Today, we’re covering the latest news in mobile payments and P2P payments from the US and UK to Singapore and China. A new Boston Retail Partners report shows ApplePay is the most popular US mobile payment platform with 36% of merchants accepting it, 34% PayPal, 25% MasterCard Pay Pass and 18% Samsung Pay.

TXN analysis showed Whole Foods and Duane Reade processed the biggest number of ApplePay retailer payments. In China, mobile payments reached $1.45 trillion in 2015 compared to just $8.71 billion in the US. It’s not yet clear who will dominate mobile payments globally but Alipay and WeChat Pay already handle 88% of all payments in China and each is planning growth in international markets.

TXN analysis showed Whole Foods and Duane Reade processed the biggest number of ApplePay retailer payments. In China, mobile payments reached $1.45 trillion in 2015 compared to just $8.71 billion in the US. It’s not yet clear who will dominate mobile payments globally but Alipay and WeChat Pay already handle 88% of all payments in China and each is planning growth in international markets.

With the large number of payment provider competitors, merchants find choosing a payments partner is a challenge according to Tracy Metzger, COO, Vesta Corporation. Amazon Payments handled 33 million transactions in 2016, up from 23 million the year before.

PayPal’s new payment bot for Slack will allow peer-to-peer payments of up to $10,000, according to Venture Beat. SingX allows money transfers between Singapore, India and other markets at a 0.5% fee compared to traditional rates up to 8%. HSBC launched its P2P PayMe app in Hong Kong.

PayPal’s new payment bot for Slack will allow peer-to-peer payments of up to $10,000, according to Venture Beat. SingX allows money transfers between Singapore, India and other markets at a 0.5% fee compared to traditional rates up to 8%. HSBC launched its P2P PayMe app in Hong Kong.

In India, Walnut partnered with TechProcess Payment Services to allow app users to transfer money instantly across banks and cards to anyone in the country. This allowed the company to capitalize on demonetization. Chase Pay added global restaurateur HMSHost and Parkmobile to its payment network.

Apple Pay is the Most Popular US Mobile Payment Platform

If you’re making a digital payment, chances are you’re doing so by way of Apple Pay. Despite a highly competitive landscape, it looks as though the iEmpire reigns supreme when it comes to adoption in the U.S. According to new research from Boston Retail Partners (BRP), Apple Pay boasts the largest percentage of supporting U.S. merchants. As of today, 36 percent of sellers accept the mobile payment service, an increase of 20 points from last year.

If you’re making a digital payment, chances are you’re doing so by way of Apple Pay. Despite a highly competitive landscape, it looks as though the iEmpire reigns supreme when it comes to adoption in the U.S. According to new research from Boston Retail Partners (BRP), Apple Pay boasts the largest percentage of supporting U.S. merchants. As of today, 36 percent of sellers accept the mobile payment service, an increase of 20 points from last year.

This proportion is expected to grow, as 22 percent of retailers say they have plans to accept Apple Pay within the next year, while another 11 percent will aim to do so within the next one to three years.

Also popular is PayPal, which enjoys a 34-percent acceptance rate in the U.S. Coming in a surprising third-place finish (given how little we tend to hear about it), is Mastercard PayPass, which is accepted by a quarter of merchants. Android Pay certainly has its work cut out in terms of catching up to Apple Pay, with 24-percent acceptance, where the slightly newer Samsung Pay has 18-percent acceptance. Via digitaltrends.com

