If chatbots had a sense of humor, they’d ask us what all the fuss is about when it comes to chatbots, robo-advisors and other artificial intelligence disruptors in the payments and banking industries. The punchline is there is lots to be fussed about and we’ve got a fintech news roundup to keep you informed on the latest developments.

If chatbots had a sense of humor, they’d ask us what all the fuss is about when it comes to chatbots, robo-advisors and other artificial intelligence disruptors in the payments and banking industries. The punchline is there is lots to be fussed about and we’ve got a fintech news roundup to keep you informed on the latest developments.

BI Intelligence reports on the key drivers for chatbots in banking including automation, efficiency, a competitive advantage and ultimately savings. Pymnts.com’s March Digital Banking Tracker™ highlights where banks are investing in and investigating new technologies. Capital One’s new chatbot text message “Eno” helps customers with basic banking tasks and offers up the occasional emojis and “well dones”.

TD Ameritrade’s robo-advisor provides investment knowledge though only 3% of customers have managed more than 76% of their investments using robo-advisors. Would robo-advisors succeed in a recession? asks The Street. Analysts are split but many say using all available tools  only makes sense. Spanish mobile-only bank ImaginBank recently launched a Facebook–Messenger chatbot for its 90,000 bank customers. Competitor BBVA Bank is also testing a chatbot.

only makes sense. Spanish mobile-only bank ImaginBank recently launched a Facebook–Messenger chatbot for its 90,000 bank customers. Competitor BBVA Bank is also testing a chatbot.

Next Insurance CEO Guy Goldstein says 70% of its California customers are using mobile to buy insurance and so a chatbot is a natural step forward in customer service. HDFC Bank, Oxigen Wallet, Intex Smartphones and Ticketgoose are early adopters of Niki.ai’s chatbot service in India.

Servion Global Solutions says banks must adopt new technologies or risk losing customers and competitive advantage in the future. Nitin Vyakaranam, founder and CEO of Arrthayanatra spoke at Fintegrate 2017 about how chatbots, robo-advisors and AI tools will change how banks handle money.

Merrill Lynch debuts new mobile features

Maria Terekhova, research analyst for BI Intelligence, Business Insider’s premium research service, has compiled a detailed report on chatbots in banking that looks at the drivers behind the proliferation of chatbots among incumbent banks, current chatbot use cases and their growing variety, and the strategic, consumer, and technological risks still attached to chatbots.

Here are some of the key takeaways:

– Incumbent banks today are facing increasing pressure to remain competitive. The pressure is coming mostly from tech-savvy entrants that lure in consumers with user-friendly, cheaper products.

– To remain competitive, these legacy players must innovate digitally, and chatbots let them do so on a budget. Either a third-party provider can build a chatbot for them to roll out on a popular messaging app, or they can develop a chatbot in-house.

– Chatbots still have risks attached to them, but they are outweighed by their benefits. If technological, strategic, and consumer risks aren’t properly navigated, a chatbot can damage a bank’s valuable reputation. However, a well-executed chatbot can deliver huge savings.

– A successful chatbot has to be able to perform a task more efficiently than can be done manually. As such, banks should develop chatbots that effectively automate basic and time-consuming tasks. This will free up human staffers’ time for more complex inquiries, thus improving customer relations and loyalty. Via finance.yahoo.com

Digital Banking: Iris Scan Authentication

As banking becomes more digital, more financial institutions are turning to technological solutions to bring more customers on board.

As banking becomes more digital, more financial institutions are turning to technological solutions to bring more customers on board.

Several banks are rolling out banking solutions that are specifically focused on winning over millennial customers as they come of age and join the marketplace as adults. Some millennial-focused banking solutions include financial tools to help users manage their money and meet their financial goals. Other companies are offering game-oriented money management solutions that allow users to create challenges aimed at making smarter financial decisions and boosting their savings.

The March Digital Banking Tracker™ highlights the ways several banks are investing in technology and innovation to bring consumers more efficient banking solutions. Via pymnts.com

‘Toes in the water’: Banks play around with chatbots

Bank phone trees are dreadful experiences, so many banks are turning to chatbots in the hope to spruce up the experience.

