Today, we’ve got a news roundup of the latest fintech developments and the challenges of challenger banks. As the Office of the Comptroller of the Currency (OCC) continues its review of special-purpose bank charters, there’s still a question whether US consumers will embrace challenger banks the way they have in the UK. The biggest barriers will be consumer trust not to mention the high cost of acquiring new customers and meeting stringent regulations.

Today, we’ve got a news roundup of the latest fintech developments and the challenges of challenger banks. As the Office of the Comptroller of the Currency (OCC) continues its review of special-purpose bank charters, there’s still a question whether US consumers will embrace challenger banks the way they have in the UK. The biggest barriers will be consumer trust not to mention the high cost of acquiring new customers and meeting stringent regulations.

In the UK, regulators like competition from challenger banks but secretly say they would like to see stronger bigger challengers to the established big banks. Meanwhile, the challengers are reluctant to merge for fear of acquiring significant bad debt or high-risk loan portfolios.

ClearBank will be more than just a new challenger bank. It will become a new clearing bank for UK banking transactions similar to the role played by Barclays, HSBC, Lloyds and Royal Bank of Scotland. With a selfie and a voice print, Fintech startup BABB (Bank Account Based Blockchain) says it will allow “everyone to be a bank.” It will offer basic banking, payments and peer-to-peer payment functions though ironically it will not use Bitcoin currency.

UK biz publication Simply Business reviewed its four top choices for best challenger banks including Tide, Aldermore Bank, Metro Bank, and Monzo. GTReview looked at Starling Bank’s customer service and product features built from scratch for the soon-to-launch digital bank. TechCrunch reports UK customers can sign up to Starling Bank with an app photo of a driver’s license or passport in order to open a current account and receive a MasterCard debit card usablein the UK and abroad.

UK biz publication Simply Business reviewed its four top choices for best challenger banks including Tide, Aldermore Bank, Metro Bank, and Monzo. GTReview looked at Starling Bank’s customer service and product features built from scratch for the soon-to-launch digital bank. TechCrunch reports UK customers can sign up to Starling Bank with an app photo of a driver’s license or passport in order to open a current account and receive a MasterCard debit card usablein the UK and abroad.

Fintech app Revolut will offer fast peer-to-peer loans up to £5,000 ($6,176) in as little as two minutes in a partnership with P2P platform LendingWorks. Startup Current raised $3.6 million to developed its new financial services to transform the financial industry.

Special bank charters could shake up the US fintech

The Office of the Comptroller of the Currency (OCC), which is part of the US Department of Treasury, is currently considering the creation of special-purpose bank charters designed specifically for financial technology firms.

The Office of the Comptroller of the Currency (OCC), which is part of the US Department of Treasury, is currently considering the creation of special-purpose bank charters designed specifically for financial technology firms.

These charters would allow fintechs to collect deposits, issue debit cards and offer loans across all 50 states without needing to get state-by-state approval, which can be a lengthy and expensive process. And it would give them a level of regulatory legitimacy that could help them win over those consumers who are still wary of doing business with financial services startups with limited track records.

But special charters would likely come at a significant cost. Not only is it likely that they’ll come with hefty fees to acquire, they will also probably subject their holders to the same kinds of regulations banks currently face. As the San Francisco Chronicle explained, this would “[mean] they must meet capital and liquidity requirements as well as offer credit to people with low-incomes and/or minorities.” Via econsultancy.com

Why ‘challenger banks’ haven’t taken off in the U.S.

Digital banks, big in the U.K., have a trust problem in the States.

Digital banks, big in the U.K., have a trust problem in the States.

“Challenger banks,” as they’re called across the pond, include the likes of Monzo, Starling, Tandem and Atom — completely digital banks built on new technology as opposed to the outdated infrastructure of legacy banks. They usually tout better interest rates, lower fees, if any, and better service. They have an easier time creating a good customer experience because they don’t build on the rusty rails of the existing financial system, making the way they operate more efficient and the user experience more enjoyable.

