Greenwood founders (l to r): rapper Michael “Killer Mike” Render, Ambassador Andrew Young, Bounce TV founder Ryan Glover

By Jeff Domansky, Jan 21, 2021

It’s only fitting that Atlanta-based digital bank Greenwood is building financial services for the Black and Latinx community, given its ownership and the historical name chosen to pay homage to the “Greenwood District” of Tulsa, Oklahoma, often called the “Black Wall Street” which flourished between 1906 and 1920.

“It’s no secret that traditional banks have failed the Black and Latinx community,” said Greenwood Bank Chairman and co-founder Ryan Glover. “We needed to create a new financial platform that understands our history and our needs going forward, a banking platform built by us and for us, a platform that helps us build a stronger future for our communities. This is our time to take back control of our lives and our financial future. That is why we launched Greenwood, modern banking for the culture.”

Digital bank Greenwood launched Oct 8, 2020, aiming to bring digital banking to the black community, and it attracted more than 100,000 sign-ups on its waiting list within its first five days.

Digital services, no fees

Like many neobanks, Greenwood features best-in-class online banking services, but also, it’s planning innovative ways of giving back to Black and Latinx causes and businesses.

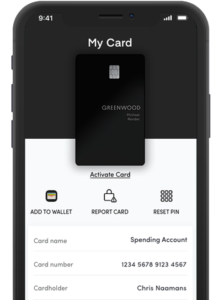

Among its initial online banking features are online savings and spending accounts, virtual debit cards, peer-to-peer transfers, mobile check deposits, two-day early pay availability, and free ATM use at more than 30,000 locations with no hidden fees. Greenwood will also provide Apple, Samsung, and Android pay services.

New account holders receive a black metal debit card, and customers also get cash awards for referring new bank customers. Greenwood deposits will initially be FDIC-insured by several partner banks.

“Greenwood was founded with the idea of recirculating dollars back into the Black community,” said Greenwood’s President and Chief Technology Officer, Aparicio Giddins. He said the bank intends to serve the underbanked who often depend on cash or check cashing and payday loan lenders.

Greenwood will give back benefits to the community by providing five free meals to families in need for every new account sign-up. Debit card transactions will prompt a donation to UNCF for education, Goodr to feed the hungry, or NAACP to support civil rights. It will provide a $10,000 grant to a Black or Latinx small business owner who is a Greenwood customer every month.

Black celebrity, influential founders

Greenwood raised $3 million in seed capital from private investors, including actor Jesse Williams. Its founders include Andrew Young, civil rights legend, former US Ambassador to the United Nations, and former Mayor of Atlanta; Michael Render, aka “Killer Mike,” rapper and activist in Black financial empowerment; and Ryan Glover, Greenwood Chairman and founder of Bounce TV network.

“The work that we did in the civil rights movement wasn’t just about being able to sit at the counter. It was also about being able to own the restaurant,” said Ambassador Andrew Young. “We have the skills, talent, and energy to compete anywhere in the world, but to grow the economy, it has to be based on the spirit of the universe and not the greed of the universe. Killer Mike, Ryan, and I are launching Greenwood to continue this work of empowering black and brown people to have economic opportunity.”

President & Chief Technology Officer Aparicio Giddins has more than 20 years of banking industry experience, including Bank of America and TD Bank. CMO David Tapscott previously worked at Green Dot and Combs Enterprises, and board member, Dr Paul Judge is co-founder of Pindrop and TechSquare Labs.

You can learn more at the Greenwood bank website.

Visuals courtesy Greenwood digital bank

LET’S CONNECT