iPhone owners use Apple Pay most at Whole Foods, Duane Reade

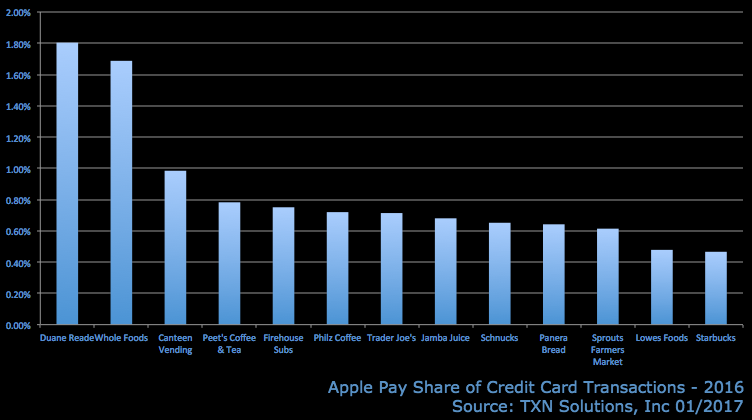

New analysis suggests that drugstore Duane Reade and grocer Whole Foods have been the most successful brick-and-mortar stores at getting customers to embrace Apple Pay — a technology that allows Apple users to pay with their phone or watch.

New analysis suggests that drugstore Duane Reade and grocer Whole Foods have been the most successful brick-and-mortar stores at getting customers to embrace Apple Pay — a technology that allows Apple users to pay with their phone or watch.

But the usage rates even at the best brick-and-mortar retailers lag behind services with popular mobile apps, according to data analysis from TXN, a consumer spending analytics app.

They found that the total number of monthly Apple Pay transactions grew by 50% year-over-year in their sample, although it still “accounts for a small percent of all credit card transactions,” according to the analysis. Via businessinsider.com

How Chinese mobile payments are quietly conquering the world

While mobile payments have been off to a slow start in most of the Western world—even the rollout of EMV chip payments in the United States is far behind schedule—China has become the melting pot for mobile payment solutions. The mobile payment space has become fiercely competitive, with both market leader Alibaba and messaging giant WeChat scrambling for valuable market share. However, what was once a strictly domestic affair has expanded abroad, with China’s mobile payment providers now battling for Chinese tourists’ mobile payments on the global stage.

While mobile payments have been off to a slow start in most of the Western world—even the rollout of EMV chip payments in the United States is far behind schedule—China has become the melting pot for mobile payment solutions. The mobile payment space has become fiercely competitive, with both market leader Alibaba and messaging giant WeChat scrambling for valuable market share. However, what was once a strictly domestic affair has expanded abroad, with China’s mobile payment providers now battling for Chinese tourists’ mobile payments on the global stage.

According to iResearch Global, the transaction volume of Chinese mobile payments reached 10 trillion Chinese yuan (US$1.45 trillion) in 2015 and is projected to reach 22 trillion yuan (US$3.20 trillion) in 2017. In comparison, the equivalent figure for the United States stood at a meager US$8.71 billion in 2015—in spite of efforts made by Apple and Samsung to promote mobile payment features in new smartphone devices. As a testament to the central stage mobile payments has taken in Chinese consumers lives, Ogilvy & Mather and Ipsos concluded in a survey of China’s mobile payment market that “[Chinese] mobile payment has permeated all aspects of life and changed basic, everyday habits.” Via technode.com

How emerging payments impact merchant acquirers

With the landscape of payments acceptance constantly changing and new disruptive technologies entering the market, a merchant acquirer must be constantly looking at how to adopt these solutions. Merchant acquirers must assess the impacts of implementation to their platforms and the consequences of passing on an emerging technology.

With the landscape of payments acceptance constantly changing and new disruptive technologies entering the market, a merchant acquirer must be constantly looking at how to adopt these solutions. Merchant acquirers must assess the impacts of implementation to their platforms and the consequences of passing on an emerging technology.

Even though some emerging payment technologies are not widely accepted or even broadly adopted by consumers, the acceptance of these technologies can create opportunities for merchant acquirers to differentiate themselves in a highly competitive and relatively commoditized industry. Every acquirer accepts the major issuing brands and debit cards, but not all acquirers accept these new technologies.

It stands to reason that offering more emerging payment technologies can help acquirers attract and board additional merchants. These days, many merchants seek to offer Apple Pay, Level Up or more mainstream alternative payment elements like PayPal. Despite their lower acceptance levels, the consumer demand is still there. Via mobilepaymentstoday.com

The Fintech Files: What Company Will Dominate Mobile Payments?