Bank phone trees are dreadful experiences, so many banks are turning to chatbots in the hope to spruce up the experience.

Take Capital One’s chatbot text message “Eno” (“One” backwards), which allows customers to text to get balance, transaction history and pay bills. Customers can even communicate with emojis – a “thumbs up” means to confirm and a “money bag” will prompt Eno to list a customer’s account balance.

Capital One’s approach to Eno may offer some clues why traditionally risk-averse banks are just taking baby steps. Capital One is only rolling out the product as a pilot for the time being, and the bank is careful to manage future expectations.

Developers say that while chatbots offer opportunities to improve customer service, banks should be concerned about early missteps. “When Facebook opened up its messenger platform, people could create bots and run them on Facebook messenger. That created a lot of opportunity for people to create some very bad chatbots,” said Eran Livneh, vp of marketing at Personetics, a software company that develops chatbots and other cognitive applications for major banks. Via digiday.com

Robo Advisors: The Future of Finance

TD Ameritrade Investment Management, for example, recently introduced Essential Portfolios, which, through a series of questions to understand personal investing goals and risk tolerance, enables users to receive a recommendation for a specific managed portfolio that can fit their financial needs for a low-cost, all within about 15 minutes. The portfolio is monitored and automatically re-balanced by TD Ameritrade Investment Management, and the investor has on-the-go access through any device to monitor their portfolio and adjust their financial goals in the app as life presents them with changes.

TD Ameritrade Investment Management, for example, recently introduced Essential Portfolios, which, through a series of questions to understand personal investing goals and risk tolerance, enables users to receive a recommendation for a specific managed portfolio that can fit their financial needs for a low-cost, all within about 15 minutes. The portfolio is monitored and automatically re-balanced by TD Ameritrade Investment Management, and the investor has on-the-go access through any device to monitor their portfolio and adjust their financial goals in the app as life presents them with changes.

While the idea of using an automated program to manage their investment portfolio may seem esoteric for certain investors, for countless others it can be an ideal option for a number of reasons. Typically, robo advisors require a smaller initial investment and have lower fees than a professional financial advisor. It’s important that investors keep in mind, however, that not everything is manageable through such programs, so for those with more complex wealth management needs, having a trusted financial advisor or tax professional is still a path worth considering.

According to TD Ameritrade’s Investor Pulse Survey*, only 3 percent of respondents reported investing 76 percent or more of their assets via robo advisor or another automated online investment service platform. This means that the vast majority of investors are still using more traditional investment methods either entirely or in conjunction with robo advisors. As investors grow, so too do their needs and companies are evolving to meet those ever-changing demands. Via tickertape.tdameritrade.com

How Will Robo-Advisors Do in a Recession?

While a bear market seems light years away based on how the markets are performing, history tells us one eventually will occur. Now modern technology has added a twist. With the popularity of robo-advisors for investing, the new question is how effective such tools will be when there’s a downturn in the market and their human users want to let emotion into investing?

While a bear market seems light years away based on how the markets are performing, history tells us one eventually will occur. Now modern technology has added a twist. With the popularity of robo-advisors for investing, the new question is how effective such tools will be when there’s a downturn in the market and their human users want to let emotion into investing?

“During market highs and lows is when an individual’s philosophies and established strategies are challenged,” said Lou Cannataro, senior partner and wealth advisor at Cannataro Park Avenue Financial. “This is where the robo-advisor alone cannot help, remind, clarify and demonstrate how to make the correct decisions and stay on track with your long-term planning. One cannot input their personal goals, greatest fears, greatest obstacles and individual circumstances into an algorithm that handles all aspects of their life and planning.”