That model hasn’t really caught on in the U.S., though, where startups are mostly building technology-based solutions for payments, investing and lending – anything that doesn’t require opening a bank account with an unknown entity. Building that type of business profitably is hard: the cost of customer acquisition is high and complying with complex financial regulations can be a big undertaking. Via digiday.com

Challenger banks are too wary to merge, writes Jim Armitage

It’s de rigueur to predict a wave of consolidation among the challenger banks. These tiddly specialist lenders seem to be growing in number by the day with new launches bearing whizzy names; Atom, Abacus, Babb. But so far, the merger talk has been just that; talk. More’s the pity. The Government rightly wants to increase the competition against the giants. RBS, Lloyds, Barclays and HSBC have a bigger market share now than before the financial crisis.

It’s de rigueur to predict a wave of consolidation among the challenger banks. These tiddly specialist lenders seem to be growing in number by the day with new launches bearing whizzy names; Atom, Abacus, Babb. But so far, the merger talk has been just that; talk. More’s the pity. The Government rightly wants to increase the competition against the giants. RBS, Lloyds, Barclays and HSBC have a bigger market share now than before the financial crisis.

But a plethora of tiny lenders does little to tame the competitive power of the big beasts. As City regulators privately say, it would be better to have fewer, bigger challengers to snap at their heels.

One of the blocks to mergers has been that challenger bank chief executives are wary of merging with other newbies’ books of business for fear of inheriting riskier loans than they’d feel comfortable with. That’s little wonder when you see these new banks growing their lending at breakneck pace. Via standard.co.uk

Not just another challenger bank, this is ClearBank

UK new entrant, ClearBank, launches today, built on a combination of Microsoft public and private cloud infrastructure and headed up by Founder and former CEO of Worldpay, Nick Ogden (pictured). At an event in London this morning, he will unveil how the company plans to bring a new level of open competition and change to the UK FS marketplace. Simon Kirby MP, Economic Secretary to the Treasury, and Hannah Nixon of the Payment Systems Regulator will both be speaking, with over 150 industry insiders and business partners present. IBS Intelligence will be at the event, so look out for a comprehensive review in the next issue of IBS Journal.

UK new entrant, ClearBank, launches today, built on a combination of Microsoft public and private cloud infrastructure and headed up by Founder and former CEO of Worldpay, Nick Ogden (pictured). At an event in London this morning, he will unveil how the company plans to bring a new level of open competition and change to the UK FS marketplace. Simon Kirby MP, Economic Secretary to the Treasury, and Hannah Nixon of the Payment Systems Regulator will both be speaking, with over 150 industry insiders and business partners present. IBS Intelligence will be at the event, so look out for a comprehensive review in the next issue of IBS Journal.

ClearBank is being pitched as not just another challenger bank. Rather it is gearing up to become the UK’s fifth clearing bank (lining up along Barclays, HSBC, Lloyds and Royal Bank of Scotland). It will open its doors during the autumn to FS providers, FCA-regulated businesses and FinTechs that require access to UK payment systems and core banking technology to support current account capabilities.

“There are thousands of new FinTech startups and challenger banks improving choice, but the industry will never truly move forward while it’s constrained by the challenges of legacy operational structures,” says Ogden.

“ClearBank was built specifically to create competition and aims to change the market dynamics radically. Figures from the Cruickshank Report indicate that, with the improved efficiency delivered by ClearBank’s built-for-purpose technology, between £2 billion and £3 billion could be saved from the annual costs that are paid for transactional banking in the UK. This represents a substantial boost to the UK economy delivering better operational processes without any impact on the way that commerce is operated in the country. We are delighted to share the result of more than three years of regulatory, operational and technology efforts, bringing true competition and a new level of transparency to UK banking. That is the ClearBank difference.” Via ibsintelligence.com

BABB Is Building a Mobile Bank on Blockchain Tech

The U.K.-based fintech startup BABB, which stands for Bank Account Based Blockchain, is developing a mobile banking app using blockchain technology that will allow “everyone to be a bank.”

