Out of this world! That pretty much sums up this week’s global payments news, and it’s only Friday. Branson and Bezos may be trying to be the first to circle the globe, but we’re here first with the news you need to know, so buckle up and launch yourself into the latest worldwide payment news.

Robinhood files to go public after squeaking to profitability in 2020

This afternoon Robinhood, the popular investing app for consumers, filed to go public. The company intends to list on the NASDAQ under the symbol “HOOD.” The company is pursuing a public listing after a period of rapid growth. Robinhood saw its revenues soar from $277.5 million in 2019 to $985.8 million in 2020. The company’s first-quarter numbers are even more impressive. During the first three months of 2021, Robinhood generated revenues of $522.2 million, up around four times from its Q1 2020 result of $127.6 million. Read more…

JPMorgan is buying an ESG investing platform in bank’s third fintech acquisition of the past year

JPMorgan Chase has agreed to buy OpenInvest, a San Francisco-based start-up. As a result, clients can use OpenInvest to create highly personalized, dynamic, values-based portfolios. It’s the third acquisition of a fintech start-up by JPMorgan since December when the bank bought 55ip, a company that automates the construction of tax-efficient portfolios and K-based robo-advisor Nutmeg to help boost its overseas digital banking growth. Read more…

Research: What consumers say about bill payments? Fail

A new bill payment study shows US consumers struggling with cumbersome bill pay processes and wanting faster, easier bill payments more in line with their one-click online shopping experiences. “Payment innovation in the e-commerce space has upped the ante for bill pay. Today’s e-commerce experiences are fast, easy, and frictionless. For example, with technologies like facial recognition, consumers never have to login or remember a password to make a payment,” said Anne Hay, head of PayNearMe’s consumer research initiative. “Consumers expect a similar experience for all their payments, including bill payments.” Read more…

JP Morgan Chase acquires 40% stake in Brazil’s digital challenger C6 Bank

JP Morgan Chase announced it will take a 40% ownership stake in the full-service Brazilian digital bank C6 Bank. The US banking giant says the firms have entered a strategic agreement to help accelerate C6’s growth across the region. Launched in 2019, C6 Bank currently boasts more than seven million customers on its digital platform. Read more…

PayPal Zettle US launch brings ‘Commerce in Box’ to SMBs

PayPal is pushing announced the launch of PayPal Zettle for small businesses in the US, a digital POS solution designed to help small businesses manage sales, inventory, reporting, and payments across all channels and in one place. In addition, the new POS offering will also be a full letter from BC rehab merchants to accept QR codes, debit cards, credit cards, and popular digital wallets. Read more…

Automating invoices becomes a hot payments play

When the COVID-19 pandemic shifted work to employees’ homes, businesses realized they needed a different solution for their check-cutting operations. However, a seemingly sleepy corner of the payments sphere woke up with a jolt when the COVID-19 pandemic struck. When the deadly coronavirus shut down businesses, many companies realized their paper-laden processes, including invoicing and manual check-writing, weren’t a good fit for a shift to employees’ homes. Read more…

Cash flow constrictions cramping small business growth

The majority of small businesses in six countries (60%) experience cash flow issues at some point, so it’s no surprise 89% of small business owners say cash flow issues negatively impact their business. Moreover, it’s among the top three issues for 76% of small business owners, according to research from QuickBooks. So if there’s any doubt about the effect of cash flow constrictions, look at the top five consequences. Read more…

Danske Bank A/S to merge MobilePay with Norwegian Vipps and Finnish Pivo

Danske Bank A/S has agreed with OP Financial Group in Finland and the consortium of banks behind Vipps in Norway to merge the three mobile payment providers MobilePay, Vipps, and Pivo. The goal is to create Europe’s best and most comprehensive digital wallet. Serving 11 million users and over 330,000 shops and webshops, the company will be one of the largest bank-owned mobile payment providers in Europe. Read more…

Western Union collaborates with leading French fintech Linxo to launch digital money transfers

Western Union has collaborated with Linxo, a leading budget management and bank account aggregation application in France, to enable users to make local and cross-border payments through Western Union’s platform. As a result, Linxo’s customers can now fund their transfers through their bank account or card and have their funds paid out into billions of bank accounts and millions of mobile wallets in approximately 125 countries. Read more…

EU watchdog takes deep dive into banks’ use of tech

Banks’ increasing dependence on ‘RegTech’ technology to automate fraud checks and send data to regulators may need standard rules to encourage wider use, the European Union’s banking watchdog said on Tuesday. Part of a broader trend of digitalizing finance, RegTech is used by banks to comply with anti-money laundering checks on customers, monitor transactions for fraud, send data to regulators about levels of capital, and assess if customers can afford a loan. Read more…

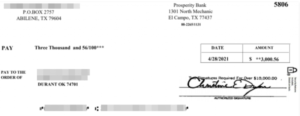

We infiltrated a counterfeit check ring! Now what?

Imagine waking up each morning knowing the identities of thousands of people who are about to be mugged for thousands of dollars each. You know exactly when and where each of those muggings will take place, and you’ve shared this information in advance with the authorities each day for a year with no outward indication that they are doing anything about it. How frustrated would you be? Such is the curse of the fraud fighter known online by the handles “Brianna Ware” and “B. Ware” for short. Read more…

We asked people at an ATM: Why are you getting cash out?

Drugs? A haircut? Coffee? In an increasingly cashless society, the answers are not what you think. Not scientific sample-sized survey or research, but boy, what an interesting read from Vice. When the writer could find UK consumers withdrawing cash and willing to talk and even have a picture taken, the answers were all over the map. But the takeaway was clear – contactless is here to stay. Read more…

That should be plenty of out-of-this-world payments news to keep you going through the weekend. So, if you’re celebrating Independence Day in the US or a long weekend holiday for any other reason, enjoy it with family and friends. As for the Spaceballs contest between Bezos and Branson, we don’t really care whose spaceship is bigger. Nevertheless, we wonder if those billions couldn’t be spent to benefit more people? We do admire the dreams and wish you a safe flight.

Spaceballs (1987) photo courtesy of Metro-Goldwyn-Mayer Studios

LET’S CONNECT