However, some see a different side to it. Yuen Yung, chief executive at Casoro Capital, said robo-advisors could actually be extremely helpful during recessions or down times. Via thestreet.com

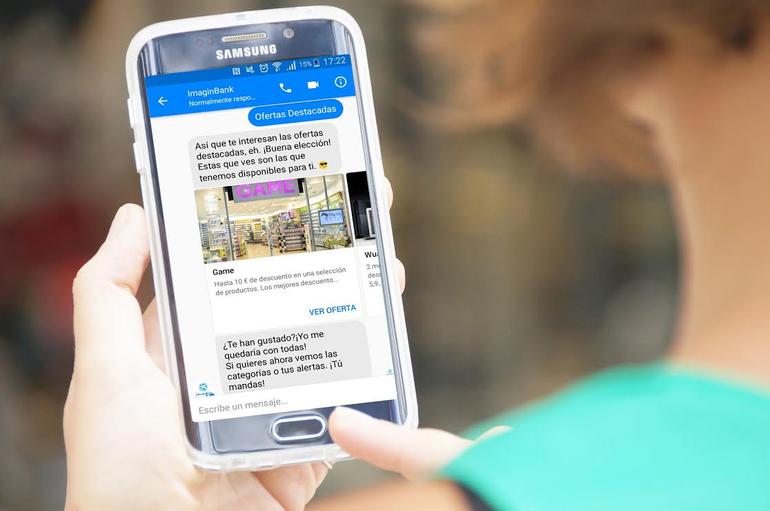

Facebook Messenger chatbots: Mobile-only bank’s new app talks discounts and deals

It’s a wave of technology that has attracted interest from the Spanish financial sector. ImaginBank recently launched a Facebook Messenger-based banking chatbot, which it describes as the first in Spain. According to American Banker, Spanish bank BBVA is also experimenting with the technology.

It’s a wave of technology that has attracted interest from the Spanish financial sector. ImaginBank recently launched a Facebook Messenger-based banking chatbot, which it describes as the first in Spain. According to American Banker, Spanish bank BBVA is also experimenting with the technology.

ImaginBank is Spanish CaixaBank’s mobile-only bank, created in January 2016 and serving about 90,000 customers. According to director David Urbano, the company’s target market of millennials registers particularly high levels of smartphone use.

“Twenty percent of Spaniards use the Facebook messaging platform,” he adds. In fact, the social network has become a “full service platform” for the mobile-only bank, as it gathers more than 65,000 followers who can check their account through the MyImaginBank page and regularly use other applications, he adds. Via zdnet.com

Next Insurance launches chatbot on Facebook Messenger

California-based Next Insurance has unveiled its new insurance chatbot that will enable personal trainers to quote and buy insurance via Facebook Messenger.

California-based Next Insurance has unveiled its new insurance chatbot that will enable personal trainers to quote and buy insurance via Facebook Messenger.

Next partnered with SmallTalk, a chatbot developer, to become the “first company to provide full service insurance via a social channel”. It also says it has developed a direct link with small business owners.

Guy Goldstein, co-founder and CEO of Next, states that 70% of its customers are buying insurance on their phones and so the chatbot “brings simplicity, transparency and easy access”. Via bankingtech.com

How This Indian AI Startup Helps Brands to Get on the Chatbot Bandwagon for Conversational Commerce

The march of chatbots and personal assistants into conversational commerce, is now a thing, and looks like it is here to stay.

The march of chatbots and personal assistants into conversational commerce, is now a thing, and looks like it is here to stay.

“AI is changing the way we interact with technologies across multiple industries. In a fast growing market such as India, AI helps making technology-based companies more efficient,” says Sachin Jaiswal, co-founder of Niki.ai. This AI startup has recently launched chatbot SDK to help brands deliver the “conversational” experience consumers are demanding on mobile and web apps.

HDFC Bank, Oxigen Wallet, Intex Smartphones and booking service Ticketgoose are some of the early adopters of its chatbot service. Two years ago, Niki.ai started out by developing chatbot programmed to respond to the chat requests of users for services such as cab order, food delivery and phone credit top-ups, and has served over 50 million interactions until now. Via forbes.com

Servion: FIs Must Bank on Latest AI for Customer Service

![]() Banks that aren’t proactive in adopting the latest artificial intelligence (AI) technology for customer service risk losing those customers. That’s because many online-only banks and others are investing in automated assistants that improve customer interactions by predicting why customers are contacting the bank and resolving the issue quickly, according to Servion Global Solutions.

