stock-trading app confirms $110M raise at $1.3B valuation

Zero-fee stock-trading app Robinhood has joined the unicorn club.

Zero-fee stock-trading app Robinhood has joined the unicorn club.

That’s thanks to it reaching 2 million total users, and 17%month-over-month growth of its revenue-driving Robinhood Gold subscription product. The startup confirmed to TechCrunch that it’s raised a $110 million Series C at a $1.3 billion valuation led by DST Global, with participation by existing investors NEA, Index Ventures and Ribbit Capital, plus new investors Thrive and Greenoaks.

Today’s announcement confirms TechCrunch’s scoop from last month that Robinhood was raising at $1.3 billion from DST. The 80-person, 4-year-old startup has now pulled in $176 million in total funding.it’s Via techcrunch.com

Fintech developments that are changing the payments landscape

What recent fintech solutions have caught Currencycloud’s attention in terms of market disruption potential?

What recent fintech solutions have caught Currencycloud’s attention in terms of market disruption potential?

There are obviously a lot of interesting fintech propositions out there, and we continue to be really optimistic about the growth of fintech in general. But the nature of fintech is changing. A lot has been made of the first wave of fintech firms, which generally focused on consumer experience, providing an app layer over an existing solution. The real innovation is at the model level, changing the infrastructure of financial services. So firms selling big data solutions, analytics or compliance services are the ones to watch. These sorts of companies are on the face of it less sexy but satisfy a real long-term demand and are incredibly sticky.

How exactly do new fintech solutions help B2B e-commerce in the context of growing cross-border e-commerce transactions? What opportunities are there to explore?

What we see is that there is a wide range of companies driving innovation in the fintech space, and what unites them is that they are all trying to do something different. The issue is that, when trying to build new solutions, the existing traditional finance infrastructure is often too big, too slow, too inflexible, and simply does not understand what the innovators are trying to do. Compliance departments will arbitrarily label an activity as ‘high risk’, when what they really mean is ‘we do not understand the risk’. IT connections are laborious and poorly documented. Workflows we by suppliers’ internal requirements, and do not fit the customer’s model. Via thepaypers.com

Blockchain Boom Begins: Ripple Locks In 10 More Financial Institutions

Blockchain payments provider Ripple announced today that 10 more financial institutions would be joining their global payments network. With a range of different sizes of banks and payment service providers joining what is known to be the only proven blockchain solution for payments, this could be the start of a blockchain boom as more and more companies start to experiment with the technology.

Blockchain payments provider Ripple announced today that 10 more financial institutions would be joining their global payments network. With a range of different sizes of banks and payment service providers joining what is known to be the only proven blockchain solution for payments, this could be the start of a blockchain boom as more and more companies start to experiment with the technology.

MUFG, BBVA, SEB, Akbank, Axis Bank, YES BANK, SBI Remit, Cambridge Global Payments, Star One Credit Union and eZforex.com have turned to Ripple’s blockchain solution to help with speed, scalability and costs that usually come with older payments systems. Via forbes.com

Goldman hopes high rates will lure consumers to online bank| Reuters

By acquiring GE’s deposits, Goldman began a process that may help it better weather future disasters. Deposits are less likely to disappear during times of stress than other funding sources because they are federally insured. Regulators have been pushing big Wall Street banks to rely more on deposits since the 2008 financial crisis.

Goldman’s online deposits from individuals now total $12 billion. Although they have grown quickly, they are still a small fraction of the $124 billion in overall deposits on Goldman’s balance sheet and an even tinier fraction of deposits at banks with sprawling branch networks. JPMorgan Chase & Co (JPM.N), for instance, holds $1.4 trillion in deposits.

Goldman has offered a competitive interest rate of 1.05 percent for digital savings accounts to attract new customers. The average national rate for savings accounts is currently 0.06 percent, according to the U.S. Federal Deposit Insurance Corporation. The bank offers even higher rates for depositors who agree to lock their money up for a set time, through products like certificates of deposit. Via Reuters

Being a ‘Digital Bank’ Goes Beyond a Pretty App

The impact of digital technologies on customer satisfaction became apparent in the most recent JD Power Customer Satisfaction survey, where the largest and most digitally focused banks scored highest in online, mobile and ATM satisfaction. These digital ratings allowed the six largest banks (Bank of America, Citigroup, JPMorgan Chase, PNC Financial, U.S. Bancorp and Wells Fargo) to take the lead in overall customer satisfaction for the first time.

