There’s so much going on in the payments world, it’s time for a roundup of quick news bytes and links to news you can use if you’re in the payments industry.

Accelerating winds of change in global payments – McKinsey

The COVID-19 public- health crisis and its many repercussions—among them, government measures to protect citizens and rapid changes in consumer behavior—changed the operating environment for businesses, large and small, around the world. For the payments sector, global revenues declined by an estimated 22% in the first six months of the year compared with the same period in 2019. We expect revenues to recover (only to a degree) in the second half of 2020, ending 7% lower than full-year 2019. More…

PayPal adds QR Codes to a Visa-branded Venmo card issued by Synchrony with an NFC chip

The no-annual-fee card, issued by Stamford, Conn.-based Synchrony Financial, is not only the first issued on behalf of Venmo but may well be unique in featuring QR code capability in addition to NFC, according to experts reached by Digital Transactions News. The card arrives at a time when consumers are turning to contactless technology in stores to avoid possible Covid-19 infection. At the same time, mobile-wallet companies like PayPal are actively investigating QR codes to allow users to make fast contactless payments with or without cards. More…

Nacha adopts new rules to modernize ACH payments

Nacha has approved eight new amendments to the Nacha Operating Rules governing the use of ACH payments. Many of the changes reflect a long-term strategy to modernize the ACH system, both through infrastructure improvements such as Same Day ACH; and making ACH payments easier to use for the country’s consumers, businesses, and other organizations. More…

Forter forecasts increased online fraud for holiday season

E-commerce fraud prevention leader Forter released its ninth Fraud Attack Index, providing in-depth insight into the impact of COVID-19 on online buyer behavior and e-commerce fraud trends. Key among its findings were a five times growth in new online account openings accompanied by an increase in false declines, and a rise in omnichannel fraud including a 55% jump in buy online pickup in-store (BOPIS) fraud. More…

Europe’s card fraud value hits €1.55 billion ($1.83B), the UK accounts for 45%

The U.K losses stand at Є706.9 million with France accounting for the second-highest losses at Є440.9 million. Germany is ranked third at Є91.5 million while Spain closely follows with losses totaling to Є90.6 million. Italy is fifth with Є67.1 million in card fraud losses. From the data, Romania has the least losses at Є2.9 million. The Buy Shares research pointed out the role of payment institutions in curbing card fraud. According to the research report: More…

Google delays India payment rules as Paytm offers alternative

Google is delaying planned changes to its in-app payment rules in India by six months, backing down after some of the country’s largest developers and startups threatened to band against the U.S. search giant. Alphabet Inc.’s Google said in a blog post on Monday it will give developers until March 2022 to integrate with its Google Play billing services, compared with an earlier deadline of September 2021 announced last week. More…

Levi’s® Stadium transitioning to cashless venue to enhance fan experience upon eventual return of 49ers fans

San Francisco 49ers announced Monday that Levi’s® Stadium will be among the first wave of NFL venues to complete the transition to a cashless payment model whenever fans are able to return to the venue. The 49ers, while also announcing a multi-year partnership extension with its long-time official payments partner Visa, are making the move to only accept card or mobile payments for concessions, merchandise, and other purchases to improve the fan experience through increased speed of service, safety, and security. More…

Cyberattackers turn to payments fraud, ransomware as tech firms fight back

As businesses fall victim to cyberattacks, new data is rolling out to show the prevalence of these incidents — and the scope of efforts by tech firms to help keep businesses safe. In this week’s B2B Data Digest, PYMNTS examines some of these numbers, finding that businesses are falling victim to payments fraud, but that tech firms are taking actions to mitigate cyber risks. More…

Cybersecurity: Emerging challenges and solutions for the boards of financial-services companies

Cybersecurity has become a top concern for the boards of financial services firms, and the level of concern seems to be growing day by day. With organizations seeking to create new digital customer experiences, applying sophisticated data analytics, and investing in a wealth of other technology innovations, cyber risk management clearly requires governance at the highest levels. The advent of the COVID-19 crisis makes this challenge even more urgent. More…

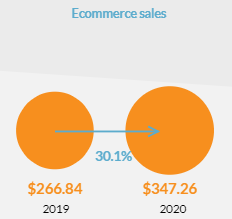

Charts: How the coronavirus is changing e-commerce

In the first six months of the year, consumers spent $347.26 billion online with U.S. retailers, up 30.1% from $266.84 billion for the same period in 2019, according to the latest Digital Commerce 360 analysis of U.S. Department of Commerce data. Comparatively, e-commerce sales during the first half of 2019 grew just 12.7% year over year. Online spending represented 18.6% of total retail sales for the first two quarters of 2020. More…

Who’s winning in Q3 pandemic e-commerce?

After a big spike in global e-commerce growth through the pandemic which sectors are consistently winning and which are softening as we near the end of Q3 and the start of the holiday shopping season? A new report from Nosto analyzes six key e-commerce sectors and shows which industry verticals are ahead as e-commerce sales and traffic level off at the end of Q3 2020 compared with the start of the pandemic. More…

Amazon’s COVID-19 windfall

For retailers who sell to both Amazon and brick-and-mortar retail, Amazon’s algorithms are relentless. If your product is popular for homebound COVID consumers, Amazon will let you know to increase inventory in its warehouses. And if you don’t stock shelves, Amazon will demote you in its search, moving a popular out-of-stock product deep into the search rankings. More…

UK startup Knoma launches its lifelong learning payment solution with £21 million+ in funding

Knoma, a London, UK-based startup that helps lifelong learners finance their tech courses by spreading the cost via loans, has launched after raising more than £21 million in debt and equity funding from Global Founders Capital, Rocket Internet, Fasanara Capital, and Seedrs, along with angel investors such as LendInvest chairman Christian Faes. The startup says it offers users access to up to £10,000 (at zero fees, and zero interest) in mere minutes, paid directly to the schools offering the courses, and those loans can then be repaid by the student over 12 months. More…

LET’S CONNECT