Banks that aren’t proactive in adopting the latest artificial intelligence (AI) technology for customer service risk losing those customers. That’s because many online-only banks and others are investing in automated assistants that improve customer interactions by predicting why customers are contacting the bank and resolving the issue quickly, according to Servion Global Solutions.

“Our philosophy is that a customer has a reason for making contact with his bank and over a period of time, as the interaction history builds up, the bank should be able to predict why the customer is calling, regardless of the channel being used,” says Ashish Koul, Servion senior vice president and general manager. “Instead of letting the customer go into [interactive voice response] mumbo jumbo of pressing 1 for this and pressing 2 for that … you have a virtual assistant, which is intelligent, powered by analytics and can either solve the problem or connect the customer to the most qualified human when that interaction requires it.”

Servion predicts AI will support 95 percent of customer interactions with banks by 2025. The company’s ServIntuit platform provides the context of previous customer interactions across channels to make the virtual assistant more intelligent, the company says. Servion works with three of the world’s top banks. One banking client’s customer satisfaction rating jumped from 77 percent to 86 percent after integrating Servion’s platform. Via paybefore.com

How robots, chatbots will change the way you handle your money

“A few years from now online trading and investments will be guided by chatbots, online tools and robot advisors,” Nitin Vyakaranam, founder and CEO of Arthayanatra tells me at Fintegrate 2017, an event organised to gauge the future of technologies that will change banks, insurance companies and share markets.

“A few years from now online trading and investments will be guided by chatbots, online tools and robot advisors,” Nitin Vyakaranam, founder and CEO of Arthayanatra tells me at Fintegrate 2017, an event organised to gauge the future of technologies that will change banks, insurance companies and share markets.

“I started the company because I was sold bad ULIP plans by a friend when I returned to India. A robot advisor would never do that,” adds Vyakaranam.

The mobile phones or devices of the future will automatically alert you on the apps if you are going to make a costly purchase. A holographic image or a USSD text would pop up if you’re likely to make a bad investment. You will be advised by an AI-based virtual assistant, if the flight fares are going up and you are still to book a return flight. They may even enter your details and just ask for your fingerprint, iris scan or a selfie to authorise the transaction. Via moneycontrol.com

Chatbots and the post-app era: Implications for banking

Interacting with a 24/7 availability intelligent robot (chatbot) on a commonly used messaging platform overcomes all these hurdles. There are no conversion hurdles in downloading a specialised app or log-ins at the bank’s website as client already has her favourite messaging app on the phone. The app is most likely located in a prominent place on client’s smartphone being opened several times a day.

Interacting with a 24/7 availability intelligent robot (chatbot) on a commonly used messaging platform overcomes all these hurdles. There are no conversion hurdles in downloading a specialised app or log-ins at the bank’s website as client already has her favourite messaging app on the phone. The app is most likely located in a prominent place on client’s smartphone being opened several times a day.

More importantly, instead of navigating menus while searching for the transaction, the client just types or says what she wants to do. The chatbot on the other side will understand the command. Sometimes, it will offer a simple menu of options to ease the interaction with the client. A good example is a recently launched TransferWise bot at Facebook’s messenger platform, who offers a list of currencies and previously saved payment recipients. Many others chatbots are already helping people to track prices for plane tickets, remittance services quotes, order food, order a manicure, etc.

With chatbots in financial services space, security should be taken very seriously. At the moment, the client is asked to log-in with their internet banking credentials to authorise themselves. The communication itself is encrypted by default. A number of messaging platforms offer a type of encryption that makes impossible to Facebook or others to read the conversation between the bank and the client. Via finextra.com

Conversation banking: The next big thing?

We’ll help you keep current on conversation banking and the latest developments in chatbots, artificial intelligence and virtual reality tools in banking and payments industry. Subscribe for free at the top this page and you’ll get valuable business intelligence every Monday-Wednesday-Friday morning.

LET’S CONNECT