The impact of digital technologies on customer satisfaction became apparent in the most recent JD Power Customer Satisfaction survey, where the largest and most digitally focused banks scored highest in online, mobile and ATM satisfaction. These digital ratings allowed the six largest banks (Bank of America, Citigroup, JPMorgan Chase, PNC Financial, U.S. Bancorp and Wells Fargo) to take the lead in overall customer satisfaction for the first time.

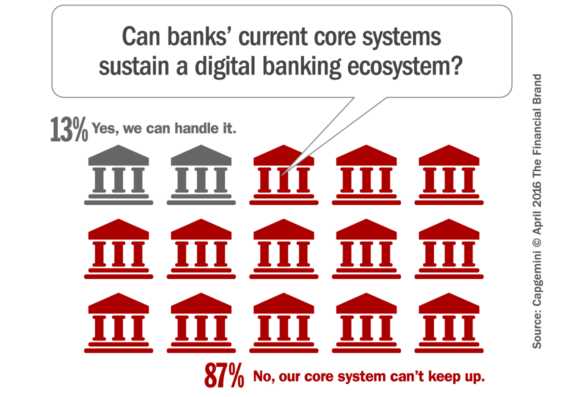

But becoming a ‘digital bank’ goes well beyond just what meets the customer’s eyes and fingers. To deliver the experience expected, a banking organization must leverage big data, new technologies, advanced analytics, a 360-degree view of the customer and personalized engagement. “It isn’t enough for banks to woo customers with nice-looking apps concealing patched-together systems. For innovation to translate into customer satisfaction, banks need to master the bare necessities,” says Ben Robinson, Chief Marketing Officer of Temenos. Via thefinancialbrand.com

ATB Financial introduces robot branch workers

The march of the robots continues, as Canada’s ATB Financial hires dancing humanoids to work in some of its Calgary branches. ATB becomes the latest bank to test Pepper, the 48-inch humanoid developed by Japanese group Softbank.

The march of the robots continues, as Canada’s ATB Financial hires dancing humanoids to work in some of its Calgary branches. ATB becomes the latest bank to test Pepper, the 48-inch humanoid developed by Japanese group Softbank.

Customers at two branches will be able to interact with Pepper through speech and a touchscreen tablet, getting info on products and services. In addition, the robot will grill customers on their financial literacy through a quiz, take selfies and dance.

Dave Mowat, CEO, ATB, says: “Pepper is cutting-edge technology. We’re excited for her to say hello to our customers and tell them about ATB — or just dance together for a bit.” Via finextra.com

Giving Customers Control, And Faster Food

According to recent industry research, consumers increasingly want and expect companies to offer transactions and experiences that are customized to their liking. Seventy-four percent of customers reported feeling frustrated when a website does not allow them to control or customize transactions, and more than three-quarters of consumers have chosen or paid more for a brand that offers personalized experiences that consumers can control.

According to recent industry research, consumers increasingly want and expect companies to offer transactions and experiences that are customized to their liking. Seventy-four percent of customers reported feeling frustrated when a website does not allow them to control or customize transactions, and more than three-quarters of consumers have chosen or paid more for a brand that offers personalized experiences that consumers can control.

Increasingly, merchants are turning to mobile apps to reach and connect with consumers and offer personalized or controllable experiences. Fast-casual restaurants and other dining destinations especially are turning to mobile technology in order to give consumers more control over how they order and pay for their food.

In a recent interview, Kramer Johnson, head of Digital Experience for chicken chain Chick-fil-A, told PYMNTS that his team built its own mobile order-ahead app designed to do just that. The app, which debuted in 2016 and is used by more than 2 million users per month, aims to give customers more control over their dining experience. The app allows diners to customize or change almost any part of their meal or experience to their liking — from ordering specific sandwiches to choosing where and when their food will be prepared and picked up. Via pymnts.com

Credit Suisse has deployed 20 robots within bank, markets CEO says

Credit Suisse AG (CSGN.S) has deployed 20 robots within the bank, some of which are helping employees answer basic compliance questions, the Swiss bank’s global markets chief executive, Brian Chin, said on Monday.

Chin, speaking at the Milken Institute Global Conference in Beverly Hills, California, said the technology may help reduce the number of calls coming into the bank’s compliance call center by as much as 50 percent.

The technology works like Amazon.com Inc’s (AMZN.O) Alexa voice system. While Chin called them robots, it was not clear if they had a physical presence or how exactly employees interacted with them. Via reuters.com

Need news you can use?

If you’re looking for the latest payments industry and fintech news, you’ll find it here at PaymentsNEXT. Get free newsbriefs in your inbox every Mon-Wed-Fri morning by subscribing at the top of this page. Join us Friday for the latest in mobile payments trends.

LET’S CONNECT