The U.K.-based fintech startup BABB, which stands for Bank Account Based Blockchain, is developing a mobile banking app using blockchain technology that will allow “everyone to be a bank.”

BABB’s banking platform is being built on top of the Ethereum blockchain to make use of smart contracts technology as well as machine learning, artificial intelligence and biometrics to create a new customer-centric banking experience. It does not, however, have plans to incorporate digital currencies themselves into the platform just yet.will

On March 13, BABB announced that it signed a deal with banking and payments solutions provider Contis Group Ltd. to use Contis’s white-label banking license and banking services infrastructure for its upcoming mobile banking app.

The banking app is scheduled to launch later this year with basic banking, payments and peer-to-peer payment functions. Users will be able to fund their BABB account using PayPal, bank transfers, credit and debit cards, and peer-to-peer payments from other “Babbians,” among other cash in/out channels. The customer on boarding process requires taking a selfie and submitting a voice print to open an account. Via nasdaq.com

The best challenger banks for small businesses

The days of the legacy banks are over – at least that’s what so-called ‘challenger banks’ are claiming. There are a number of them vying for customers’ favour, so it can be hard to know which, if any, to pick.

The days of the legacy banks are over – at least that’s what so-called ‘challenger banks’ are claiming. There are a number of them vying for customers’ favour, so it can be hard to know which, if any, to pick.

In the past, these exciting startups were designed specifically for consumers. But there is an increasing number of challenger banks offering business banking services, and some of them are hoping to revolutionize the world of small business finance. Here, we’ve rounded up some of the best. Via simplybusiness.co.uk

Challenger banks: friend or foe?

“Hi! Can we help you with anything?” A small purple chat box pops up in the left corner of the screen as I enter the website of Starling Bank.

“Hi! Can we help you with anything?” A small purple chat box pops up in the left corner of the screen as I enter the website of Starling Bank.

Albana of customer service is on the other end. She is quick to answer my numerous questions about why I should choose the digital-only bank – part of the newest wave of the so-called ‘challenger banks’ – which is soon to launch “banking in-sync with you” for mobile lovers.

“We’re building a full-stack bank from scratch,” she writes. “Nothing is being used from an already existing platform, which means that we can design our processes as we want, and we want them to match the needs of our customers.” Via gtreview.com

Starling Bank, a digital-only UK challenger bank, launches beta

Starling Bank, one of a number of digital-only or so-called “challenger” banks in the U.K., is launching a beta of the app that powers its current account, the first time it has been available beyond a very small group of private testers close to the company. Those already on the beta waiting list will begin being invited into the app as of today.

Starling Bank, one of a number of digital-only or so-called “challenger” banks in the U.K., is launching a beta of the app that powers its current account, the first time it has been available beyond a very small group of private testers close to the company. Those already on the beta waiting list will begin being invited into the app as of today.

Initially available for iOS, with an Android beta to follow at the end of the month, the Starling Bank app lets you sign up to a full current account, thanks to the restricted banking license it was issued in July. Upon approval of your account, which involves things like photographing your passport or driving license via the app, you are issued a Starling Bank MasterCard debit card that can be used in the U.K. and abroad.

You also are able to set up regular payments (i.e. Direct Debits using an account number and sort code), and make one-off payments in and out of the account, including via the Faster Payments network. Via techcrunch.com

Fintech app Revolut launches peer-to-peer loans, property ISA, plans more products

Hot fintech app Revolut is launching superfast peer-to-peer loans that will let users borrow up to £5,000 in as little as two minutes.

Hot fintech app Revolut is launching superfast peer-to-peer loans that will let users borrow up to £5,000 in as little as two minutes.

