Fintech credit card startup Petal recently launched its second no-annual-fee credit card for those with no credit history or a blemished credit record.

Petal hopes to make it easier for younger, new credit card applicants and those with damaged credit records to get approval for its new credit card. The card offers credit from $500 to $5000 for consumers with fair, poor, or no credit card history.

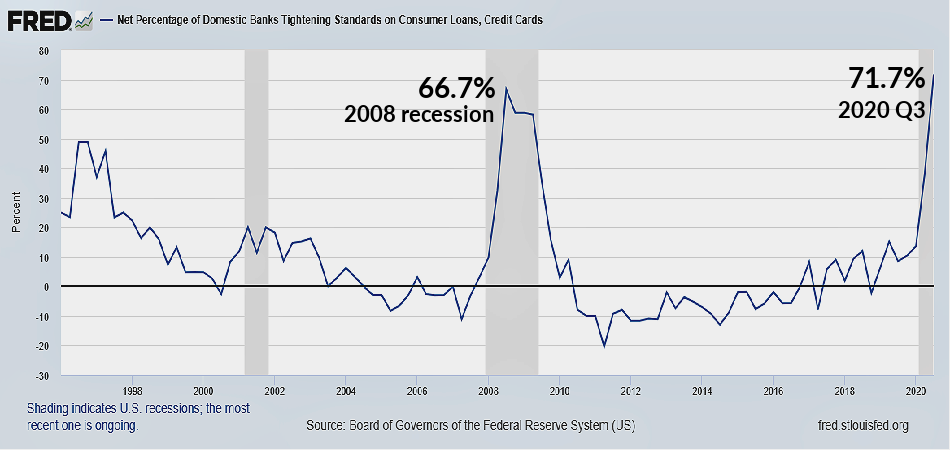

“According to the CFPB, half of all Americans have non-prime credit scores,” said Jason Gross, CEO and co-founder of Petal. “Given the current economic situation of high unemployment and millions of people going through financial stress, non-prime will become the new normal. Currently, these Americans are being underserved as mainstream banks pull back, much like they did in the 2008 recession.”

Simple application uses AI to build “Cash Score” rating

Unlike secured cards that require a deposit to serve as usable credit, the Petal 1 “No Annual Fee” Visa® Credit Card, requires no deposit, has no annual fee, no foreign transaction fees, provides from 2% to 10% cashback from selected merchants, and offers APRs ranging from 19.99% to 29.49%. The card does church $29 for the first late payment and $40 for the second.

The company uses data analysis and artificial intelligence to establish an alternative measure of creditworthiness based on income, savings, and spending history. This “Cash Score” is not dependent on FICO scores for approval and allows more people to be approved with better rates, even if they’ve never had credit.

The original Petal credit card, now called Petal2, launched in 2018 providing credit and other credit card benefits including cashback to first-time applicants, millennials, and those with no credit history.

“About 70% of the folks on our original [Petal 2] card had no credit history prior to joining us. In just three months of using the card they’ve achieved an average score of 673,” Gross told American Banker.

Once approved, the Petal mobile app helps members automate payments, track their credit scores, manage subscriptions, and stay on top of their spending.

COVID-19 causing banks to tighten lending

“Traditional credit scores have become less reliable in the COVID economy, forcing mainstream banks to significantly scale back access to credit at a time when many people need it most. Cash flow scoring allows Petal to continue making credit available even in these volatile economic conditions,” Gross says.

According to the Federal Reserve Bank of St. Louis, 71.7% of domestic banks tightened their lending standards on credit cards in the third quarter of 2020, more than five percentage points higher than at the height of the 2008 recession in Q3 when it hit 66.7%. This is creating a severe credit crunch for many US consumers.

The company said an estimated 45 million US residents have invisible or unscorable credit ratings, with as many as 62 million with “thin-file” records in the US. With total fees charged by US financial products estimated at more than $175 billion annually, the potential for the blemished credit market is substantial.

Petal1 hopes to widen the credit card application success even further, to those with poor credit history using this new AI developed credit score. The new credit card is provided by Visa, and is issued in partnership with WebBank and the short-term future for the new credit card product looks unblemished.

In nine funding rounds from 36 companies, Crunchbase reports New York-headquartered Petal has raised over $435 million in debt and equity from VCs including Valar Ventures (backed by Peter Thiel), Great Oaks Venture Capital, RiverPark Ventures, and Silicon Valley Bank. Led by Valar Ventures, its latest equity round in September 2020 raised $55 million from additional investors including Rosecliff Ventures, Afore Capital, RiverPark Ventures, Great Oaks Venture Capital, GR Capital, Nelstone Ventures, Abstract Ventures, Ride Ventures, The Gramercy Fund, Adventure Collective, Starta Ventures, and NFL star Kelvin Beachum.

You can learn more about Petal and its credit services here.