Mobile payments may not be the hottest area in fintech, but the largest fintech company by far is a payment company.

Mobile payments may not be the hottest area in fintech, but the largest fintech company by far is a payment company.

Of all the new fintech uses, mobile payment is arguably the one in which traditional financial institutions have lost the most share. For example, Alipay and WeChat Pay already have millions of users although they have only been in the space a short time. Together, they processed 88% of all mobile payment transactions in China in 2015.

PayPal and its peers have radically changed these dynamics. Alibaba and Tencent, the tech giants behind Alipay and WeChat Pay, respectively, have gone even further and started their own banks. The threat to traditional banking institutions is more real than ever. Via seekingalpha.com

Amazon Payments makes gains but still lags behind rivals

Time and time again, PayPal (PYPL) has rebuffed fears that the company will be badly stung by an upstart online payments player. Though its shares — and back when it was a part of eBay (EBAY) , eBay’s shares — have dipped several times on news that a tech giant is trying to muscle in on its turf, the company has kept delivering 20%-plus payment volume growth like clockwork.

Time and time again, PayPal (PYPL) has rebuffed fears that the company will be badly stung by an upstart online payments player. Though its shares — and back when it was a part of eBay (EBAY) , eBay’s shares — have dipped several times on news that a tech giant is trying to muscle in on its turf, the company has kept delivering 20%-plus payment volume growth like clockwork.

But while any talk of a would-be “PayPal-killer” merits skepticism, the company does arguably face a tougher competitive environment than any time in recent history. This has a lot to do with the expansion of platforms that — for one reason or another — already have the payment card data of hundreds of millions of consumers.

Amazon.com (AMZN) provided fresh evidence of this threat on Tuesday when it announced Amazon Payments, which lets consumers pay on third-party sites and apps process via their Amazon account info, has now been used by over 33 million people. That’s up from over 23 million as of last April, at which time Amazon opened up Payments to e-commerce software/services platforms such as Shopify (SHOP) and Future Shop. Via cnet.com

Amazon and Apple’s Payments Growth Shows PayPal Is Facing Stiffer Competition

Time and time again, PayPal (PYPL) has rebuffed fears that the company will be badly stung by an upstart online payments player. Though its shares — and back when it was a part of eBay (EBAY) , eBay’s shares — have dipped several times on news that a tech giant is trying to muscle in on its turf, the company has kept delivering 20%-plus payment volume growth like clockwork.

Time and time again, PayPal (PYPL) has rebuffed fears that the company will be badly stung by an upstart online payments player. Though its shares — and back when it was a part of eBay (EBAY) , eBay’s shares — have dipped several times on news that a tech giant is trying to muscle in on its turf, the company has kept delivering 20%-plus payment volume growth like clockwork.

But while any talk of a would-be “PayPal-killer” merits skepticism, the company does arguably face a tougher competitive environment than any time in recent history. This has a lot to do with the expansion of platforms that — for one reason or another — already have the payment card data of hundreds of millions of consumers.

Amazon.com (AMZN) provided fresh evidence of this threat on Tuesday when it announced Amazon Payments, which lets consumers pay on third-party sites and apps process via their Amazon account info, has now been used by over 33 million people. That’s up from over 23 million as of last April, at which time Amazon opened up Payments to e-commerce software/services platforms such as Shopify (SHOP) and Future Shop. Via realmoney.thestreet.com

PayPal adds P2P bot for Slack

A new bot, PayPal’s first, will allow peer-to-peer payments of up to $10,000, according to Venture Beat. The move follows French app Lydia’s launch of a similar bot on the rapidly growing collaboration tool last year.