Revolut is partnering with peer-to-peer platform Lending Works to let its UK users borrow between £500 and £5,000 through the app at a representative APR rate of 9.9%.

Revolut, which began as simply a foreign exchange app, says users will be able to get funds in as little as two minutes, thanks to its integration with credit check providers and the fact that users will have already passed through legally required “Know Your Customer” checks when they signed up for the card. Customers applying for a loan only have to specify the amount they want to borrow, their monthly income, and their residential status. Via businessinsider.com

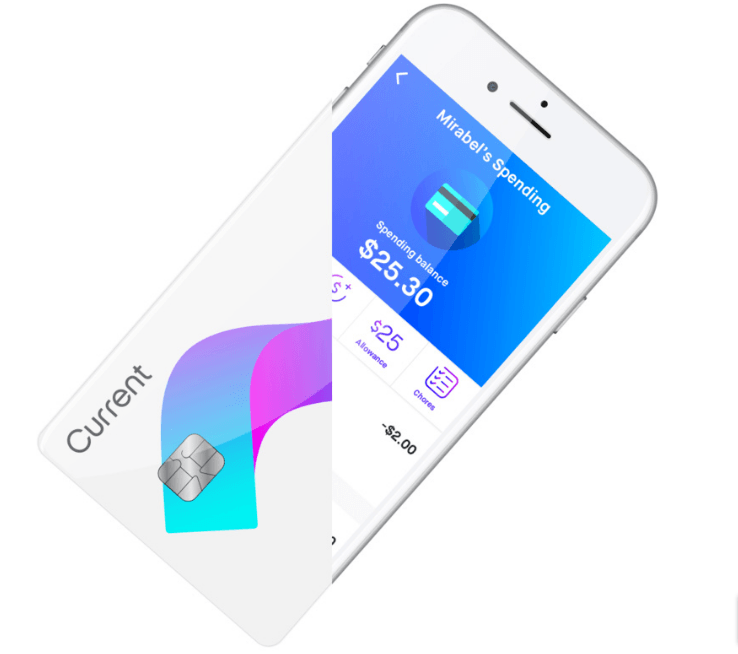

Fintech Startup Current Announces $3.6 mil Raise With Eye on Injecting “C’s” Into Payments and Banking Space

The buzz around ‘fintech” continues to grow louder and louder, ranging from innovating the financial services space to the legitimacy of crypto currencies to a fight over tech talent to the impact of President Trump’s travel ban on the space. Fintech is the new black (when it’s got it’s own hashtag, you know it’s real) and the pool of players continues to grow deeper.

The buzz around ‘fintech” continues to grow louder and louder, ranging from innovating the financial services space to the legitimacy of crypto currencies to a fight over tech talent to the impact of President Trump’s travel ban on the space. Fintech is the new black (when it’s got it’s own hashtag, you know it’s real) and the pool of players continues to grow deeper.

Today Current, founded by former Wall Street trader Stuart Sopp in an effort to propel himself from a “stagnating banking industry,” announced a seed round venture capital raise of some $3.6 million backed by Expa (co-founded by Uber’s Garrett Camp and Foursquare’s Naveen Selvadurai among others), Human Ventures and Future Perfect Ventures and other investors.

What is Current and why should you care? Initially the company launched as a payment platform allowing Slack users the ability to pay their co-workers without leaving the messaging app — familiar indeed. But in a heartfelt post on Medium announcing the raise, Sopp elaborated on a new trajectory mapped out over the past two years. It focuses on words not often seen in banking outside of speeches to Rotary clubs by bank executives. Words like community, collaboration, and yes, perhaps even transforming a stagnating financial services industry. Via huffingtonpost.com

Enjoyed the Challenger Bank challenges?

If you enjoyed this post about Challenger Banks, subscribe at the top of the page to get regular Monday – Wednesday – Friday news briefs in your inbox for free. Enjoy your weekend and we’ll be back Monday with more PaymentsNEXT news.

LET’S CONNECT