By Jeff Domansky

A new bill payment study shows US consumers struggling with cumbersome bill pay processes and wanting faster, easier bill payments more in line with their one-click online shopping experiences.

“Payment innovation in the e-commerce space has upped the ante for bill pay. Today’s e-commerce experiences are fast, easy, and frictionless. For example, with technologies like facial recognition, consumers never have to login or remember a password to make a payment,” said Anne Hay, head of PayNearMe’s consumer research initiative. “Consumers expect a similar experience for all their payments, including bill payments.”

This sets a high bar for billers, and many are not up to the task.

Say what?

Think about the last couple of bills you received. Which got paid first? The clear, simple, transparent ones, or those filled with way too much information, bafflegab, misplaced marketing, and no clear calls to action?

The PayNearMe research provided a few chuckles for our editorial team initially. For example:

- Nearly 1 in 3 adults (29%) say paying bills causes them stress and anxiety. Remembering login information is the top reason (52%).

- One-quarter of consumers (25%) feel disorganized when trying to manage and pay their bills.

- 51% paid at least one bill late during the past 12 months; 2 in 5 consumers (37%) say they just forgot or procrastinated.

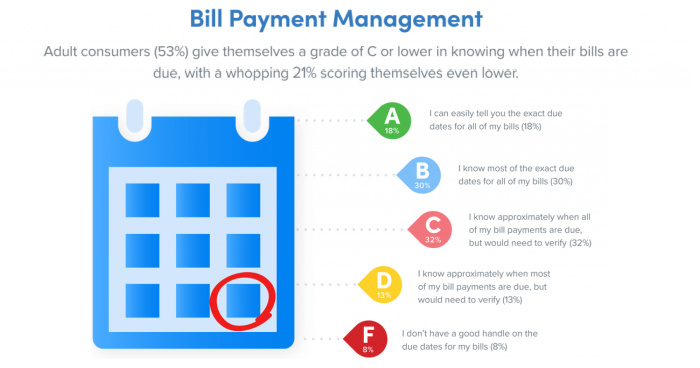

- More than 1 in 5 adults (21%) grade themselves either a poor “D” or failing grade “F” when it comes to remembering bill due dates.

I think consumers give themselves way more credit (pun intended) than they deserve. How do 99% of people not feel stress about bill payments and remembering passwords and logins?

Only 25% feel disorganized? Have you looked at the desk in your home office lately? The number 99% disorganized comes to mind. I think respondents are pulling your legs, researchers, but that’s the challenge of surveys, whether it’s politics or payments.

And that 21% payment memory date? Not even close, in my humble opinion.

Valuable payments insights

All kidding aside, PayNearMe does the industry a giant service with their research. Let’s highlight several of the essential insights worth a deep dive:

- Late payment reasons include: forgot or procrastinated (37%), lost or overlooked in the mail (34%), lost in email (26%), too many different due dates (24%), too complicated (19%), lack of money (23%), and job loss (7%).

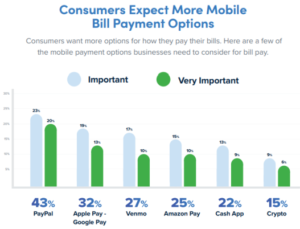

- 38% of consumers say if they had the option, they would likely or very likely use Apple Pay or Google Pay to pay bills; 27% of consumers point to Venmo as a preferred option to pay their bills.

- 30% say it would be easier to pay bills on time if they had mobile payment options, such as PayPal or Apple Pay.

Just looking at the mobile payment options preferred is valuable. Consumers want more options they ranked as “important” and “very important,” including PayPal (43%), Apple Pay/Google Pay (32%), Venmo (27%), Amazon Pay (25%), cash apps (22%), and cryptocurrency (15%).

What’s clear is billers, payments processors, and fintechs have many miles to go to catch up with consumers on their payments journey when it comes to UX, CX, and consumer satisfaction.

“One might think the main stressor in bill payment is not having enough money in the bank, but lack of funds is not the issue for the large majority of consumers (70%),” Hay observed. “A poor bill pay experience is the main culprit, with nearly half of consumers (44%) saying they wish managing and paying bills was easier.”

Ample technology & solutions available

Remember, the goals of billers and businesses are increasing efficiency, managing cashflow, profitability, and business growth. With some exceptions, that’s not where many companies are today with efficiency and cashflow, let alone profitability in challenging times.

It’s not that we don’t have the tools or technology. Many lack the tenacity to adopt proactive solutions before changing bad payment practices and habits. Here are three solutions that jump out from the research:

- Help consumers be better organized: provide simple, helpful tracking and reminder tools; deliver better data and more useful information.

- Provide payments flexibility and more payment options: add more payment channels such as mobile, payment apps, and make it easy to use several; increase payment choices by adding Apple and Google Pay, PayPal, QR codes, and other popular options.

- Deliver a better payment user experience: create better web and mobile design and simpler navigation; don’t overwhelm.

“The bar has been raised for bill pay. Consumers now expect a bill payment experience that is as convenient and frictionless as making an Amazon purchase or paying a friend with Venmo,” Hay said. “There is a great opportunity and urgency for businesses to step up and improve the payment experience for their customers with modern bill payment options.”

Consumers may be late with their payments for many reasons and, yes, there’s a cost to make these improvements to payment practices. The even higher price is not taking action.

Researchers surveyed 2,676 US consumers online in April 2021. PayNearMe’s How Consumers Pay Bills: Expectations vs. Reality study is available for free download here.

Other PaymentsNEXT related stories:

Navigating payments automation, COVID impact, and finding success

Beanworks acquisition highlights payments automation growth

WEX adds new cross-border & payments automation partnerships

LET’S CONNECT