PayPal is trying to capitalize on rising interest for digital peer-to-peer (P2P) payments. As cash and checks become less popular and younger users gain spending power, mobile and digital P2P volume is on the rise. BI Intelligence estimates that US mobile P2P volume will grow to $336 billion in 2021 from $19 billion in 2015. Via businessinsider.com

SingX aims to be ‘Airbnb of global payments’

Money transfers between Singapore and India can now be done at a fraction of the cost that customers typically pay for overseas money transfers. Local fintech start-up SingX has launched an online remittance platform that charges consumers a transaction fee of 0.5 per cent of the amount to be transferred, compared with up to 8 per cent levied elsewhere.

Money transfers between Singapore and India can now be done at a fraction of the cost that customers typically pay for overseas money transfers. Local fintech start-up SingX has launched an online remittance platform that charges consumers a transaction fee of 0.5 per cent of the amount to be transferred, compared with up to 8 per cent levied elsewhere.

Those pricey charges are often not fully transparent to customers, and include cable fees, bank commissions and markups on exchange rates, said SingX, whose remittance service is licensed under its sister company, Transfer Easy, by the Monetary Authority of Singapore.

For example, a transfer of $1,000 from a bank account in Singapore to a bank account in India could cost $76 to convert the money to 47,500 rupees, based on Wednesday’s data from Reuters. But that transfer would incur just $5 in transaction charges using SingX’s platform. Via straitstimes.com

Fund transfers made easy as HSBC rolls out P2P app

HSBC has launched a person-to-person payment app, enabling users to transfer funds to any bank account from today.

HSBC has launched a person-to-person payment app, enabling users to transfer funds to any bank account from today.

By setting up an account at the bank’s PayMe app, users can add value to the wallet by linking it with a credit card, Visa or Mastercard, from any bank.

Registration requires a user’s e-mail address, credit card information and mobile phone number. People who wish to link credit cards issued by banks other than HSBC and Hang Seng Bank need to submit their electronic ID copy as well. After injecting money into the account credit card, app users can input the fund amount together with a message to the recipient. Via thestandard.com.hk

Walnut partners with TechProcess for P2P payments

Personal finance management app, Walnut has partnered with TechProcess Payment Services to allow app users to transfer money across banks and cards.

Personal finance management app, Walnut has partnered with TechProcess Payment Services to allow app users to transfer money across banks and cards.

This partnership will initially allow Walnut users to send money instantly to anyone in the country, initially using their debit cards, and subsequently, bank accounts. This will be done using TechProcess’s Paynimo payment platform.

Amit Bhor, CEO, Walnut, said “Post demonetization, number of digital payment transactions has risen up sharply in India. We’re seeing a huge rise in the use of our bill split feature and P2P transactions on Walnut. However, as far as peer-to-peer payments are concerned, we have seen that people still prefer to receive money in their bank accounts rather than wallets. Our partnership with TechProcess allows users to send money from any bank account-to-any card and vice-versa completely free.” Via economictimes.indiatimes.com

Chase Pay adds two new partners to expand acceptance

Chase customers will soon be able to use Chase Pay while on the go with two new merchants: global restaurateur HMSHost and Parkmobile. HMSHost is a food and beverage provider for travel venues; Parkmobile enables users to pay for parking in cities around the country through a mobile app, according to a press release about the announcement.

Chase customers will soon be able to use Chase Pay while on the go with two new merchants: global restaurateur HMSHost and Parkmobile. HMSHost is a food and beverage provider for travel venues; Parkmobile enables users to pay for parking in cities around the country through a mobile app, according to a press release about the announcement.

HMSHost will accept Chase Pay at all U.S. locations; implementation in the majority of these will be completed in 2017, according to the announcement. The company operates nearly 2,000 restaurant locations in more than 80 North American airports and 99 motorway service centers, and partners with more than 300 traveler-preferred brands such as California Pizza Kitchen, Lorena Garcia Tapas y Cocina, and Starbucks.

Parkmobile customers will soon be able to use Chase Pay for on-demand and prepaid parking on the street, at garages, airports and events across the United States. The company did not provide a time frame for implementation. Via mobilepaymentstoday.com

LET’S CONNECT